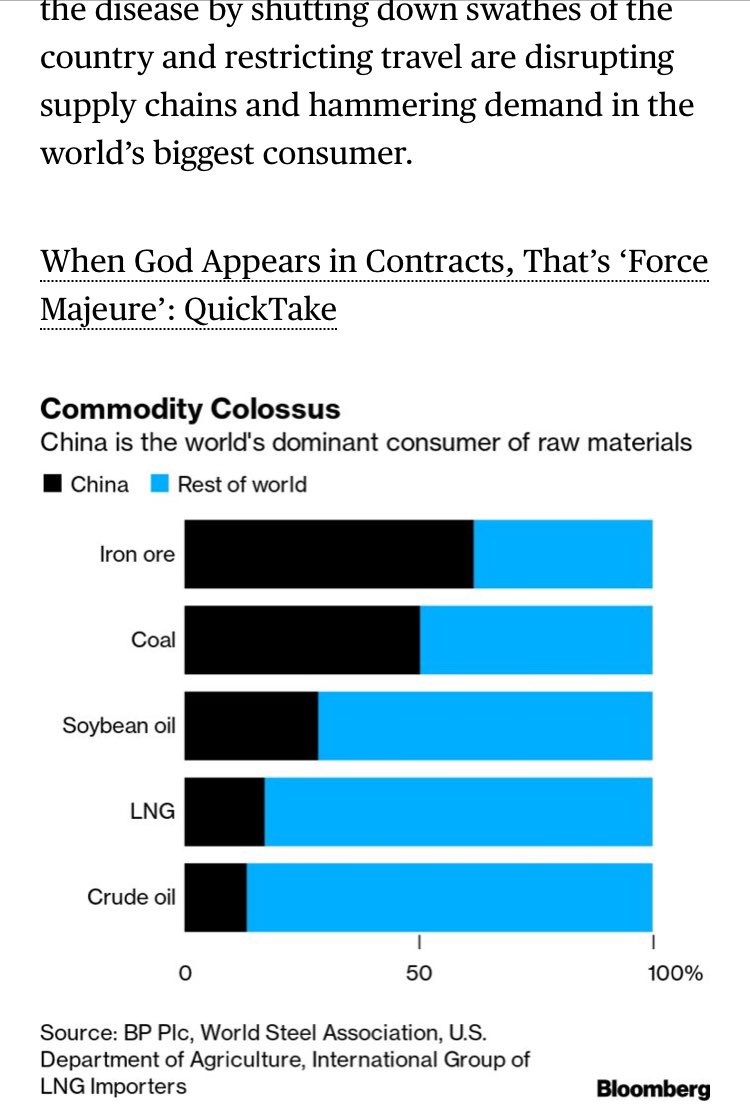

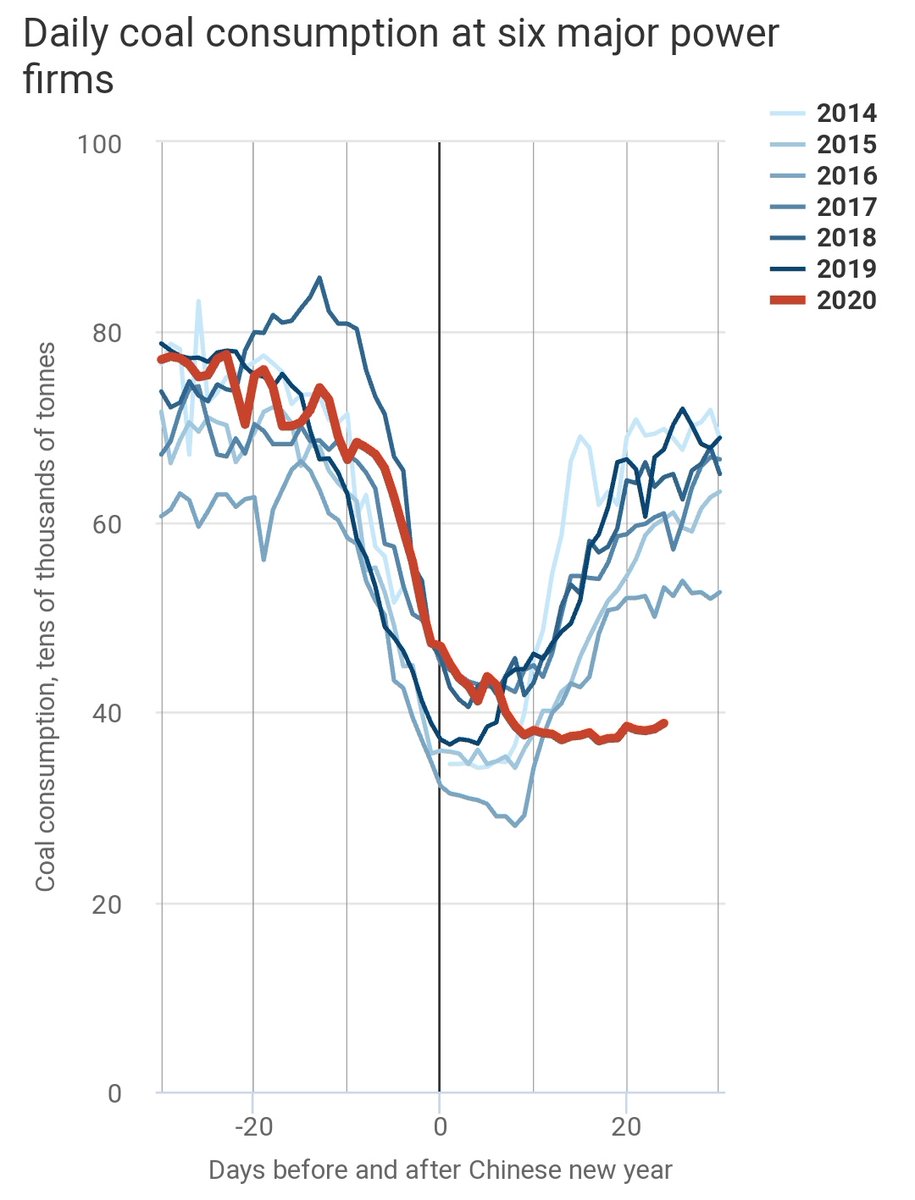

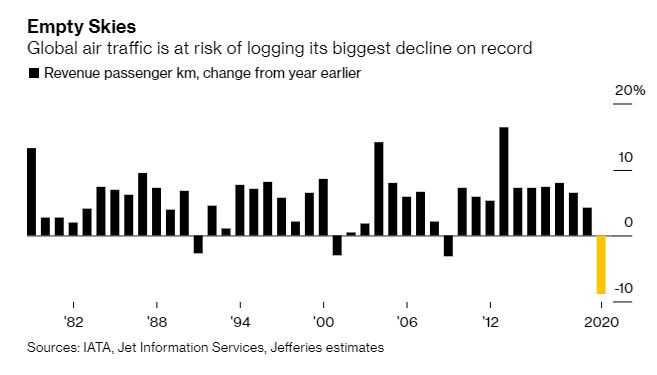

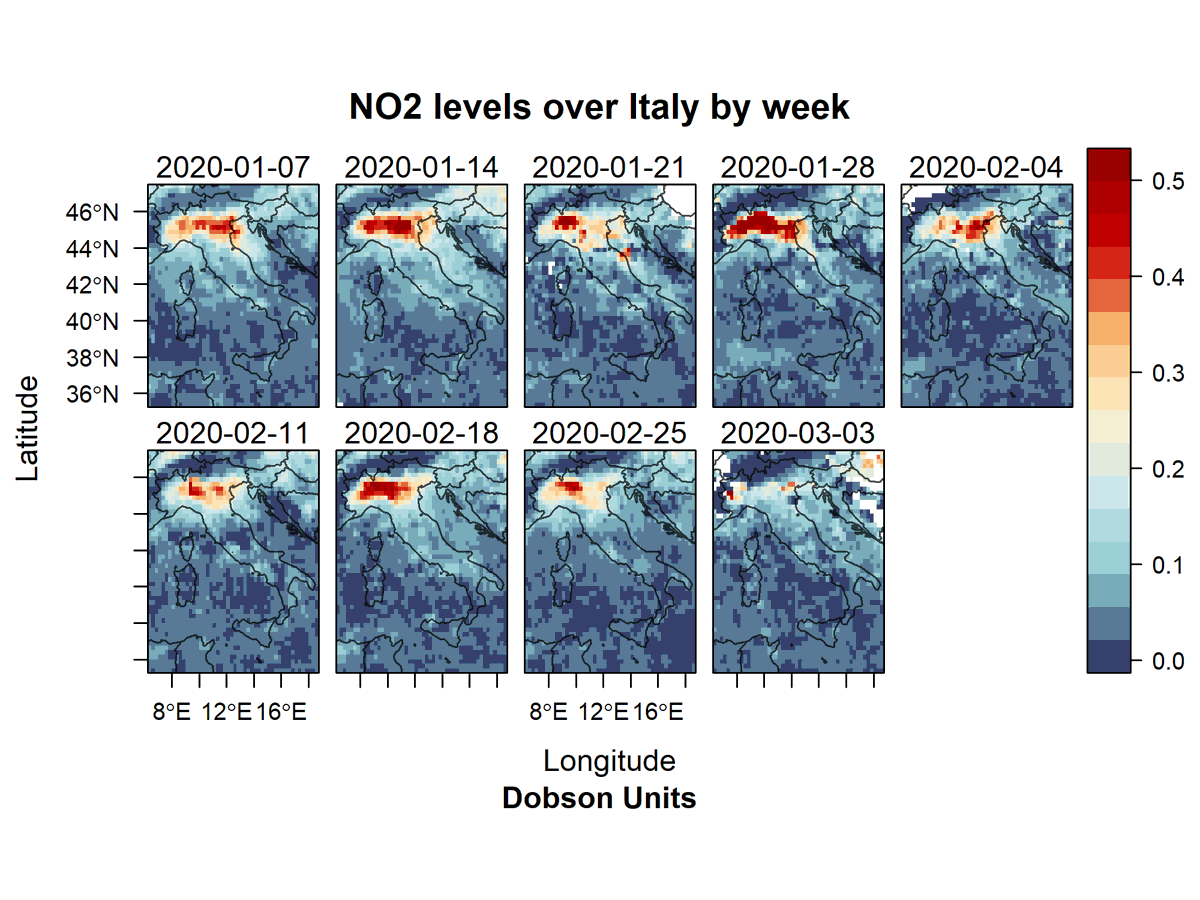

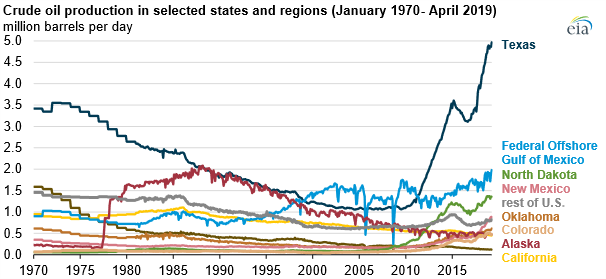

