#TETHER WATCH ALERT 🚨🚨🚨🚨🚨

I think found the source.

I was partially looking in the wrong direction. I suspected Bitfinex due to them owning Tether. But i didn't suspect collusion.

Think it was Kraken all along.

FULL, DETAILED explanation below!!!!

#Bitcoin $BTC #Fintwit

I think found the source.

I was partially looking in the wrong direction. I suspected Bitfinex due to them owning Tether. But i didn't suspect collusion.

Think it was Kraken all along.

FULL, DETAILED explanation below!!!!

#Bitcoin $BTC #Fintwit

To catch everybody up to speed on the scam:

desogames.com/why-i-hate-bit…

SKIP THE BITCOIN PART! I'm not gonna have the value discussion here. We can all agree that there have been plenty of scams in history involving value. If you love bitcoin you'd want it to be scam free.

desogames.com/why-i-hate-bit…

SKIP THE BITCOIN PART! I'm not gonna have the value discussion here. We can all agree that there have been plenty of scams in history involving value. If you love bitcoin you'd want it to be scam free.

First off; Tether printed another 71,500,000 tether last night. Nice round number. Very organic. They printed 96,399,401 yesterday, what's that all about then?

Printed ~$500 million last 7 days, annualized $25,6 billion, down from $35B. Guess the rising price attention helps.

Printed ~$500 million last 7 days, annualized $25,6 billion, down from $35B. Guess the rising price attention helps.

Now. What you've all been waiting for. Where is this all coming from, and WHY doesn't anybody else see it?

Well. Turns out - it's because nobody's looking at the RIGHT data source. Because the scam is limited to very few actors, it only shows up in THEIR sources, if at all!

Well. Turns out - it's because nobody's looking at the RIGHT data source. Because the scam is limited to very few actors, it only shows up in THEIR sources, if at all!

Meanwhile, there are so many other sources that LOOK like they report the same thing, people think that 1 source is a glitch. What have i been telling you people about glitches? They're either consistent, or one off.

Let me run you through *exactly* how i found the link.

Let me run you through *exactly* how i found the link.

