😬

reuters.com/article/us-chi…

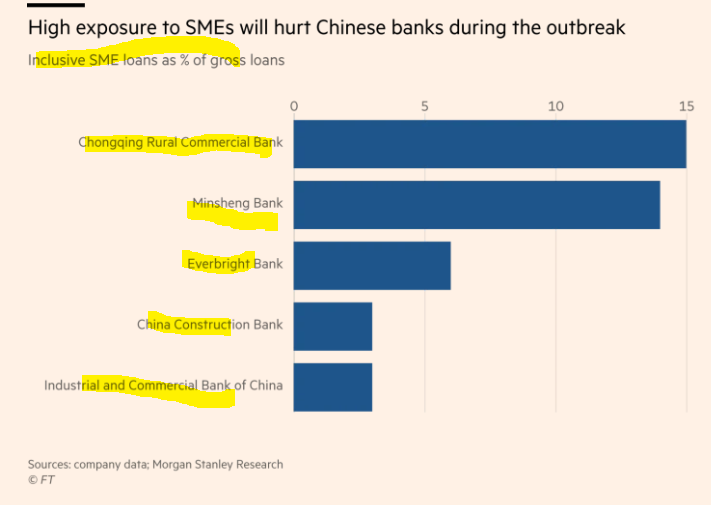

Key questions:

a) Will the SMEs actually get the funds needed to ensure survival?

b) Consequence for banks?

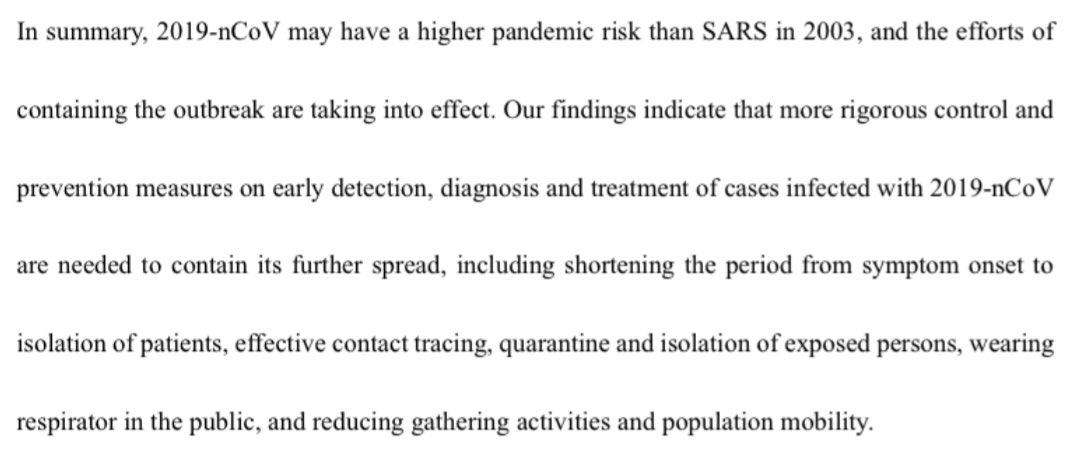

1) Businesses shut (hurting SMEs & domestic-oriented firms most as export driven still got outside markets)

2) SMEs are 60% of GDP & 80% of urban employment & based on a survey by Tsinghua & Peking Uni, only 18% can survive w/ 3 months closure

4) Gov says to banks to LEND or ROLL OVER DEBT or LOWER rates

5) Assuming banks comply (they may not)..

So the math for the banks...

OK, the PBOC

Not rocket science to conjecture that help is needed & what that means is that if more yuan is going to be injected & rates lower etc then that CNY can't be too strong vs USD

Banks most exposed to SMEs👇🏻😬

ft.com/content/deb2f1…

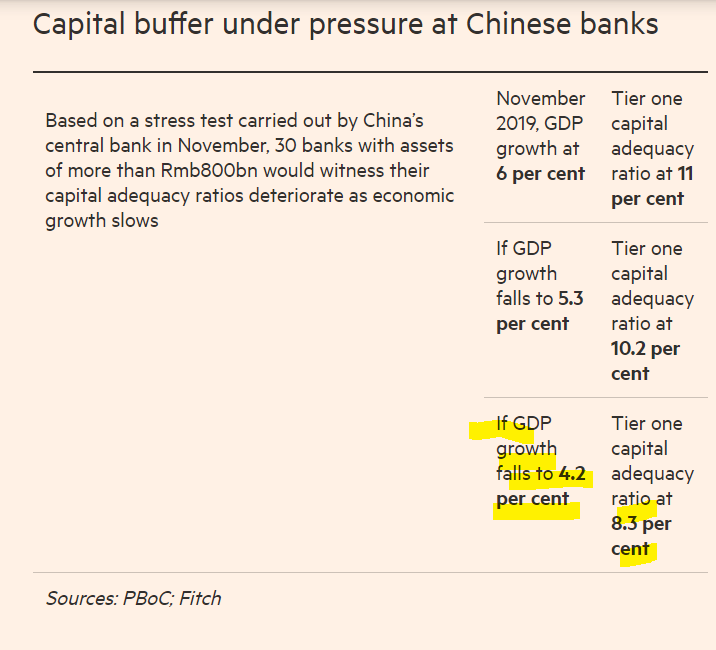

Note that the WORST case was 4.2% GDP growth...

👇🏻👇🏻👇🏻