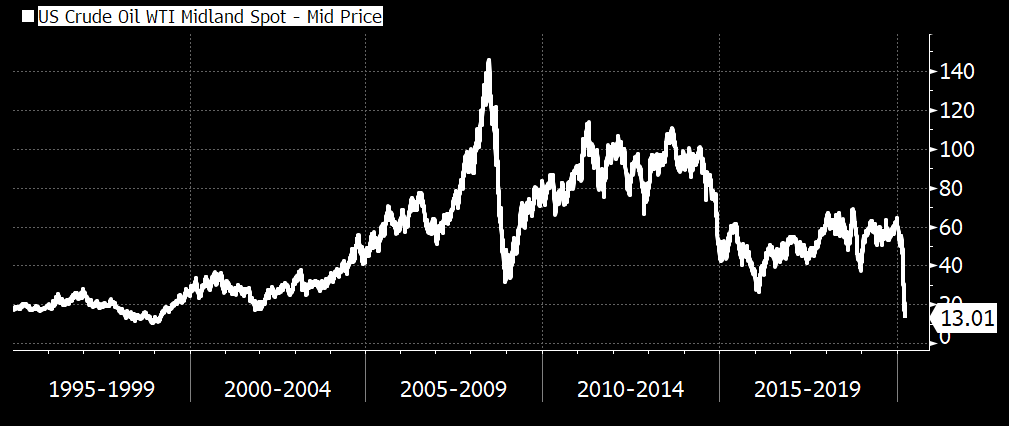

Woke: Coronavirus takes matter into its tiny DNA hands & unilaterally imposes Global Carbon Tax. Oil Falls 3mbd. Most since Crash bloomberg.com/news/articles/…

