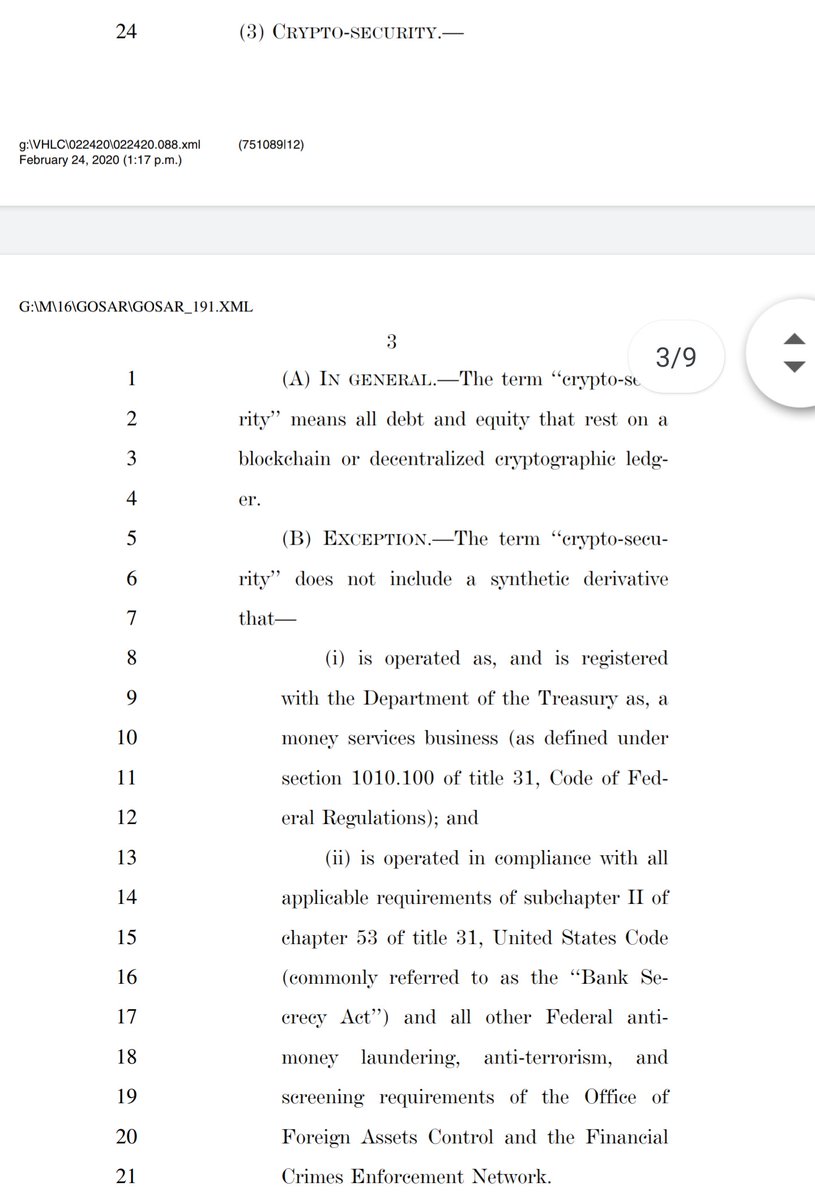

Interestingly, the bill introduces a whole new crypto taxonomy to the space, which until now, seems to be the most clear and straight-forward ever proposed to the Congress.

