Someone on the street of #Singapore (in the financial area of Raffles Place) recognized me from Twitter last month.

While that's quite funny, it isn't the point of this tweet. They went on to ask what my financial advice would be as we...

Firstly, I said never to take advice from anyone in the financial industry you don't know and haven't looked into their track record / returns. But if you...

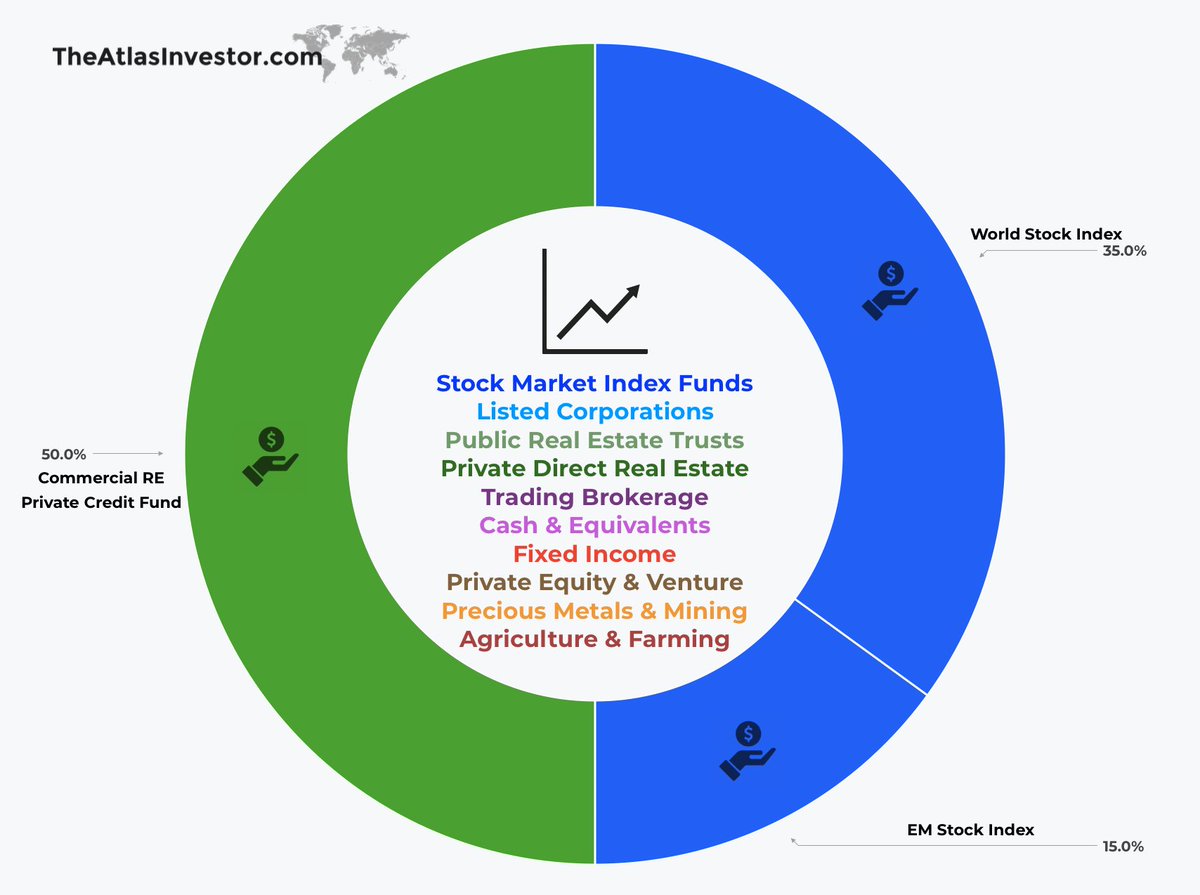

• half of your portfolio is in liquid global equities, the other half in illiquid real estate senior mortgage deals

• focus on the dollar-cost averaging & definitely go global as @RayDalio advises

Before all the smart ass comments come from those who don't invest but can argue until the sun goes down — especially due to real estate debt option — let me just say that deal selection is the key with the alternatives.

Also, I'm not selling...

The one I selected here is from the New York area, focusing...

With a portfolio like this, you have a much better chance of making it through the next crisis.

EM economies are only 15% of the global index but they sport 50% of GDP and 85% of the global population. Eventually, it will matter.

You get your own life back to spend precious time on things that matter & people who are important.

Life is too short.