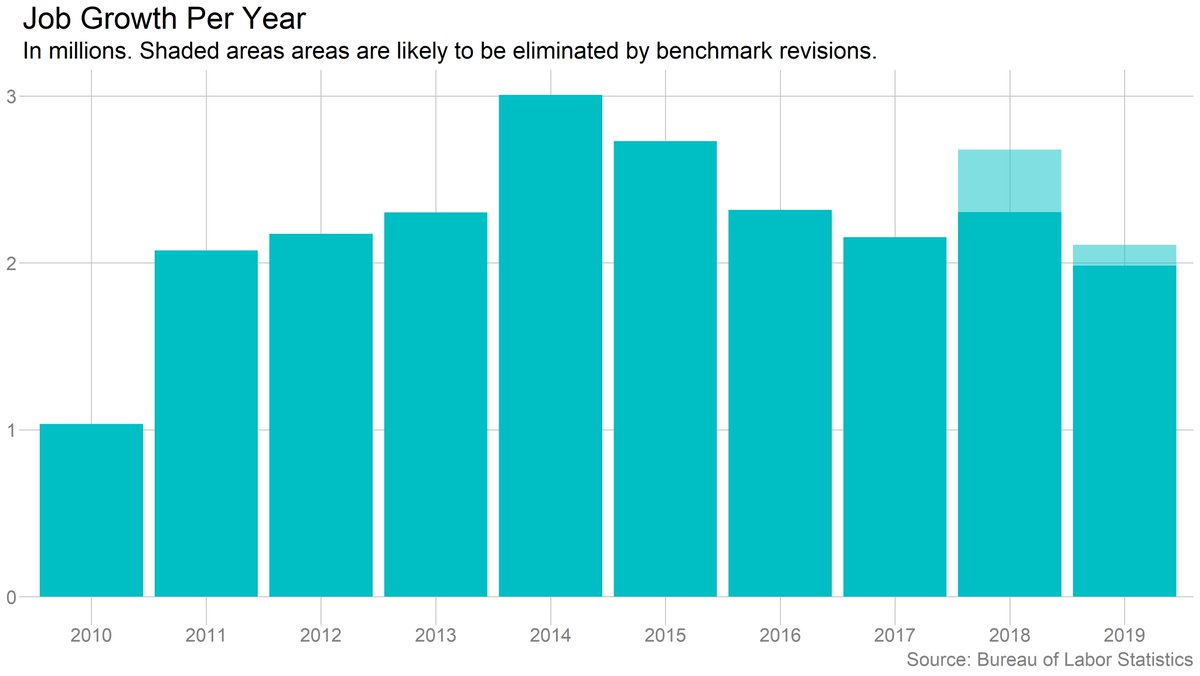

nytimes.com/2020/01/10/bus…

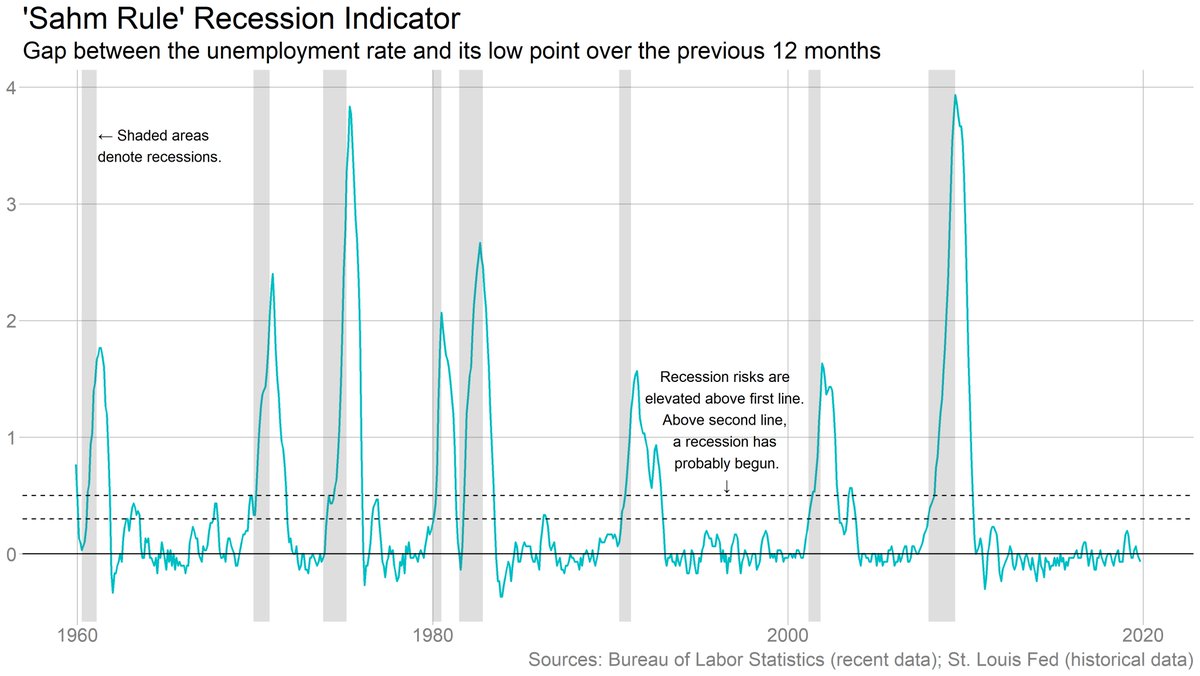

nytimes.com/2019/08/21/bus…