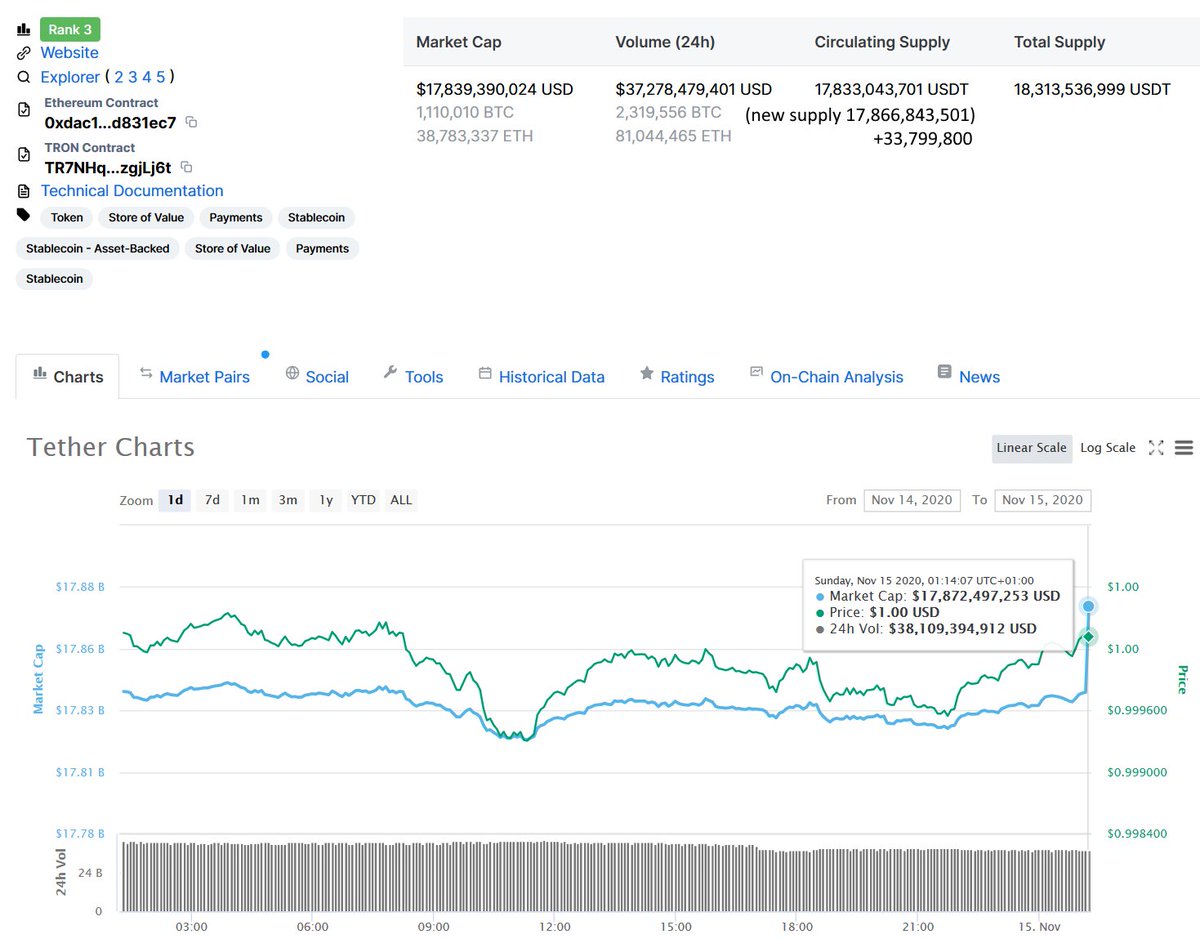

Lets start with the "Volume Event" on Coinmarketcap on November 17th.

I've been watching Coinmarketcap on the daily as it's the first site i found on google that cleanly showed the market cap of Tether going up in a parabolic line.

And people *really* need pictures these days.

I've been watching Coinmarketcap on the daily as it's the first site i found on google that cleanly showed the market cap of Tether going up in a parabolic line.

And people *really* need pictures these days.

Well, since Tether's been printing at the same time every night, and since i was up on November 17th, i decided to check it live. The picture is what i observed.

I figured such a MASSIVE jump in volume should have repercussions. So i went to another website to check.

I figured such a MASSIVE jump in volume should have repercussions. So i went to another website to check.

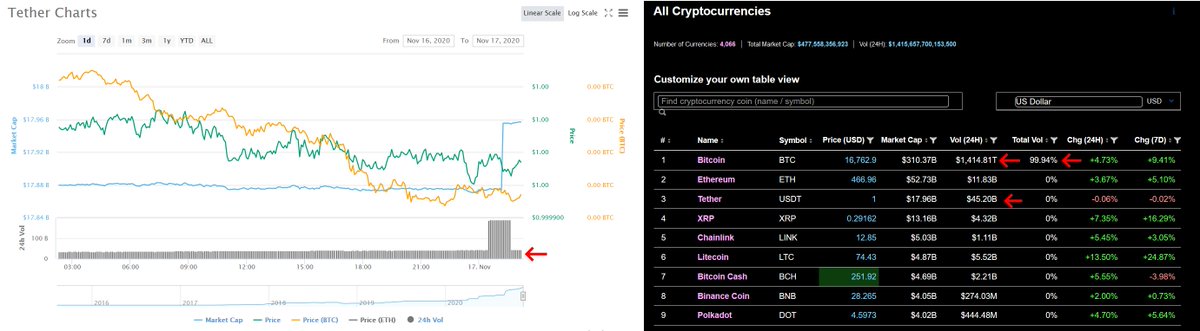

The site i regularly go to check charts is Investing.com. My followers will see me link charts from there regularly (no affiliation just the first one i found in January, they offer alot for free and it gives me good oversight ^_^).

