How should we decide what to do?

1) Follow the demand.

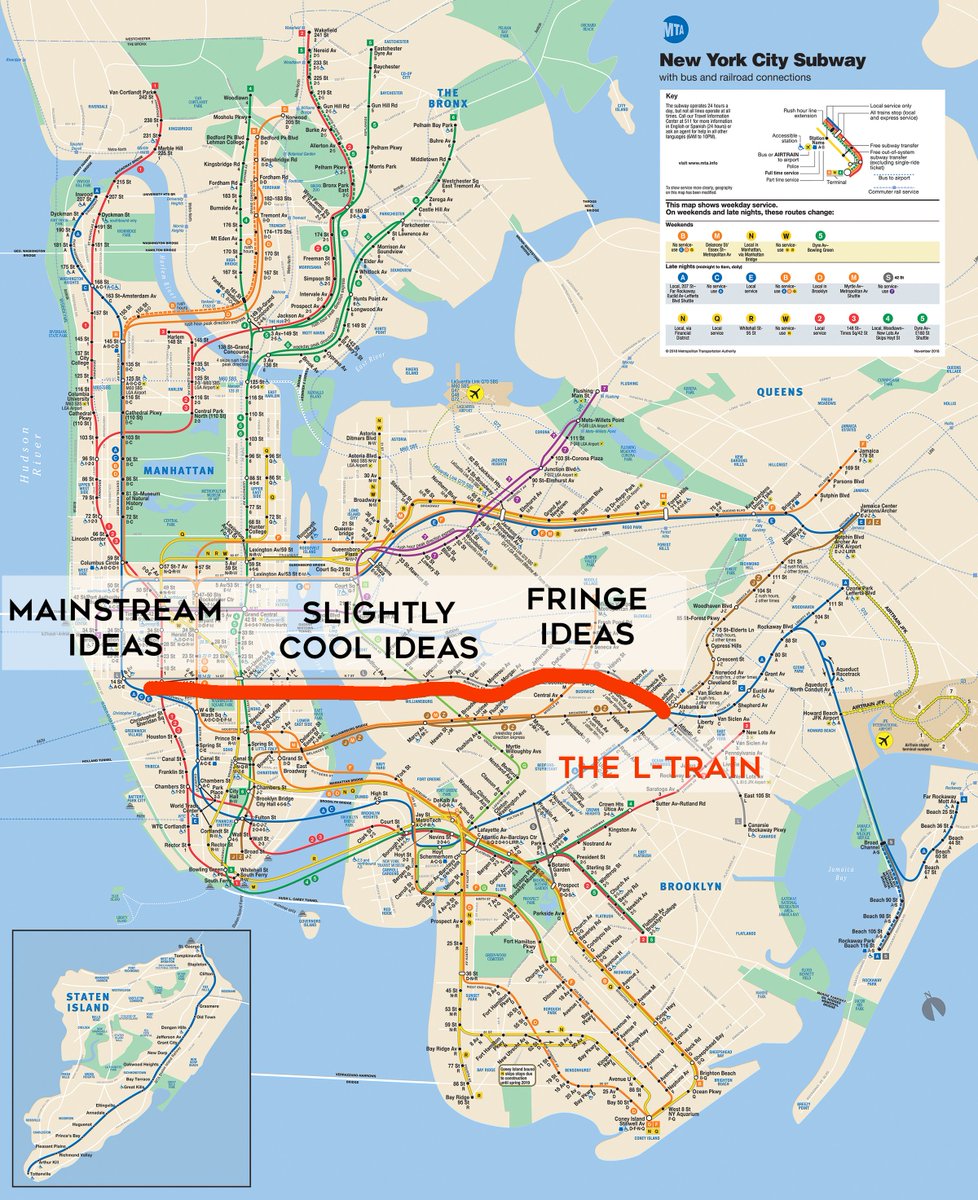

2) Good opportunities are easy to explain.

3) Invest when there’s big upside, small downside.

These rules let Zell succeed in spite of chaos + uncertainty.

Jeff Bezos has compressed his entire philosophy, packed with ideas, into two simple rules:

1) It’s always Day 1

2) Be obsessed with the customer

But he suggests a better strategy: learn through awareness.

1. imagine your the desired outcome. What does it feel like? Look like? Sound like?

2. Don’t judge yourself.

That’s it.

And it works like MAGIC!

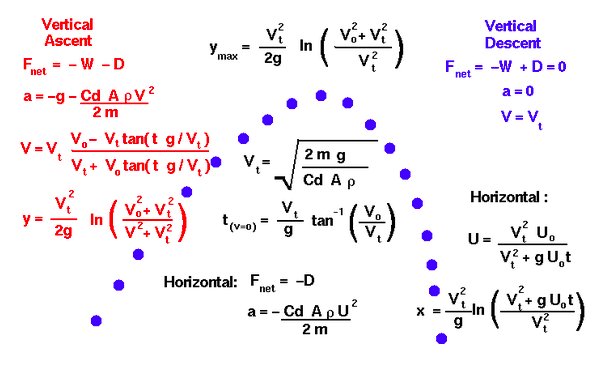

This is what the mathematical formula for catching a baseball looks like.

1) Align a flying ball in the center of your gaze.

2) Run.

3) Adjust your run so the angle of the ball stays at the same spot in your gaze.

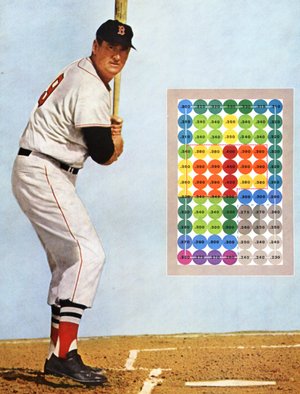

Williams simply waited for the right pitch. Then, he swung.

1) Break a sweat every day.

2) Get enough sleep every night.

3) Eat food, mostly plants. Not too much.

Why?

Because Grandma has spent her life compressing rules down to their essence. Her rules stand the test of time.

1) Be as curious as possible.

2) Good things come from compounding.

3) Always ask better questions and obsess over that.

4) Talk about other people being wrong as little as possible.

perell.com/podcast/tyler

But simple rules allow for relaxed concentration, which improves performance.

Simplicity makes us more focused and less stressed.

Good rules let us focus on what’s important. They reduce stress, guide action, and improve our thinking. This reduces internal chatter so we can be present, aware, and free.

There are definitely exceptions. But in general, there’s too much complexity and not enough simplicity.

Charlie Munger once said: “More investors don’t copy our model because our model is too simple. Most people believe you can’t be an expert if it’s too simple.”

Simple maxims, repeatedly performed, make for a successful life.