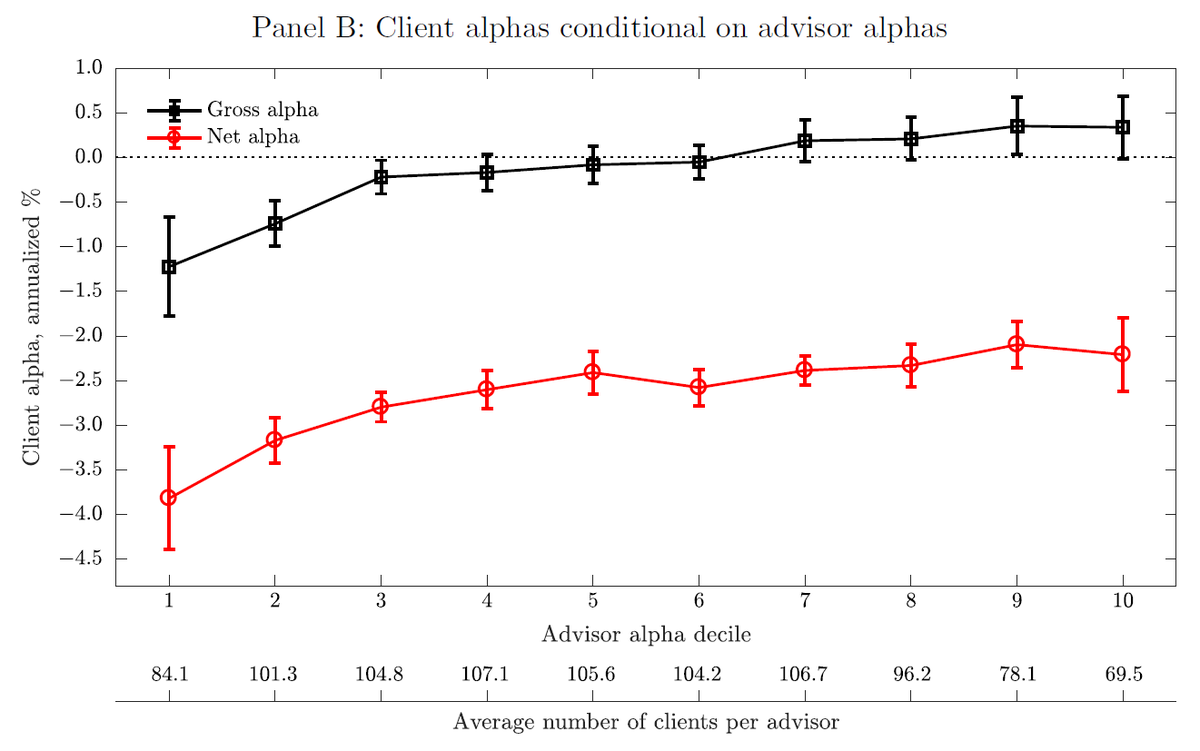

"Advisors trade frequently, chase returns, prefer expensive, actively managed funds, and underdiversify. Their net returns [alphas] of −3%/year are similar to their clients'."

papers.ssrn.com/sol3/papers.cf…

"Investments recommended by financial advisors, by contrast, are poor investments even before commissions.

"Clients would underperform the market even if advisors provided services free of charge."

"When advisors recommend strategies that underperform, they act as an agent exactly as they do as a principal [in their personal accounts]."