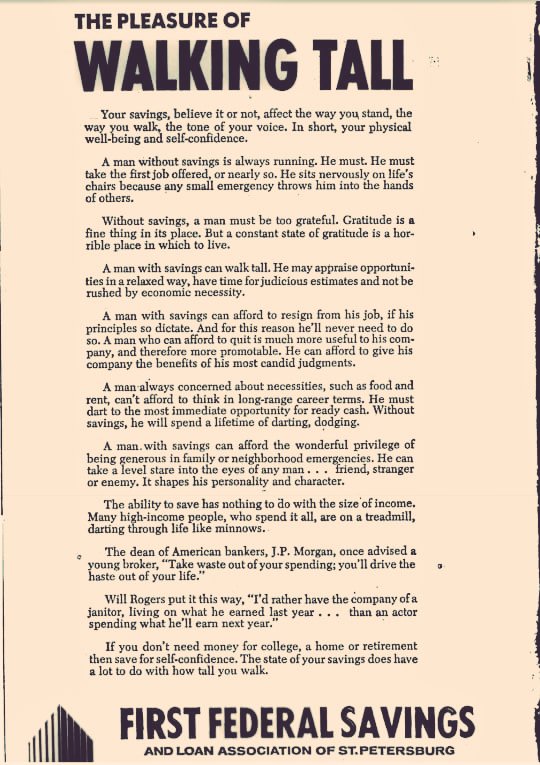

My thumb rule is that my trading system must be tat which allows me to sleep 8 hours a day unmindful of CNBC's 24x7 telecasts saying 1000 different things which negate one reasoning at one time

10/n

In act one thing I can share with you. I was trading at some point in time all of NSE FNO,MCX, Currency and NCDEX.

In 2013 post #NSEL I quit MCX trading inmany commodities, quit Gold/Currency in 2016 post Brexit and in 2019..

11/n

Today my trades are executed in NSE only between 9.15 to 3.30 and am a free man for the rest of 17 odd hours getting nice sleep of 8 hours.

I like the present scenario as I have a lot of time to do other thngs

12/n

But our system must suit all the above to give a positive expectation. Mind you only expectation. Final result could be disappointing.