So i did again and observed this:

So i did again and observed this:

Now.

I don't give a FUCK about what other website you tell me to check cause "it shows the correct data". THEY are wrong.

Because the volume of Tether on BOTH investing.com and coinmarketcap.com went up at the same time, *i know their data source is the same*.

I don't give a FUCK about what other website you tell me to check cause "it shows the correct data". THEY are wrong.

Because the volume of Tether on BOTH investing.com and coinmarketcap.com went up at the same time, *i know their data source is the same*.

It's not the site. Coinmarketcap being buggy is being run as cover.

THE COINMARKETCAP DATA IS CORRECT! THE DISCREPANCY IS IN THE DATA, NOT IN THE WEBSITE!

Since both sites are unaffiliated (investing.com is just a CFD trader as far as i know), this proves it.

THE COINMARKETCAP DATA IS CORRECT! THE DISCREPANCY IS IN THE DATA, NOT IN THE WEBSITE!

Since both sites are unaffiliated (investing.com is just a CFD trader as far as i know), this proves it.

This is further shown by my observations moments later, when the Tether volume returned to normal on both Coinmarketcap and Investing; But the Bitcoin volume stayed elevated moments longer.

If nothing else, this PROVES the link between the Tether discrepancy and Bitcoin.

If nothing else, this PROVES the link between the Tether discrepancy and Bitcoin.

However. This is not enough to prove it's Kraken, merely that it's happening.

Well thanks to the incessant linking of other websites, i decided to actually GO to other websites and see if i could find any trouble.

First target the most linked one: CoinGecko.

Well thanks to the incessant linking of other websites, i decided to actually GO to other websites and see if i could find any trouble.

First target the most linked one: CoinGecko.

Aaaand i didn't find anything resembling Coinmarketcap, as expected.

I did find some discrepancies of its own, but nothing of the same magnitude. And i kept wondering why that is.

But yknow, it lists the exchanges it tracks at the bottom on Coingecko. And no.1 is Bitfinex.

I did find some discrepancies of its own, but nothing of the same magnitude. And i kept wondering why that is.

But yknow, it lists the exchanges it tracks at the bottom on Coingecko. And no.1 is Bitfinex.

This made me wonder: MAYBE you don't see anything on Coingecko because the DEFAULT datasource you're looking at is Bitfinex - and coinmarketcap's is different.

Coinmarketcap Doesn't state their source for the default volume. So i wondered how i might check this theory.

Coinmarketcap Doesn't state their source for the default volume. So i wondered how i might check this theory.

I checked Investing, But they have this "new" view that doesn't show it either. However, their "old" view still works when i click bitcoin in a menu on their front page, and i figured, if i just go old-school and change the address bar link, i can see Tether in the old view too.

Success! AND, *this* view lets me cycle through sources. Because you see, Since Investing.com *WAS* affected by the volume event and coingecko wasn't, i figured maybe i can find a way to check Investing's default source.

It defaults to Kraken:

It defaults to Kraken:

Why is this important?

Because of the SECOND listing there. The Investing.com Tether Index - Tradeable on Investing (and their likely list default)

Since Investing is a CFD trader their index is a Derivative. What is it derived from? Why, all other exchanges ofcourse!

Because of the SECOND listing there. The Investing.com Tether Index - Tradeable on Investing (and their likely list default)

Since Investing is a CFD trader their index is a Derivative. What is it derived from? Why, all other exchanges ofcourse!

And as such, since Kraken *fucked up* with that Giant spike on the picture above (WHICH IS THEIR OWN EXCHANGE), i have proof that it's them - or they're atleast involved.

Via the menu i showed above, i can *show you the link* between Investing's index and Kraken's shenanigans:

Via the menu i showed above, i can *show you the link* between Investing's index and Kraken's shenanigans:

But i'm not done. There's only 1 thing left to prove, that the volume spiked on November 17th in Bitcoin.