nytimes.com/2020/02/03/bus…

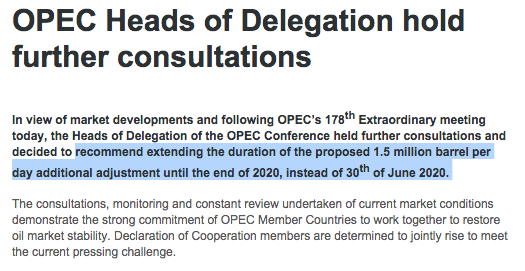

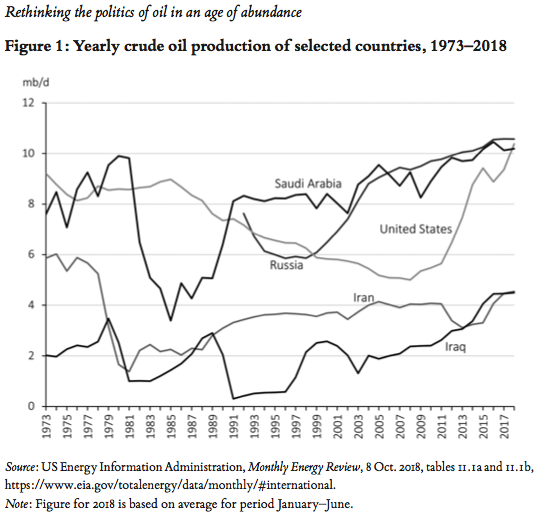

"Who Da Man?" bellows Coronavirus, MBS/Putin: "You Da Man!" #CoronavirusImposesCarbonTax aljazeera.com/ajimpact/saudi…

