I needed a distraction after i hit that pile of bad memories and had a little panic attack; So i decided to make another crypto chart ^_^

Maybe this shows better *why* i don't trust Bitcoin volume as measured in trades instead of dollars.

It doesn't line up with the price spike

Maybe this shows better *why* i don't trust Bitcoin volume as measured in trades instead of dollars.

It doesn't line up with the price spike

Peter Lynch in his 1994 speech said "Stocks aren't lottery tickets.... Coca Cola is earning 30 times what it did 30 years ago, its price has gone up 30 times. Bethlehem steel earns half as much as it did 30 years ago, the share price is half."

Well Crypto runs on Pure Demand.

Well Crypto runs on Pure Demand.

IOTA is more reliable in price action because it's a private network with no ability to print more money AND it's an alt coin with a smaller market cap. Meaning it's out of the public eye, including Tether's eye.

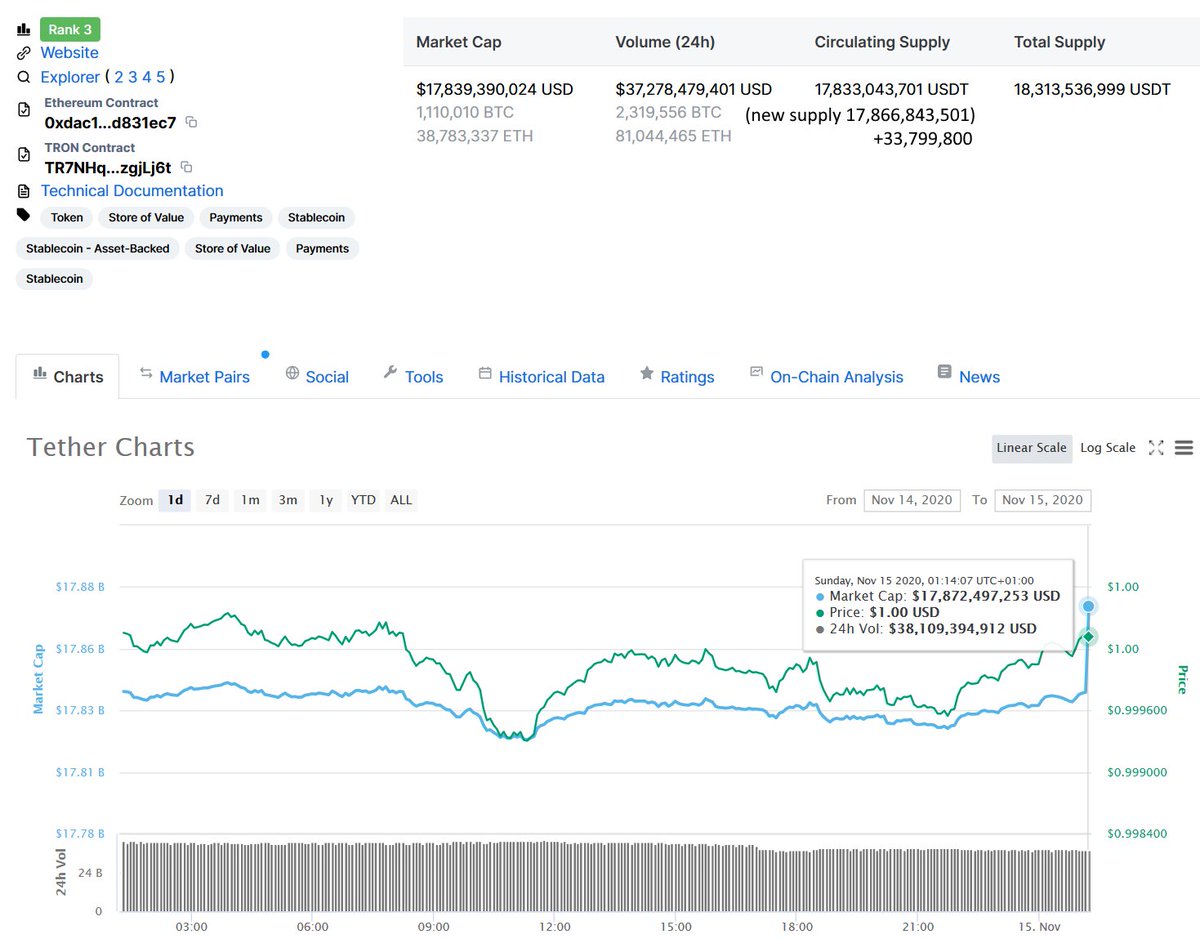

And while Bitcoin might not be able to print more, Tether sure is.

And while Bitcoin might not be able to print more, Tether sure is.

The key here is that Tethers can be EXCHANGED for Bitcoin, and Bitcoin/Tether can in turn be exchanged for Dollars. Yes, they could pump up IOTA too by hoarding it - but the market cap is small which has no effect on a now $18 billion scam, and is way too suspicious anyway.

My point being. IOTA can be trusted to run on actual demand at this point in time.

And the chart *clearly shows* *what* price action goes with *what* increase or decrease in volume.

The volume and price trends are clearly identical in angle of the line. This is all expected.

And the chart *clearly shows* *what* price action goes with *what* increase or decrease in volume.

The volume and price trends are clearly identical in angle of the line. This is all expected.

Bitcoin shows the *exact same behavior* BUT! only outside of price spikes.

If you eliminate just 4 months from that multi year bitcoin chart, the pattern lines up again.

Meanwhile, the volume trend *never deviated* from the mean, until *very* recently.

If you eliminate just 4 months from that multi year bitcoin chart, the pattern lines up again.

Meanwhile, the volume trend *never deviated* from the mean, until *very* recently.

Furthermore, EACH deviation in 2020 *followed* a spike in price, *it did not lead the rise in price*.

In other words;

Because the price went up, more people went looking for it.

Instead of;

The price went up because more people looked for it and bought it after consideration.

In other words;

Because the price went up, more people went looking for it.

Instead of;

The price went up because more people looked for it and bought it after consideration.

The google trends search volume chart that everybody is so fond of linking does not show this behavior THROUGHOUT 2017.

It's not enough to see an uptick. In 2017, search volume matched the price uptick for uptick, sometimes even frontrunning it.

That is NOT the case today!!

It's not enough to see an uptick. In 2017, search volume matched the price uptick for uptick, sometimes even frontrunning it.

That is NOT the case today!!

People think i'm against crypto in general and i'm not. I'm against there being 4064 of em now on investing.com.

A few of em undoubtedly have value.

But we're never gonna find out which ones without a good ol' fashioned Purge.

And Tether/Bitcoin will lead the way.

A few of em undoubtedly have value.

But we're never gonna find out which ones without a good ol' fashioned Purge.

And Tether/Bitcoin will lead the way.

• • •

Missing some Tweet in this thread? You can try to

force a refresh