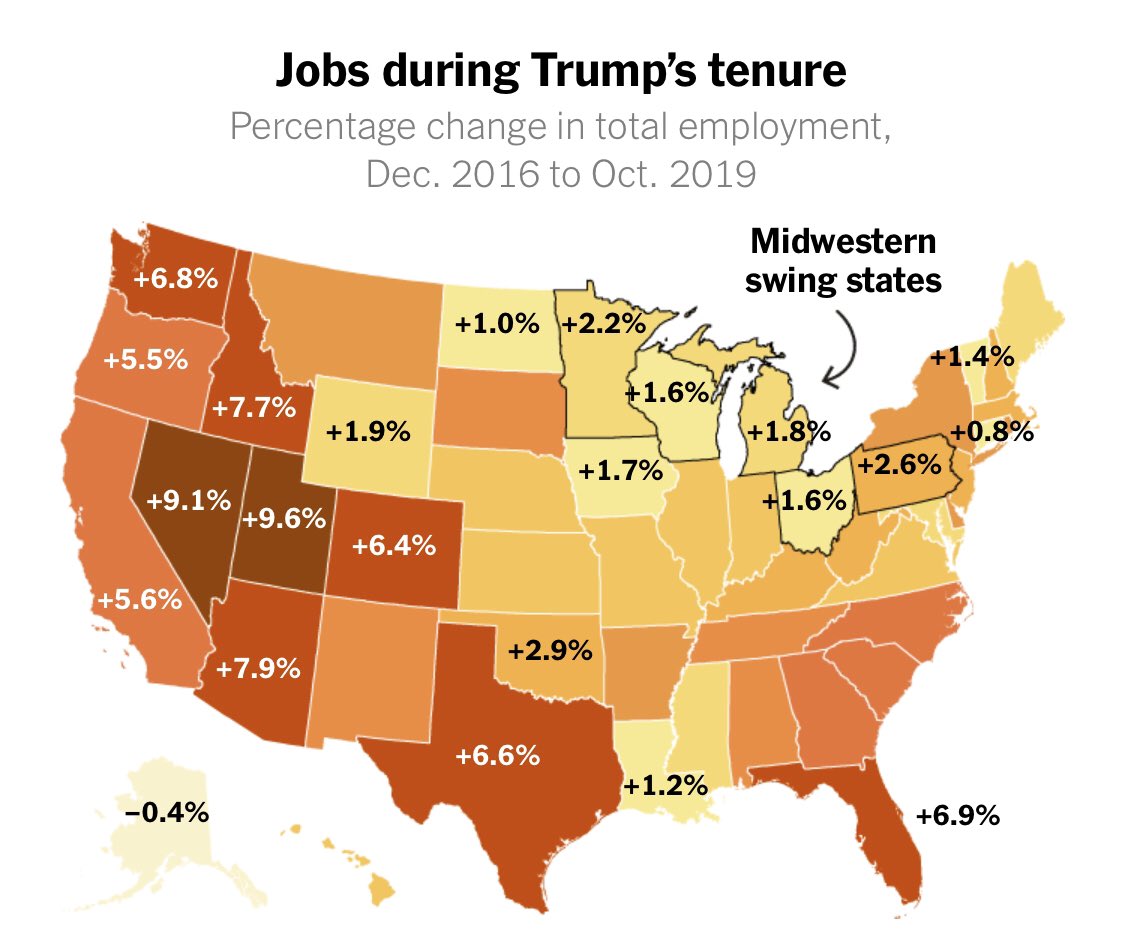

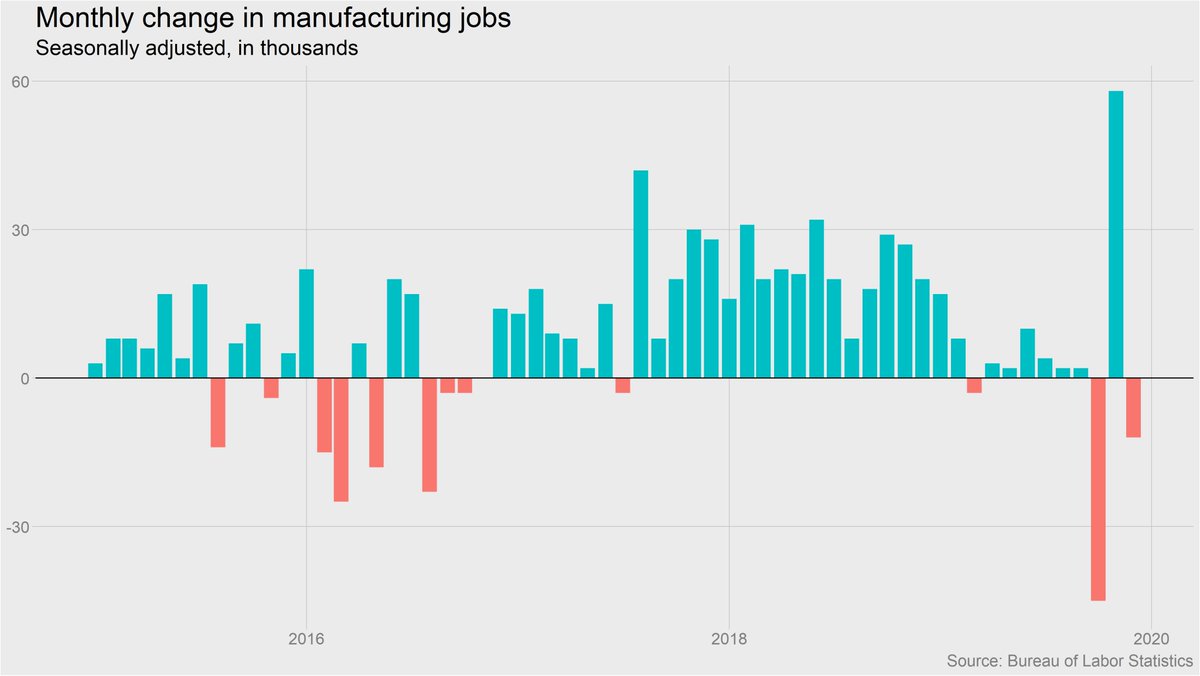

This has been a particularly big issue