#CoronavirusImposesCarbonTax aljazeera.com/ajimpact/saudi…

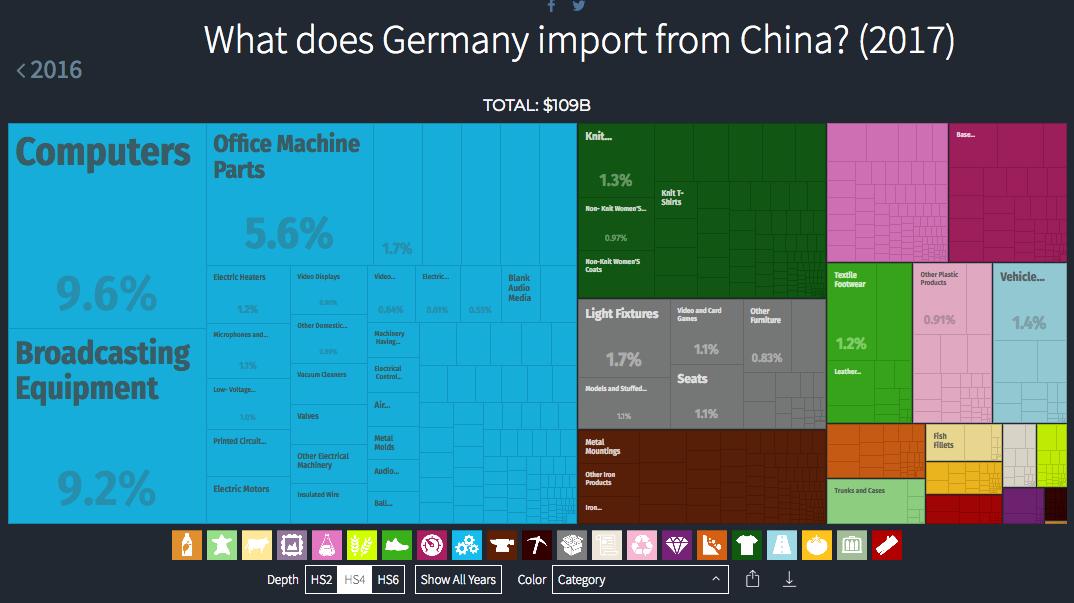

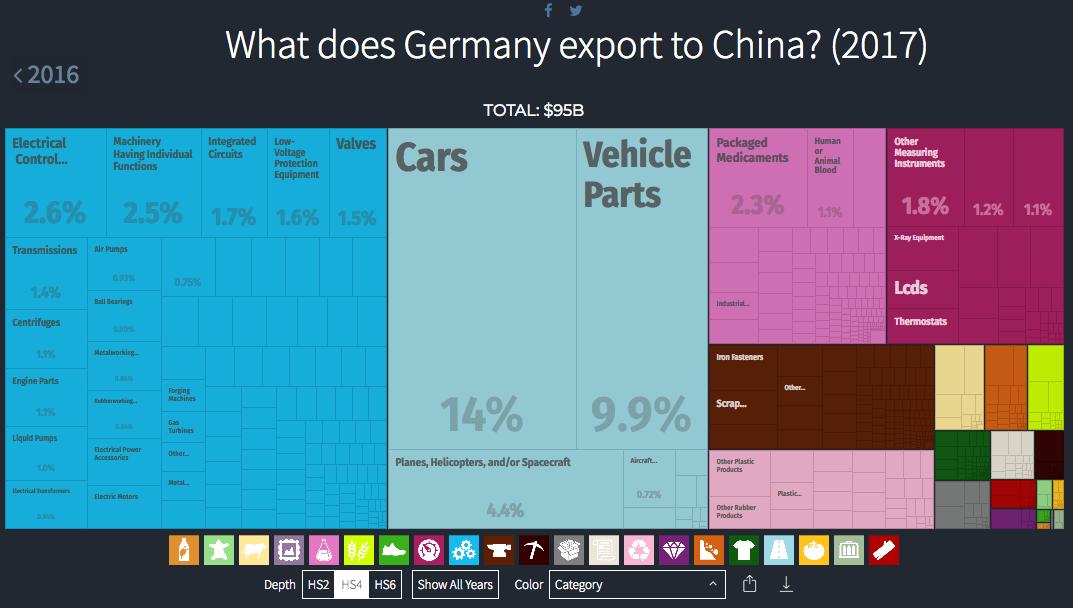

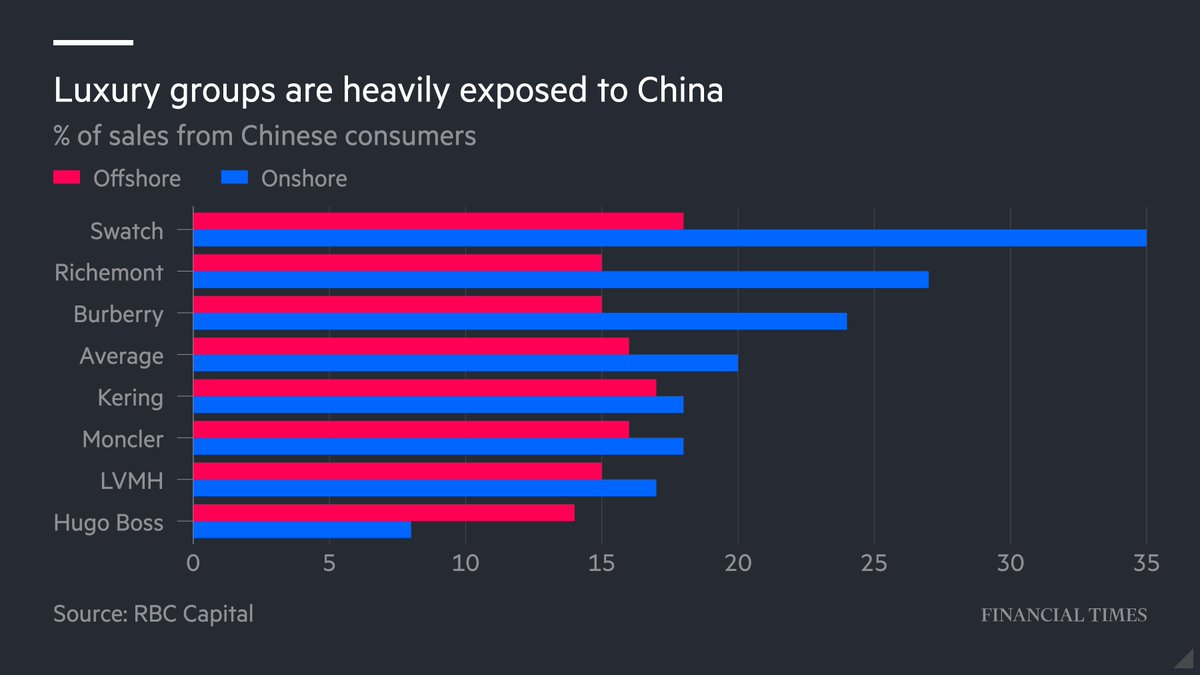

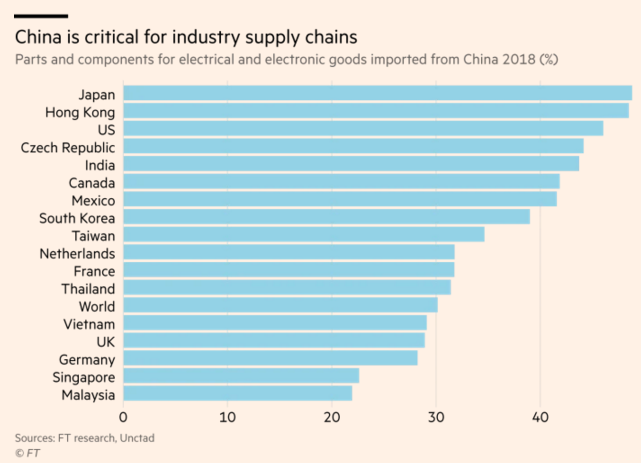

