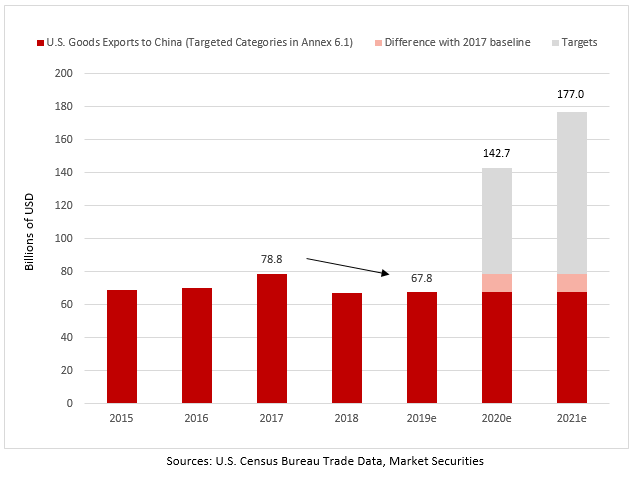

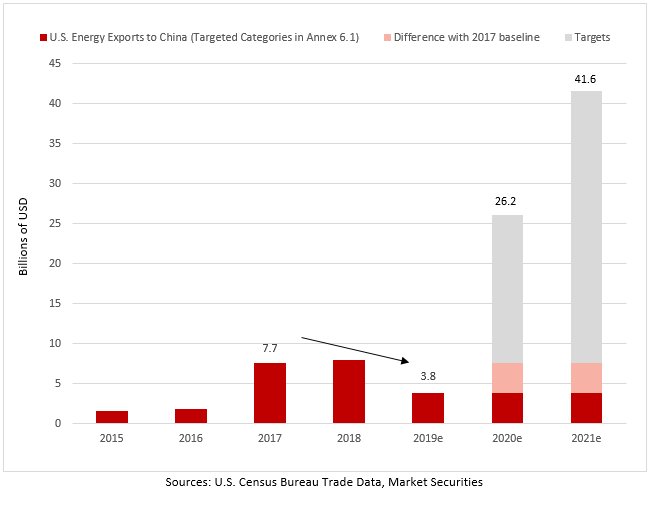

➡ For goods, I used Census Bureau trade data (goods) (bit.ly/2RAtaqd) on U.S. exports to #China and matched them to the list provided in Annex 6.1 (from p.57: bit.ly/3axsY3B).

*⬆/% are calculated using unrounded numbers.

*U.S. Export Control System

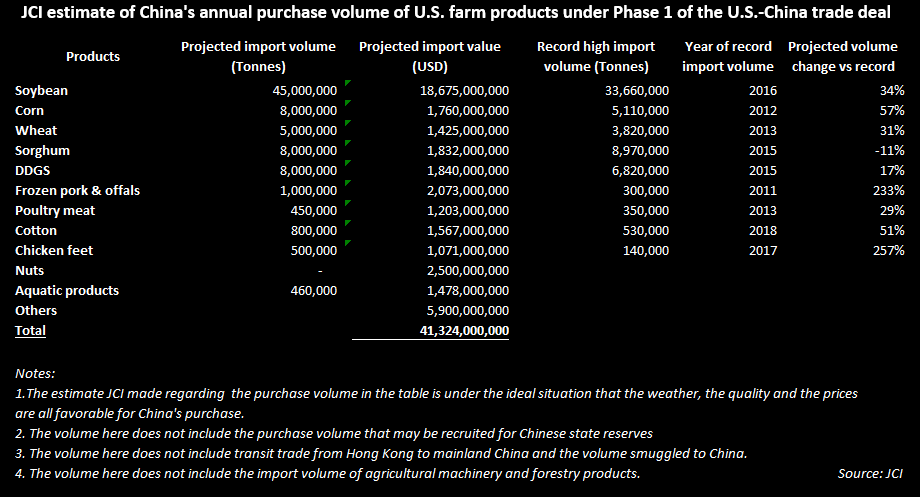

*Tariffs on $360bn remain in place (damaging the global value chain)

*Boeing crisis with 737 max

#China also said last year that it was starting to favor a homegrown nuclear reactor design for new power plants.

reuters.com/article/us-chi…

bloomberg.com/news/articles/…

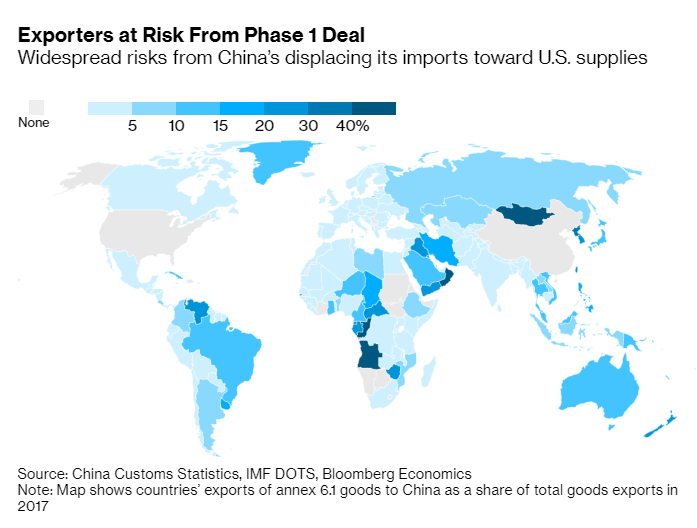

🇨🇳 🇧🇷 🇸🇦 #China-U.S. Deal Sets Up #Brazil and #Saudis Among Likely Losers - Bloomberg

*Link: bloom.bg/2RnHmUN

reuters.com/article/us-usa…

🇨🇳 🇺🇸 China coronavirus could hit #Beijing’s ability to meet US trade war deal import demands - SCMP

scmp.com/economy/china-…

scmp.com/economy/china-…

*Link: bit.ly/31mNos2

➡ My detaild analysis: bit.ly/2GQWnbz

However, #China will increase purchases ahead of the first compliance review to show goodwill.