Area or Common gap

Breakout gap

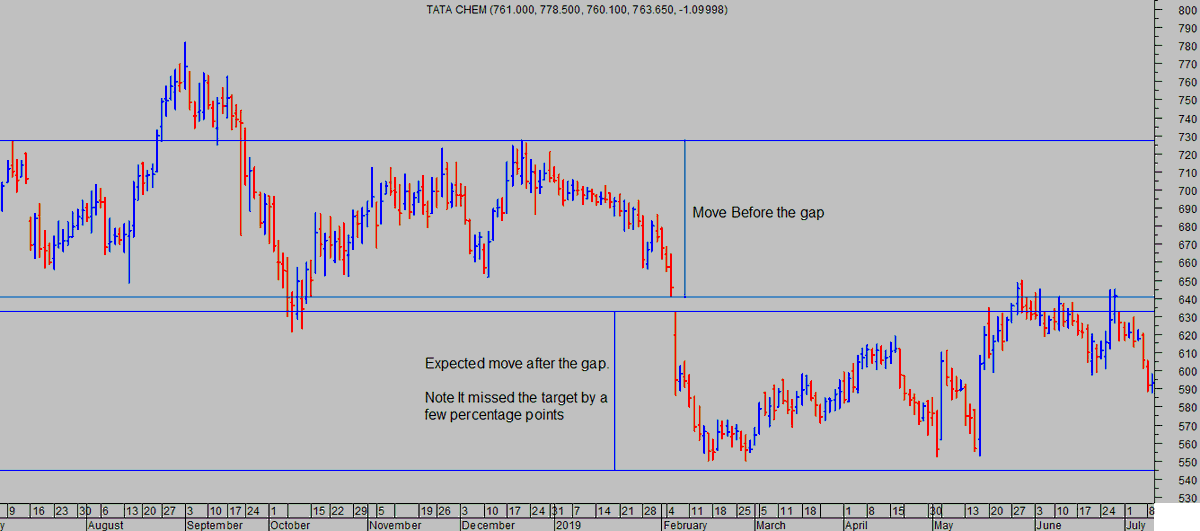

Runaway gap or Measuring gap

Exhaustion gap.

This is one of my favorite. If spotted at the correct time one can use it to trade on an intermediate term time frame. The volume in such cases is generally on higher side a short covering as well as fresh buying comes in.

This type of gap generally occurs in middle of a strong trend. It is a signal of trend intensifying.

Psychology behind runaway gap is missed out traders jump into the bandwagon as sudden major fundamental news changes the rating of the stock.

This gap generally occurs at top or bottom of the trend. Euphoria / pessimism are generally high and such volume can be very high. Trading volume diminishing after the gap day is usually first warning sign that an exhaustion gap may have formed.

It is a combination of exhaustion gap followed by breakout gap. A sort of island can be identified from bars of certain number of days.

An uptrend resumes after a prolonged down trend of more than five to six months. The uptrend registers a series of gaps at regular interval. It is a signal of a strong bull market ahead. Dips should be used to buy.

A series of gaps is registered in short time frame. Gaps are accompanied by a parabolic rise in index/ stocks.

1.Creation of gaps results in volatility. Stop loss in trade might be deep.

2.Points discussed above have a success rate of 80%, but draw down on losing days are high. Careful planning is must to negotiate days which creates gaps.

4.Blindly following measuring aspect may hurt a trader.

The End.