WELL. Kraken's own site doesn't show the Minute chart beyond a day. CONVENIENT (neither does investing.com on the interactive chart, but still, convenient).

WELL. Kraken's own site doesn't show the Minute chart beyond a day. CONVENIENT (neither does investing.com on the interactive chart, but still, convenient).

The picture in the beginning shows volume spikes on the 3 minute chart, since it goes back 2 days and i saw some Minor irregularities (and i didn't wanna come up with nothing despite their hamstringing).

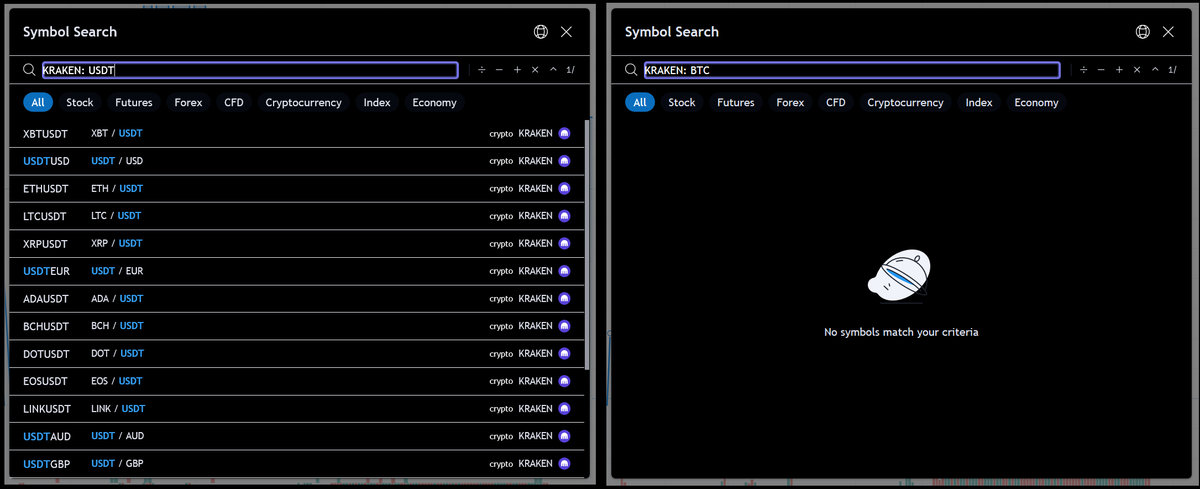

So i asked google for another site. Came up with tradingview.com.

So i asked google for another site. Came up with tradingview.com.

Now i'm PRETTY SURE nobody here is going to argue THAT site is glitchy, because i remembered the name as i saw it. *Their whole business* is stock market charts.

So i looked for the Kraken BTC/Tether pair.

But i couldn't find it. No matter how much i looked.

So i looked for the Kraken BTC/Tether pair.

But i couldn't find it. No matter how much i looked.

That's how i realized why nobody is seeing the same thing i am; Everybody is standing in the dark.

Tradingview Does Not Show Kraken BTC.

There are plenty of Bitcoin/USD pairs there. Plenty of Data from Kraken.

But Kraken Bitcoin isn't there. I can't externally prove the link.

Tradingview Does Not Show Kraken BTC.

There are plenty of Bitcoin/USD pairs there. Plenty of Data from Kraken.

But Kraken Bitcoin isn't there. I can't externally prove the link.

This has to be the case for plenty of other sites. If they're not using the Kraken data source, it never showed up.

Trading view *does* offer a more detailed look at USDT/USD volume, but i can't bring up the volume numbers. Anybody more experienced than me feel free to dig.

Trading view *does* offer a more detailed look at USDT/USD volume, but i can't bring up the volume numbers. Anybody more experienced than me feel free to dig.

There are spikes all over the place. So at the very least there's little trading among people and more trading among whales - if it's not Tether/Kraken themselves moving stuff around to pump up price.

On the 17th though, there's no comparable massive spikes.

On the 17th though, there's no comparable massive spikes.