German cars; French, Swiss, Italian brands hit hard ht ft.com/content/f3fcdc…

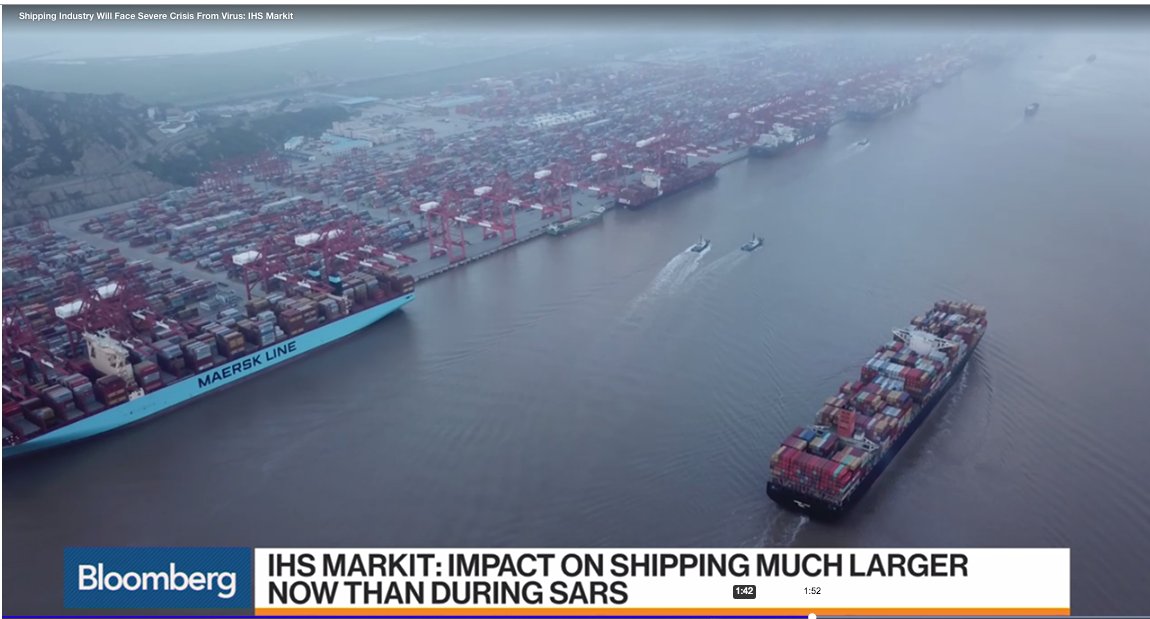

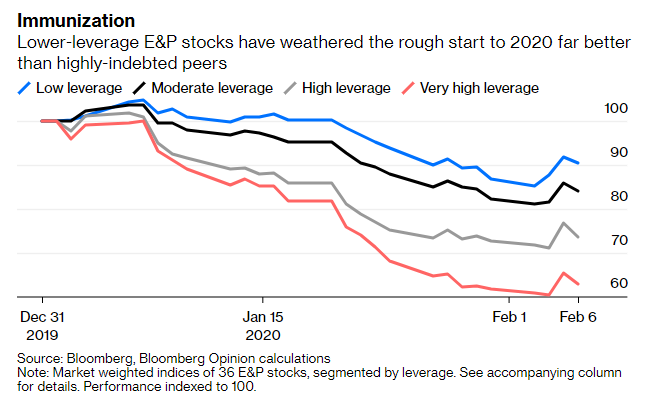

ht @liamdenning @yayitsrob bloomberg.com/opinion/articl…

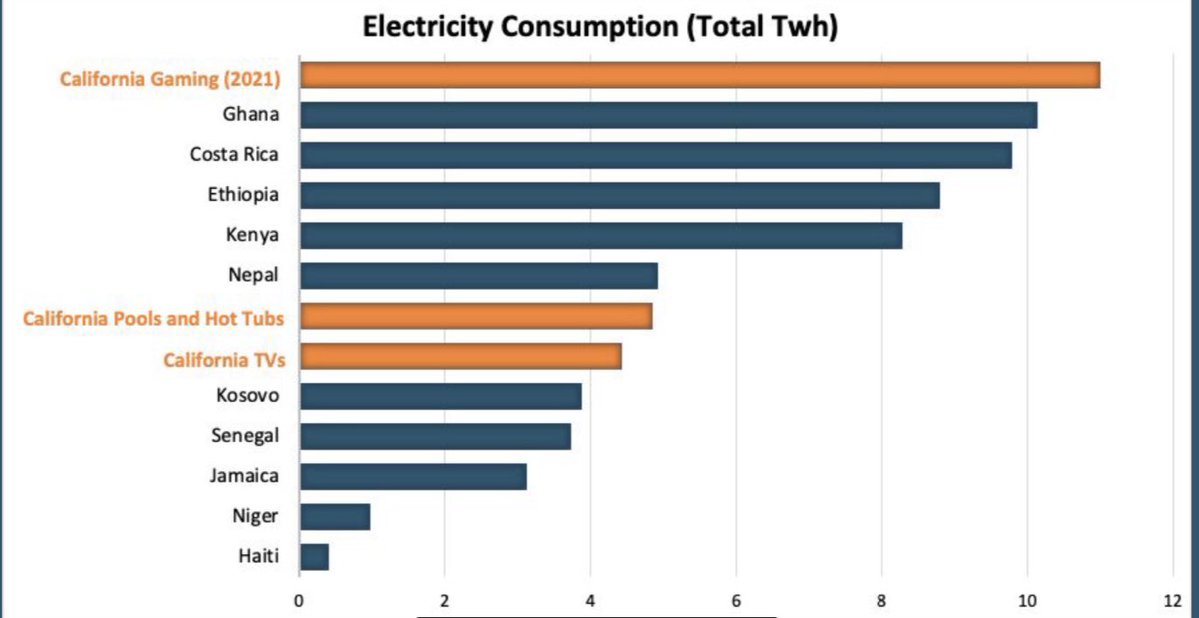

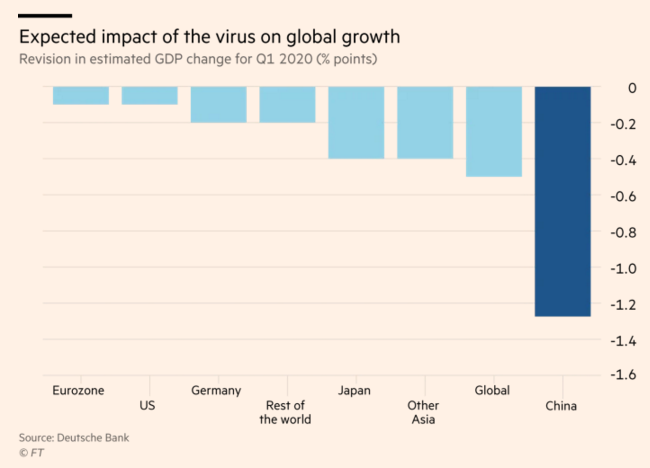

