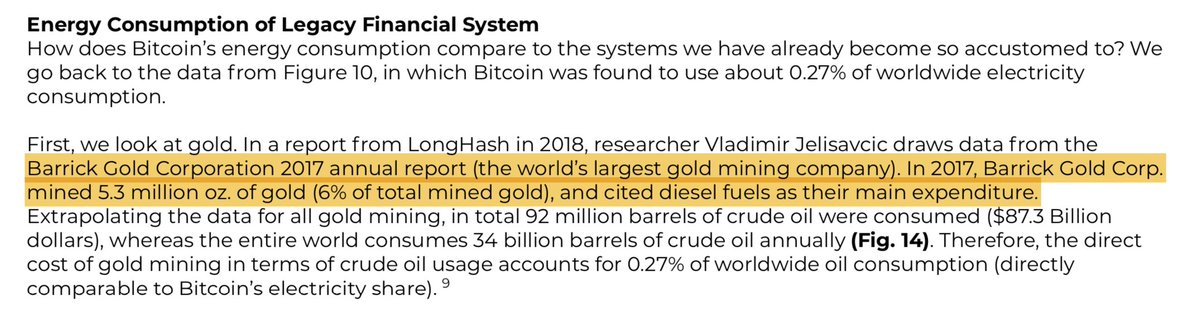

76% of the energy used to mine $BTC comes from renewable sources, whereas *diesel* appears the main source of energy for gold mining companies.

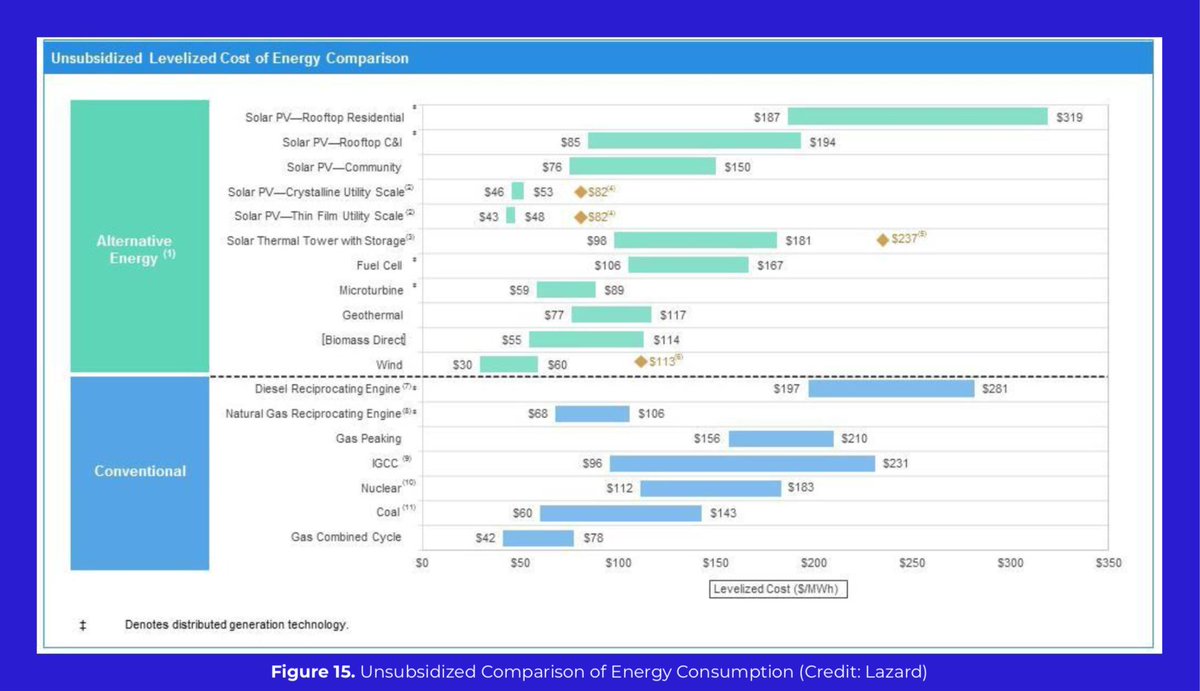

$BTC miners will continue to take advantage of renewable sources of energy that are lower cost, not just economically but environmentally.

People love things they helped create, and the things that are the rising generations' become the most treasured.

Gold represents glories of centuries past, socially washed up aside from bling.

Thanks to @ArcaChemist for sharing the report he wrote that gave me these numbers and thoughts to mull over: ar.ca/bitcoin-study

Gold inflating ~1.5% off $7T base = $105B

$BTC inflating ~4% off $140B base = $5.6B

Ratios are ~inline, w/ BTC miners having slightly better margins for risk.

Forgive the slight misinformation at the start, it came from a bad place anyway (attempted sensationalism to get peoples' attention).