Hypothesis: Bitcoin's track record of bull runs makes it the ultimate temptation.

It is irresistible to institutional whales as a capitulation target.

Plus it’s a buying opportunity.

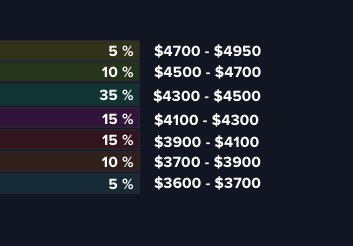

That’s why we always spread our buy orders out in layers.

Weird things happen on exchanges during moments of extreme volatility, and occasionally orders don’t get filled.

There will be plenty of great buying opportunities during the institutional accumulation period that follows capitulation.