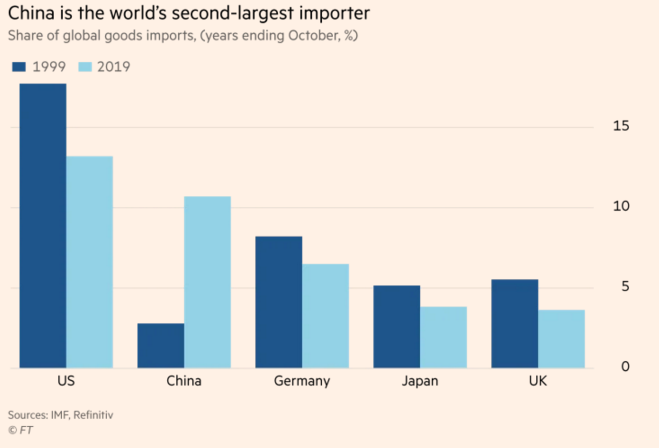

Comprehensive FT #CoronavirusImposesCarbonTax ft.com/content/a7a8bf…

Case for a 4-day workweek ht @KateAronoff newrepublic.com/article/156626…

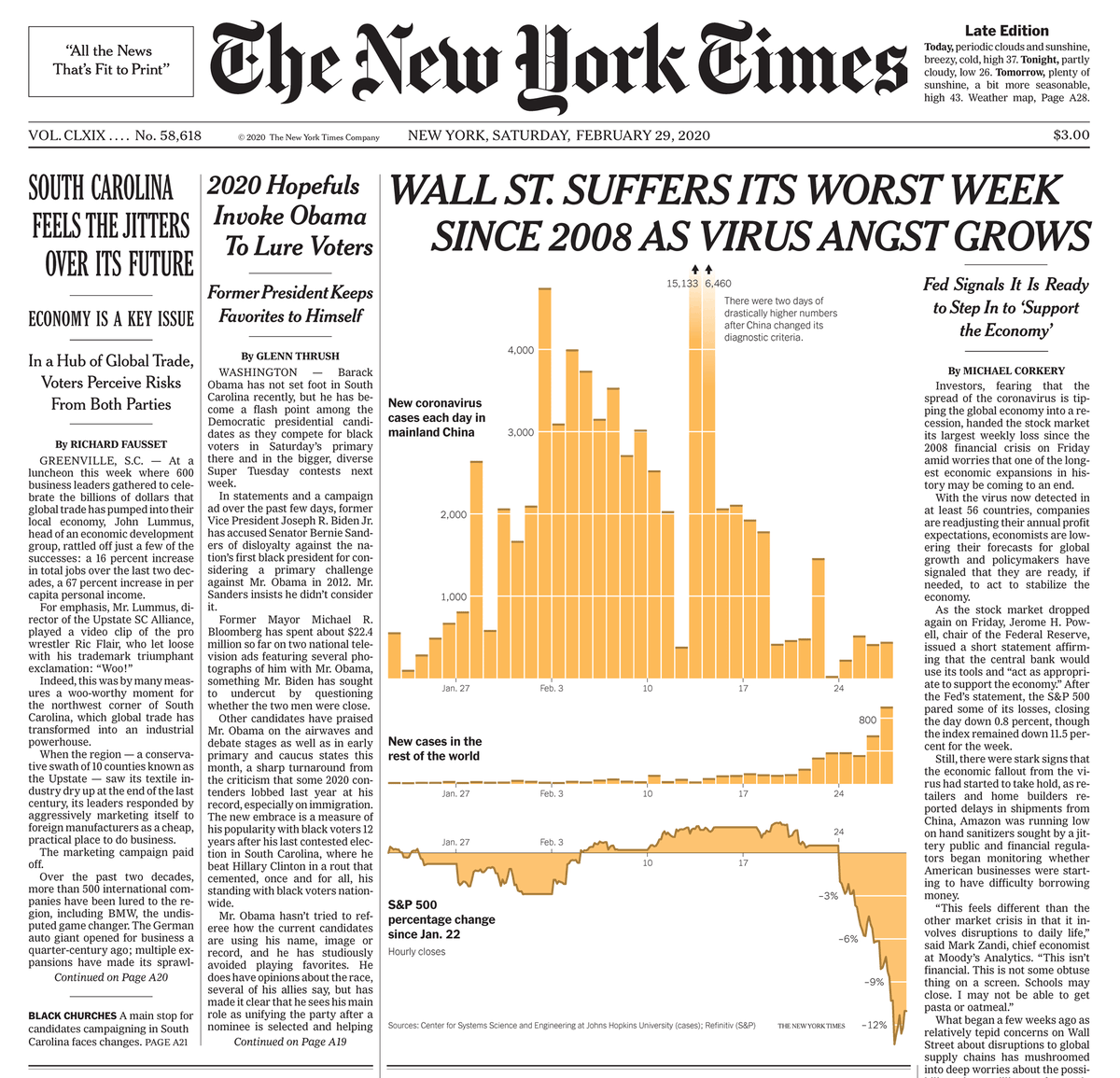

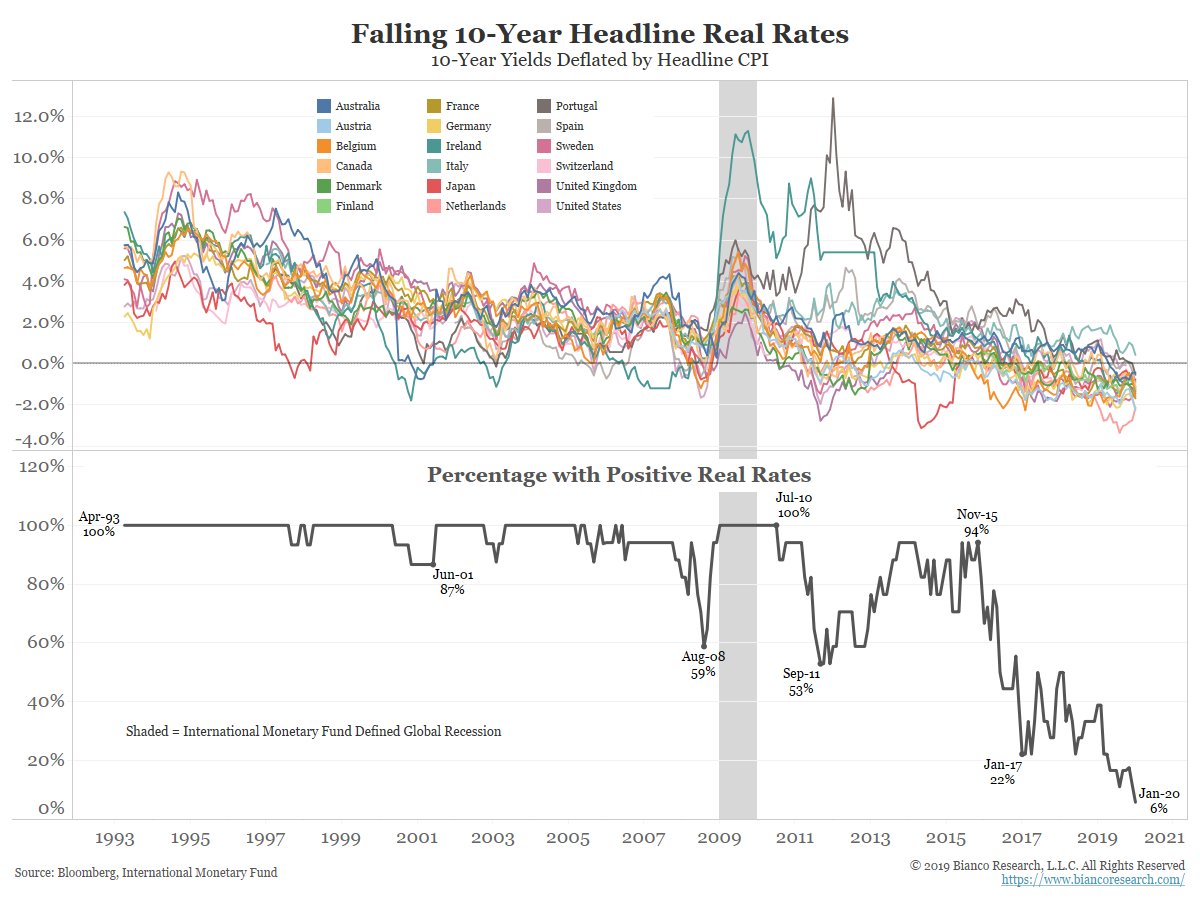

