1/10) Prior to last week's #Uranium sector retreat😱 #Nuclear fuel consultants UxC & TradeTech forecasted deep multi-year U supply deficits with 200M lbs demand vs 135M lbs mined #U3O8 supply + 25M lbs of Secondary Supply that will be dropping due to pivot from #Russia⚠️ A🧵4U👇2

2) World #Nuclear Association was reporting 439 operable reactors (392 GW) + 56 more under construction (62GW)⚛️🏗️ with 26 expected to come online this year & next.⚡️🌞 96 more in advanced planning/ordered + 325 proposed🧾 for projected +2.6%/yr growth rate↗️🏗️🤠🐂 #Uranium🧵👇3

3) On Monday #Pakistan announced that a new 1100MW 'Hualong One' #Nuclear reactor built with #China had begun commercial operation⚛️⚡️ which will consume circa 0.5Million lbs of #U3O8 #Uranium per year delivering #CarbonFree #electricity for the next 60+ years.🌞🇵🇰⛏️🤠🐂 🧵👇4

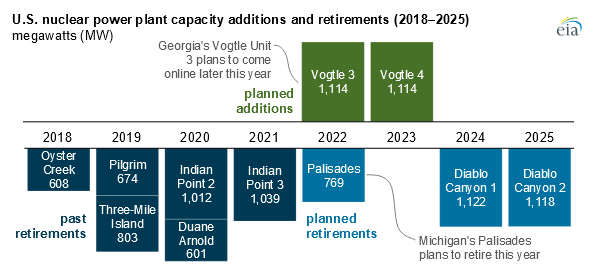

4) On Tuesday, Biden admin launched a $6 Billion Civil #Nuclear Credit program aimed at preventing premature closures of economically at-risk US reactors.💰⚛️🚑 #Michigan's Governor is applying to prevent May closure of Palisades NPP=> more unexpected US #Uranium demand.⛏️🤠🇺🇸👇5

5) On Wednesday, #China announced approvals to build 6 new #Nuclear reactors this year that are expected to add around 7.5 Gigawatts of new #CarbonFree #electricity⚡️ that will consume about 3.5 Million lbs of #U3O8 #Uranium per year for 60+ years (>200M lbs total)🌞⚛️⛏️🤠🐂🧵👇6

6) On Wednesday #SouthKorea's new president-elect reaffirmed plan to reverse planned phaseout of the nation's 24 #Nuclear reactors↪️⚛️🇰🇷 announcing policy change to allow 18 reactors to be life-extended, adding about 8.3M lbs per year of future unanticipated #Uranium demand.⛏️👇7

7) On Thursday, #India announced that approvals had been given to begin construction of 2 more 700MW indigenous #Nuclear reactors that will deliver 1.4GW of #CarbonFree clean #electricity⚡️ consuming about 0.5 Million lbs of #U3O8 #Uranium per year for 40+ years.🇮🇳⚛️🏗️⬆️🤠🐂🧵👇8

8) On Thursday, #Poland received a first bid from #SouthKorea to build 8 new #Nuclear reactors of a combined capacity of 8.4 Gigawatts of #CarbonFree #electricity to support planned #coal exit🌞⚡️ consuming over 4 Million lbs per year of #Uranium #U3O8 for 60+ years⚛️🏗️⬆️⛏️🐂👇9

9)Last week Spot #Uranium was sucked down in a North American U #stocks & commodity meltdown🌪️ that shaved $8/lb off Ux #Uranium Futures Front Month contracts in an early "month-end smash"🔨 & panic selling😱 dropping to $56.60/lb⤵️🎆😲 🧵👇10

10)Take-away for the week:🥡 major growth in #Nuclear fuel demand⚛️⬆️ collides with drop in #Uranium price⛏️⬇️💥🔀 now >$20/lb below incentive U price to restart idle mines & build new ones, which further delays U supply response🐌 putting even more pressure on U supply/price🗜️🚀

• • •

Missing some Tweet in this thread? You can try to

force a refresh