in the politically crucial Midwest. nytimes.com/interactive/20…

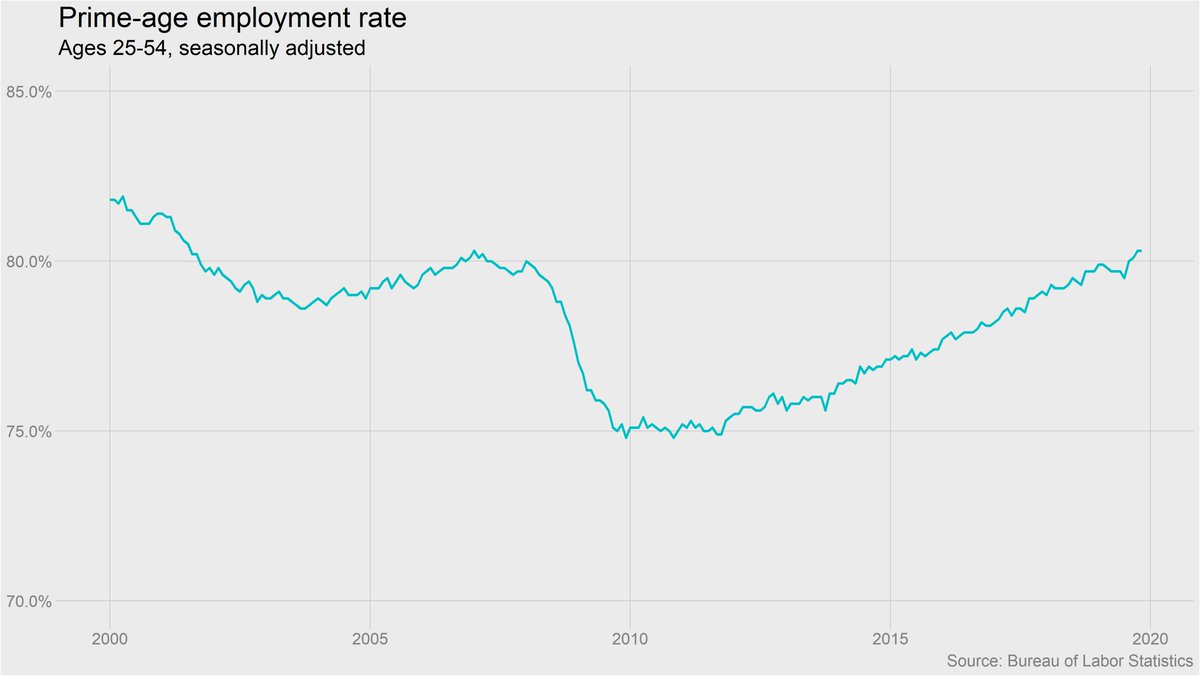

nytimes.com/2019/12/12/bus…