I'm not one to trust a liar though. Not aggregating quick massive trades can cause this (AKA part of the plan). So i looked for *other* USDT/USD pairs.

There aren't any.

In short. The relevant pairs aren't shown. I can't find realtime data either. There's no way to check.

There aren't any.

In short. The relevant pairs aren't shown. I can't find realtime data either. There's no way to check.

Glitches are either one off or consistent.

But Forged Data shows patterns. As it's a human doing the forging actively, they will try and hide their actions best they can. In a vacuum it looks like a glitch, but in context, it shows a pattern.

The. Data. Is. Forged.

But Forged Data shows patterns. As it's a human doing the forging actively, they will try and hide their actions best they can. In a vacuum it looks like a glitch, but in context, it shows a pattern.

The. Data. Is. Forged.

I can't tell you *specifically* why the volume of Bitcoin on Investing.com spiked. But my best guess is because their derivative index also indexed the datasource at the one time the fraud would be visible: During the moment of transaction. Before it was averaged out.

At this point i REALLY don't know what else to do.

SOMEBODY JUST NEEDS TO GO LOOK AT TETHERS BOOKS!

IS THAT TOO MUCH TO FUCKING ASK!

THAT AUDITORS GET OFF THEIR LAZY FUCKING ASS AND GO RAID AN OFFICE!

IF THERE'S NOTHING WRONG, THIS COULD BE PUT TO REST IN A WEEK!

COWARDS!

SOMEBODY JUST NEEDS TO GO LOOK AT TETHERS BOOKS!

IS THAT TOO MUCH TO FUCKING ASK!

THAT AUDITORS GET OFF THEIR LAZY FUCKING ASS AND GO RAID AN OFFICE!

IF THERE'S NOTHING WRONG, THIS COULD BE PUT TO REST IN A WEEK!

COWARDS!

What do you expect to happen? For them to just admit to the crime when they've run it into the ground this far?

WIRECARD, FFS!

Have we REALLY become such an uncaring society that we don't give a shit about the people who stand to lose their entire life savings when this ends?

WIRECARD, FFS!

Have we REALLY become such an uncaring society that we don't give a shit about the people who stand to lose their entire life savings when this ends?

btctimes.com/news/kraken-ex…

If Kraken is becoming a full fledged BTC bank, why don't they show a BTC trading pair in trading view?

Does the US really think it's smart to *not* check Tether's books BEFORE handing over the keys to the city here?

If Kraken is becoming a full fledged BTC bank, why don't they show a BTC trading pair in trading view?

Does the US really think it's smart to *not* check Tether's books BEFORE handing over the keys to the city here?

Now i'm more than happy to take responsibility for raising an unnecessary fuss here if there's nothing wrong. I'll apologize and happily sink into irrelevance.

But never in my life have i seen such aversion to honesty and transparency. WHY isn't anybody in favor of checking?

But never in my life have i seen such aversion to honesty and transparency. WHY isn't anybody in favor of checking?

Well that's me done. I'll continue the watch, but i doubt i can find *even* more angles. I can only do so much from home. At some point, the police just needs to go knocking.

Tags! @PalisadesRadio @goldsilver_pros @wmiddelkoop @CFTC $BTC $ETH $BHC $USDT $XRP $LTC $LINK #fintwit

Tags! @PalisadesRadio @goldsilver_pros @wmiddelkoop @CFTC $BTC $ETH $BHC $USDT $XRP $LTC $LINK #fintwit

Forgot to add 1 thing. Because of the Kraken spike, and me keeping screenshots, i can calculate the move in market cap had that spike been market wide.

Moved from 1 to 1.12. Market cap is price x circulating supply. Supply was 18,018,593,900, x 0.12 = $2,162,231,268.

Both ways.

Moved from 1 to 1.12. Market cap is price x circulating supply. Supply was 18,018,593,900, x 0.12 = $2,162,231,268.

Both ways.

• • •

Missing some Tweet in this thread? You can try to

force a refresh