The good news are [should this bill be approved], IMO:

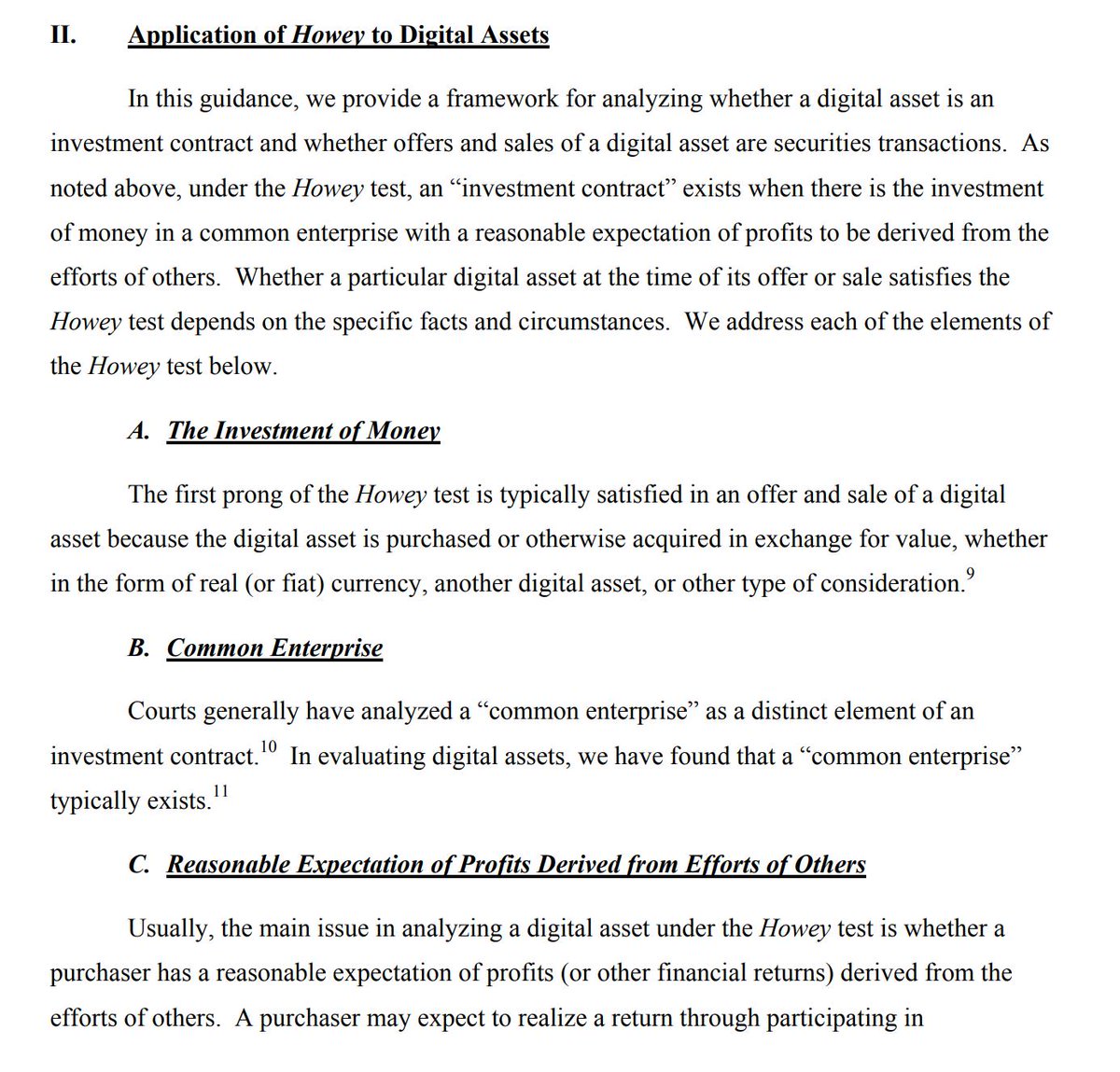

1) DAs such as XRP will be classified as Crypto-Commodities subject to CFTC supervision. This, since buying XRP clearly does not imply participation in any company's debt or equity nor is XRP a synthetic US derivative.

2) As opposed to the obtention of burdensome MSB licenses, the bill would allow USD stablecoins, etc., to operate only with a registration before the Secretary of Treasury.

This could potentially simplify the regulatory framework for interoperability layers (ILP connectors)

The bad news are:

1) The bill does not propose changes to the Securities Act, which means that both regulations would end-up confronting in courts (potentially).

2) Same could happen with respect to MSB regulations.