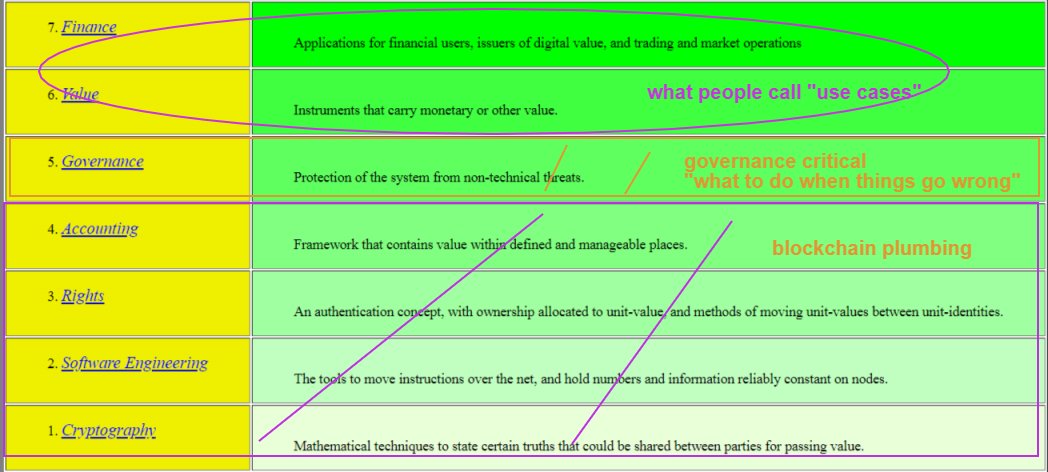

The limits of this model are exposed once you move up to the app layer 1/

1. Individuals yes

2. Or also part of a group with other humans

The app layer with current models is not flexible enough (at all) for group dynamics

Eg guarantees from members of a savings group 2/

individual digital footprint + group guarantees/savings group footprints 👣 3/

An individual

Or the group itself 4/

Are they in biashara?

Are they in boda boda biz?

Are they in a special biashara group ?

Group dynamics help refine the score

Right now, digital footprint is only part of true picture

5/

Im more concerned that he, the author, is trapped in his bias

He cant see any other way out besides attempting to refine what we've established is sub par 6/

Now see point /1

/10

Eg lender who tout the same digital data with an AI algorithm spin /11

🙄

Uber

And

Twiga

Have unearthed data that was hidden and why they are the new avenue for lenders /12

Who are lending to Jumia online merchants 13/

Data on the savings, credit, investment and insurance patterns of people within a group setting?

Where is it? 14/