As I moved on

13/n

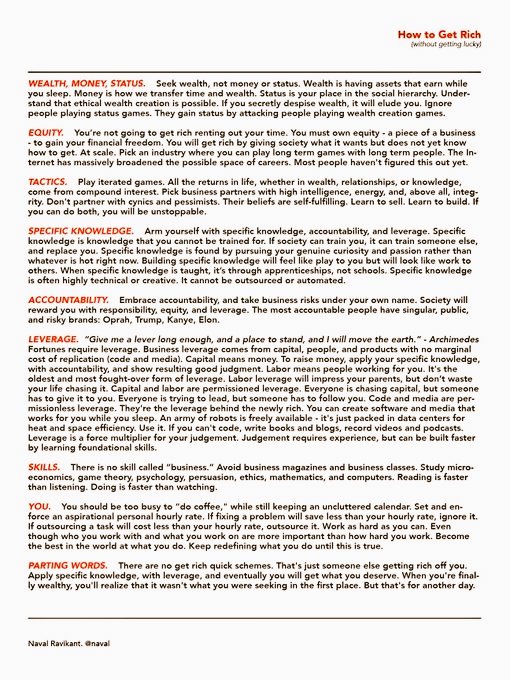

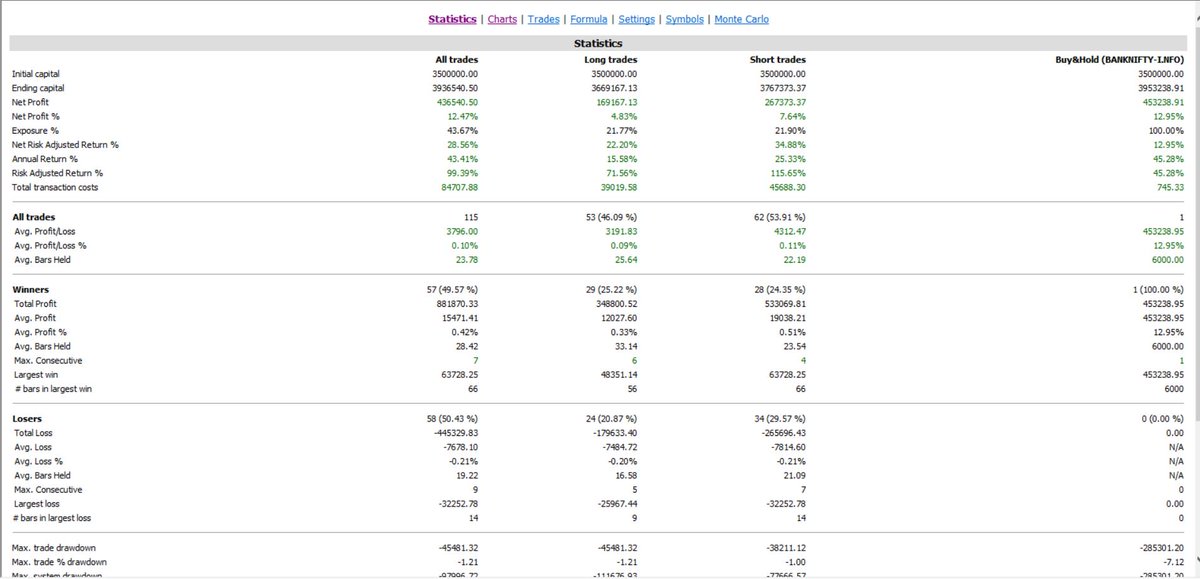

Broadly lower the timeframe more will be your trades and hence transaction costs and slippages not to mention brokerage charges.

Each timeframe adds to number of lots and consumes capital

14/n

Choose wisely

15/n

Remember thehigher the TF the drawdowns will be more and your capital gets eroded on a/c of drawdowns.

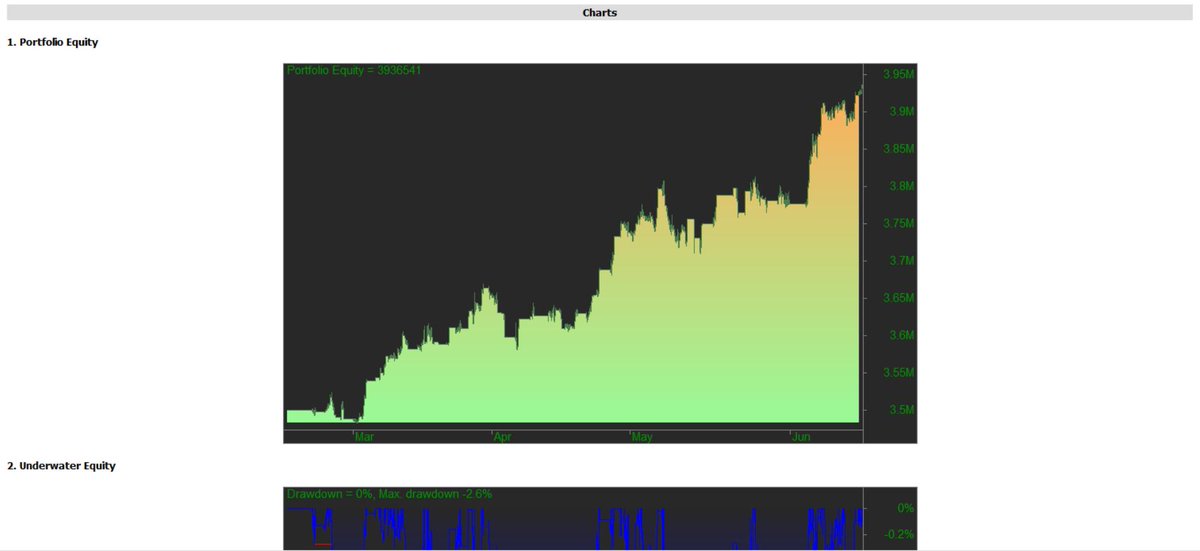

2.What system do I use?