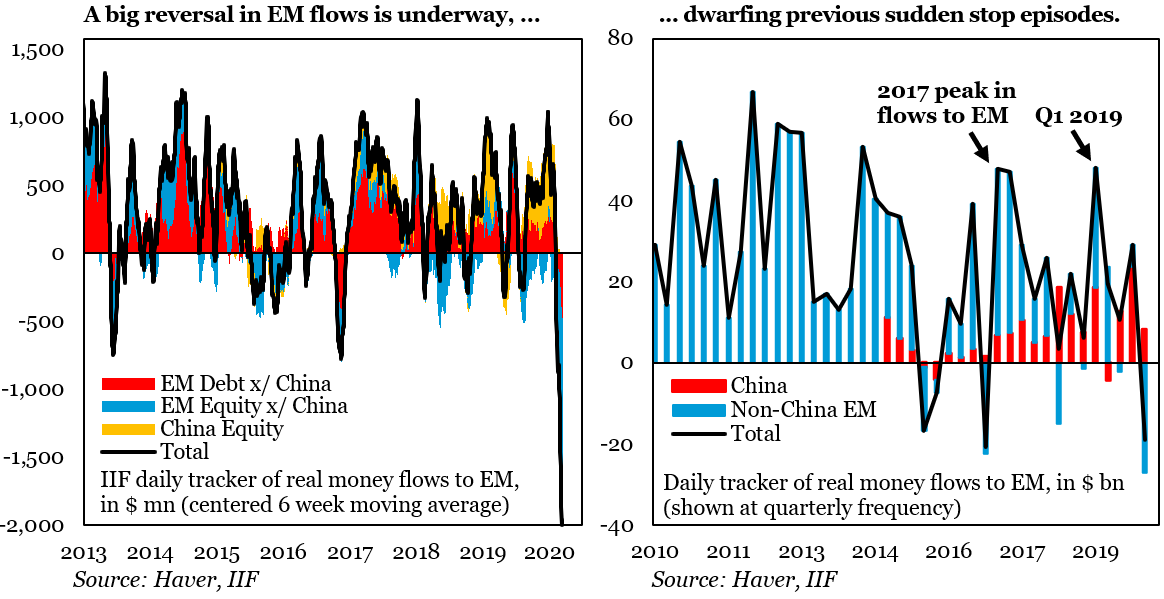

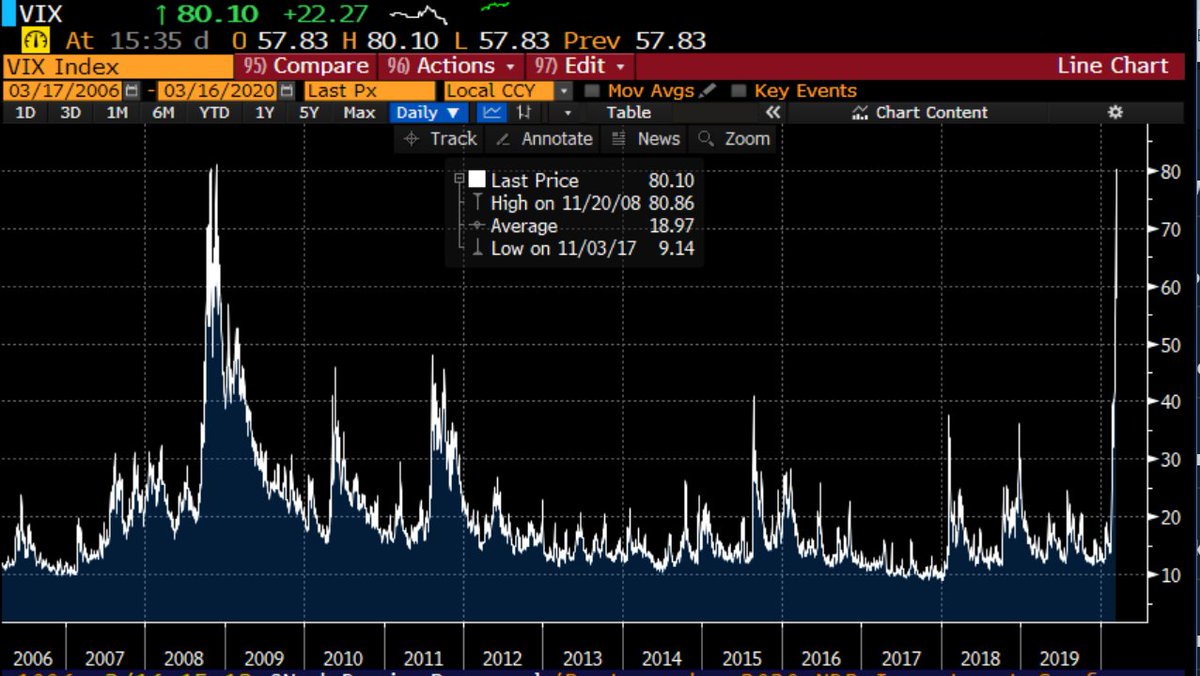

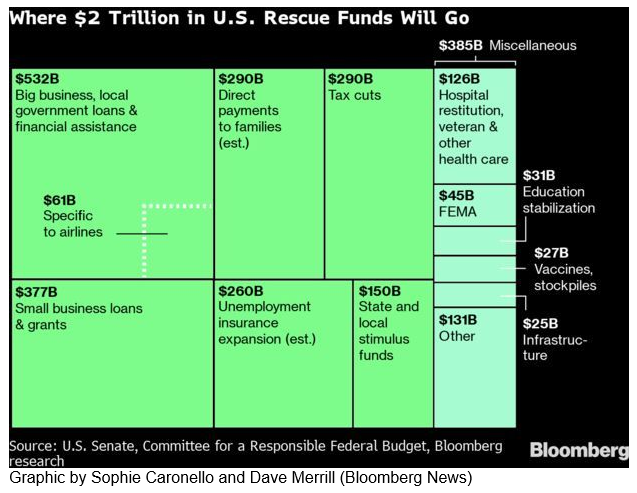

Woke: Coronavirus takes matter into its tiny RNA hands & unilaterally imposes Global Wealth Tax. #CoronavirusImposesWealthTax

