cc'ing for comments : @TMFJMo @Gautam__Baid @Matt_Cochrane7 @7Innovator @saxena_puru @FromValue @IntrinsicInv @BrianFeroldi

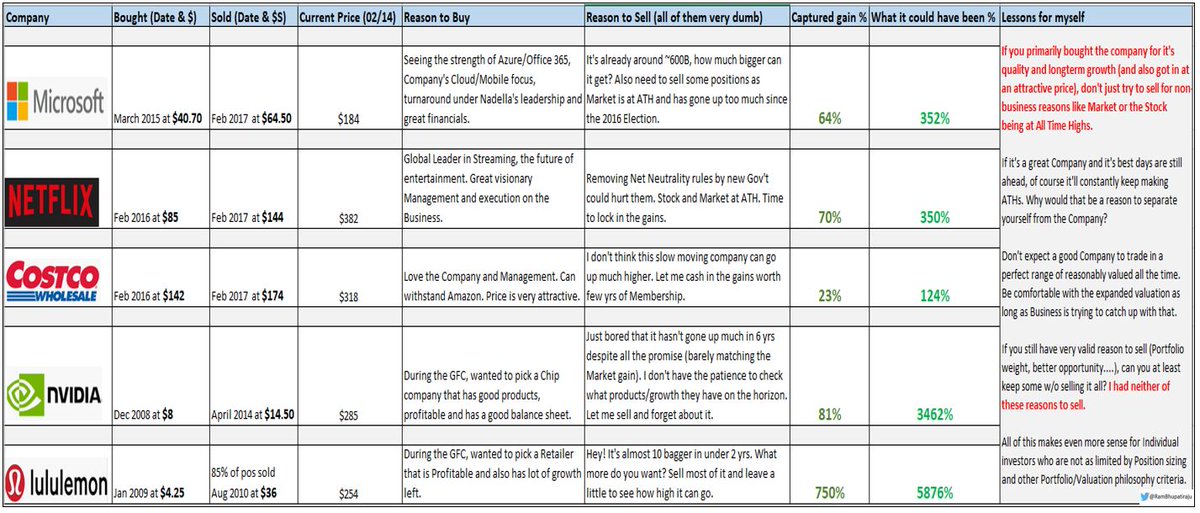

Each investor have to decide for themselves when to make exceptions and for which exceptional companies, about not selling purely on valuation reasons.

/END🙏