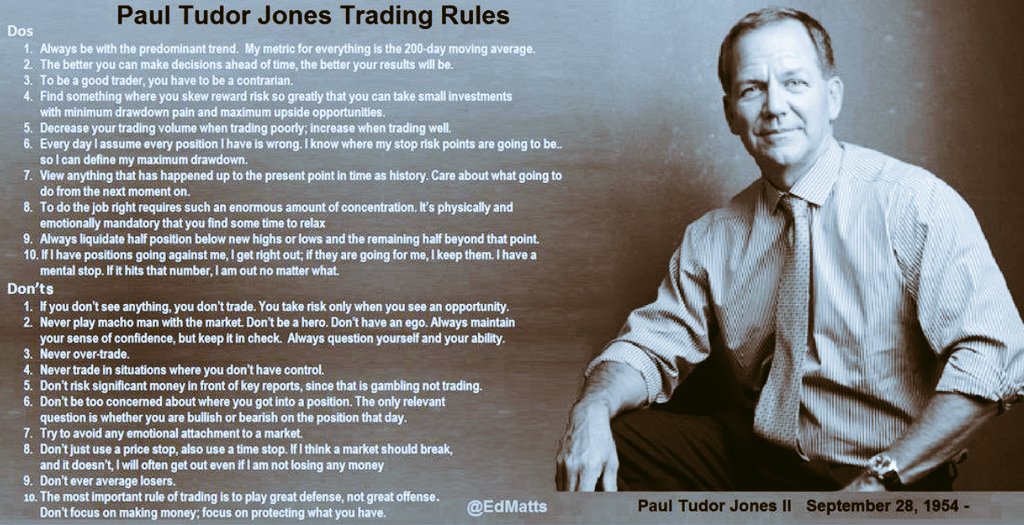

I use MACO(Moving Averages Cross Over)

16/n

Many. Again each one can result in different drawdowns. It is similar to timeframes. So what suits your purse and psyche is what you need to choose.

Which combination gives the best result. Do your home work. Right from 5 periods to 200 periods select combos

17/n

amazon.com/Pristine-coms-…

I have followed many of their course contents

Pristine used 20x200 but for me the drawdowns were very big so I moved to 10x20 which I had used for many years.

Backtest every combination and choose the one most suited for your risk profile. Keep this back testing a continuous exercise till such time you continue to trade

Not all stocks on FNO are amenable to trading in shorter duration timeframe. Your slippages may be huge.

Keep your mock trading journal reports ready on hand

If I can lay hands on I may even upload on Goolge Doc a model report - a typical excel sheet which you can follow,refine and use for your needs.

Do I use indicators while I trade.

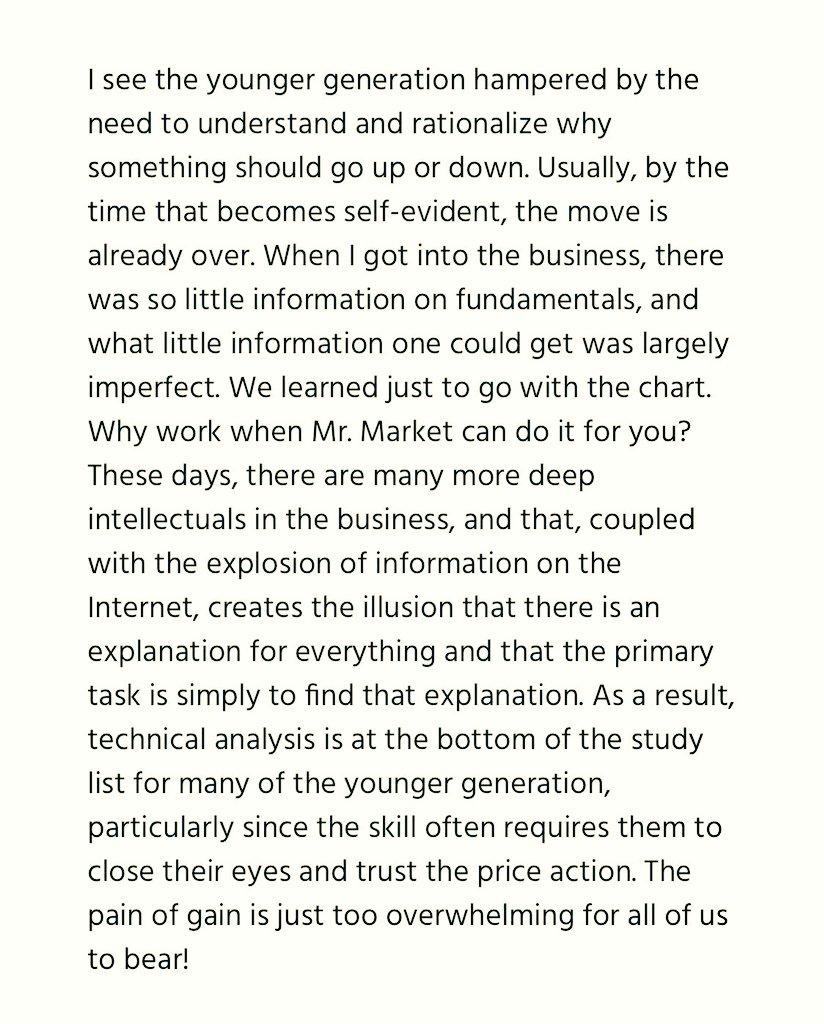

I think I might have told this earlier too. Reiterating it now here. Indicators are just that

Think of indicators in a Car that is travelling ahead of you. These indicators may give the signal to turn right but how far is it reliable?

Is it genuine or false signal?

Price is something nobody can fake. But indicators can be. I never trade on them but use them as ref