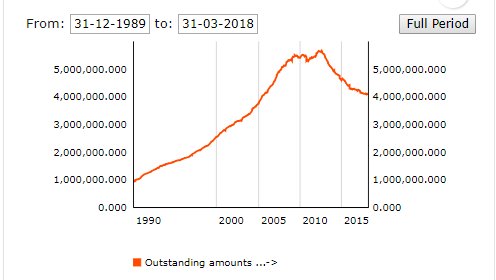

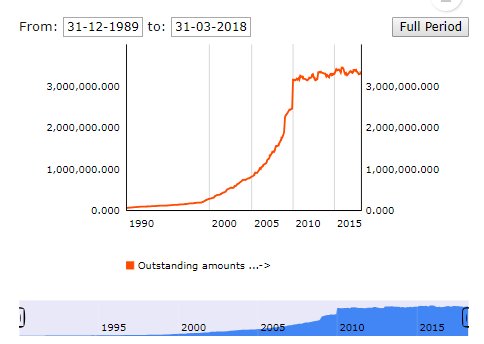

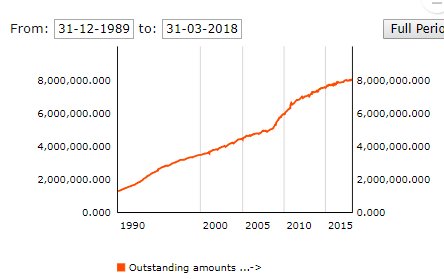

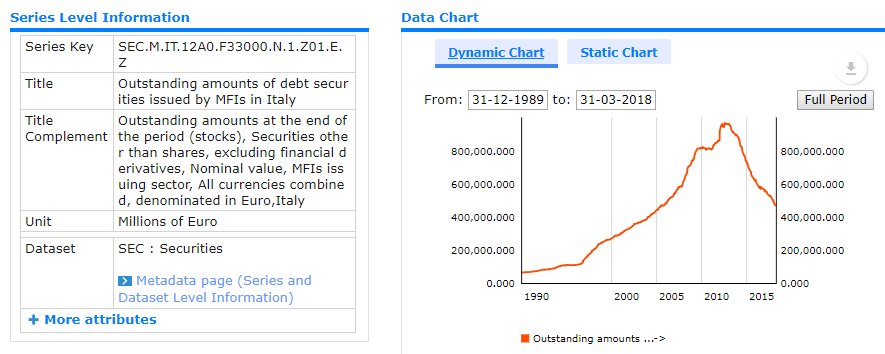

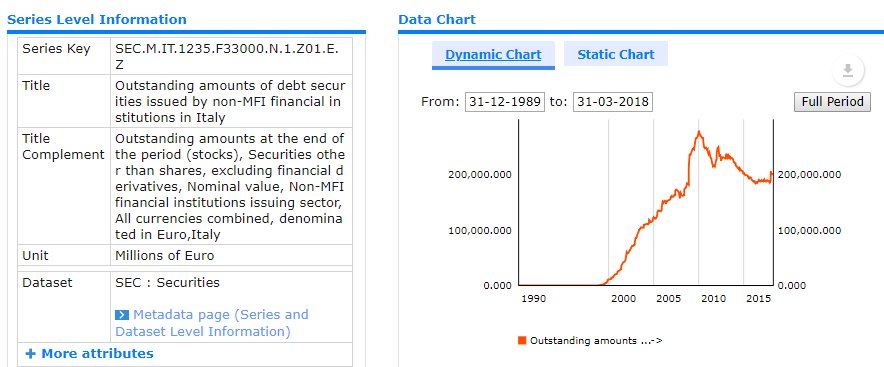

Eurozone banks (first chart) and "non-monetary" financial institutions (eg insurors) had more bonds outstanding in 2010 (€8.6 trillion) than all governments (€6trn).

Because banks hold much of this, their balance sheets they can't survive a sovereign default (eg Greece).

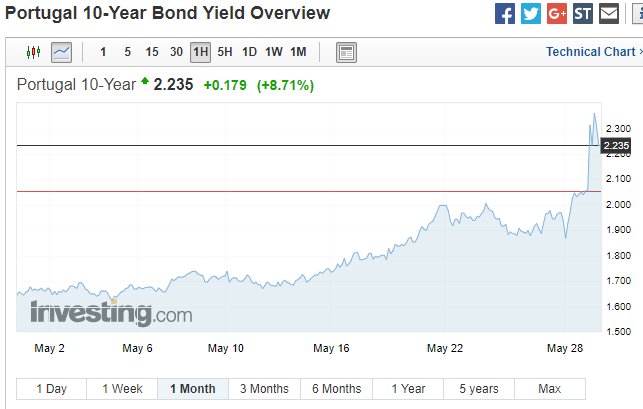

The Italian sovereign bond market has gone into full scale panic today, for very good reason (there is €2trn outstanding). And its spreading fast to others peripherals, as Portugal below shows.

ENDS