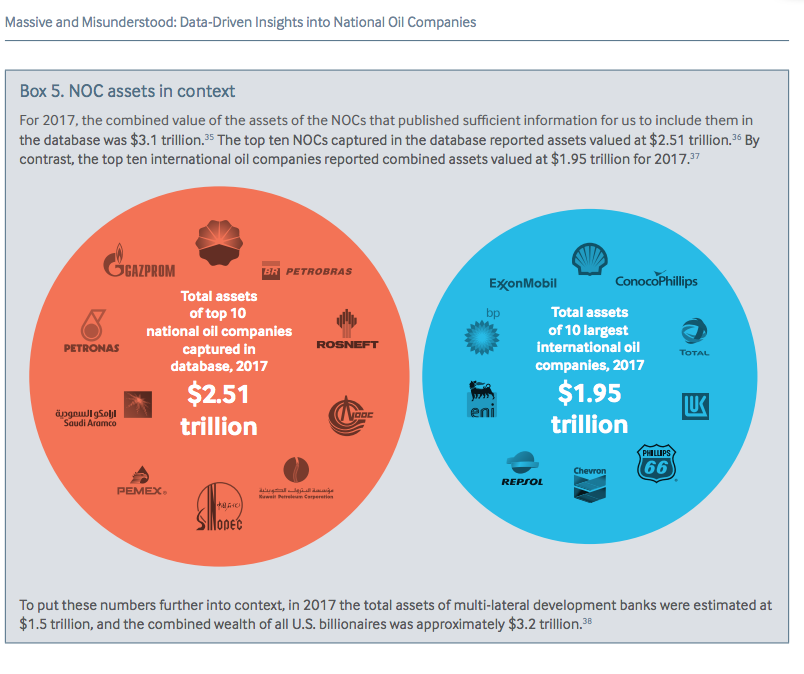

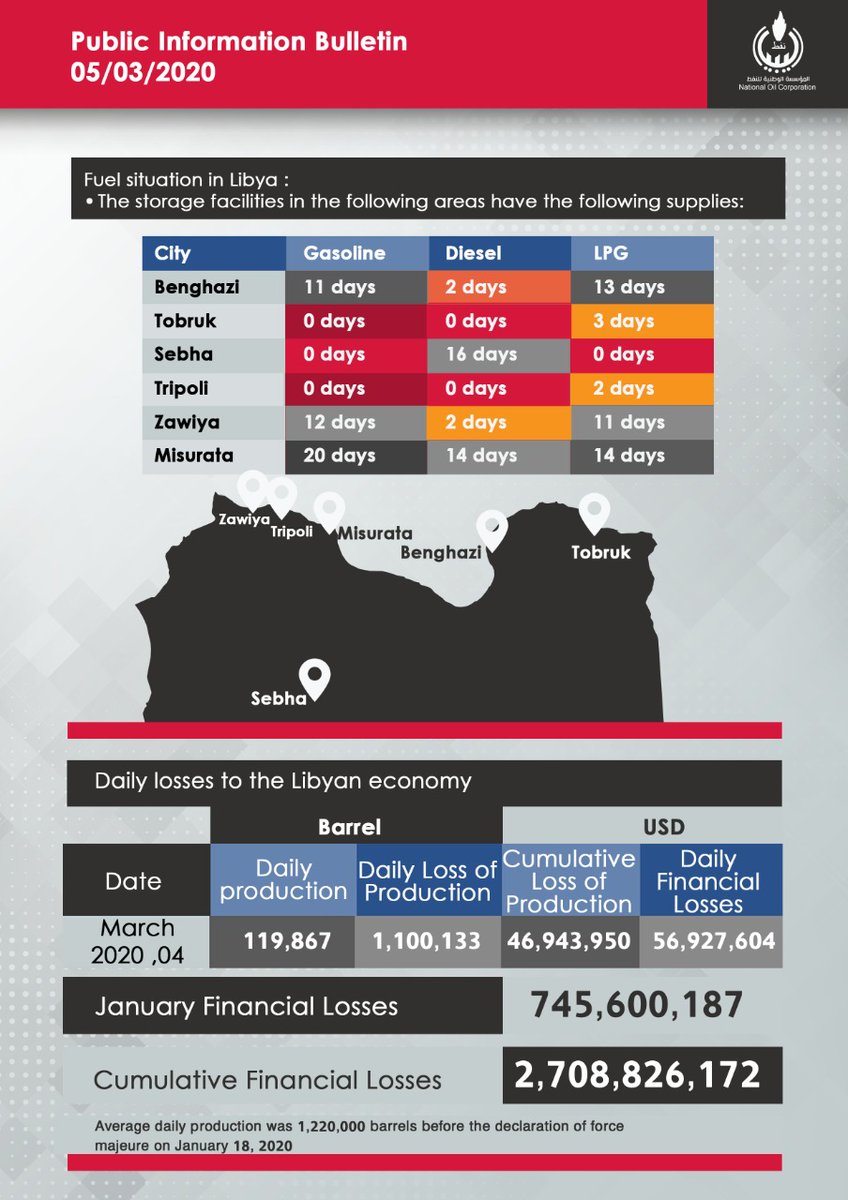

noc.ly/index.php/en/n…

Wickedly funny Downfall meme ht @Ochefedoboss1 captiongenerator.com/1694052/Its-a-…

ht @vtchakarova #CoronavirusImposesCarbonTax #CoronavirusImposesWealthTax #CoronavirusImposesSystemChange

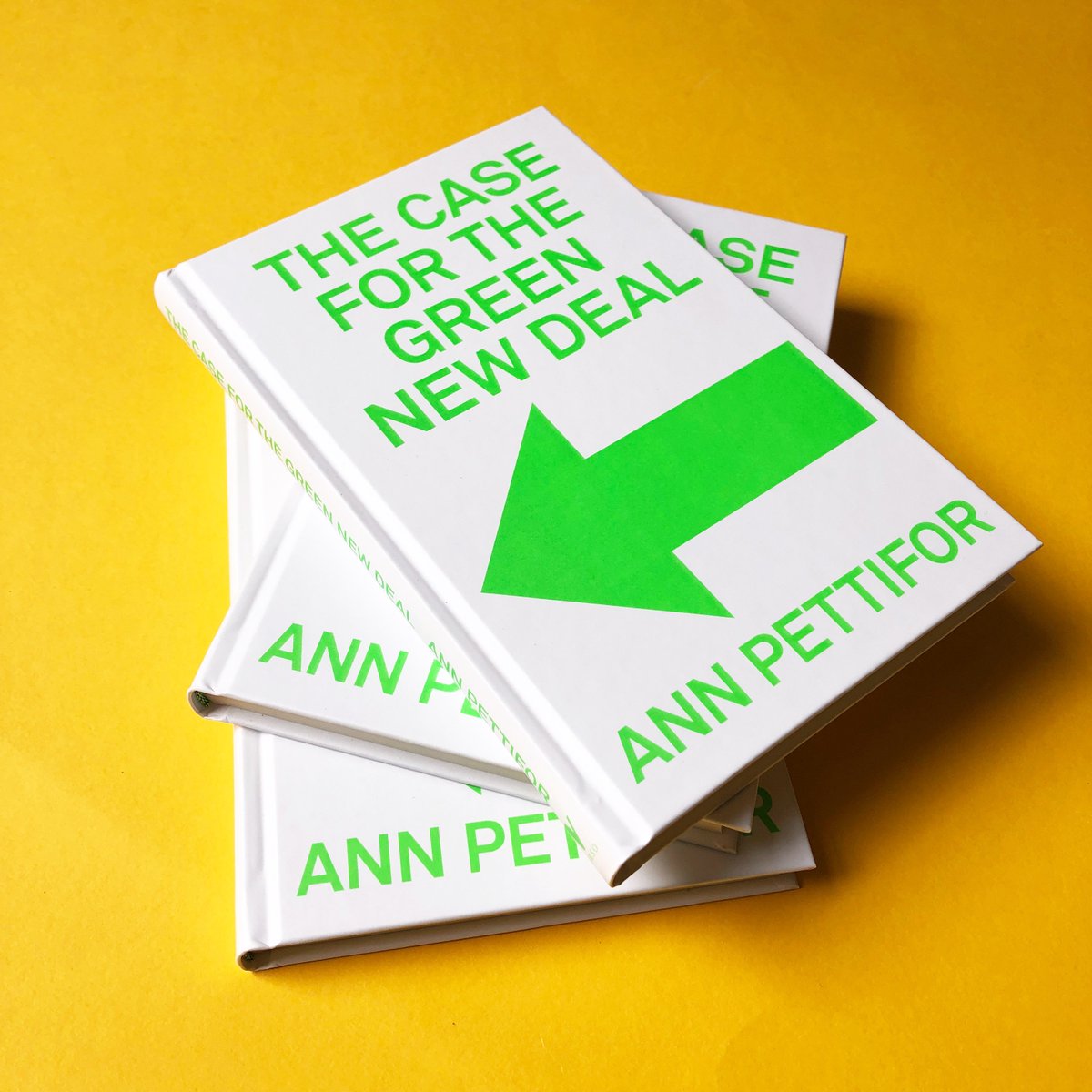

Intolerable situation with loss of hard currency export mkts in US&EU criticalfinance.org/2020/03/24/dev…

thehill.com/policy/energy-…

ft.com/content/1da60f…