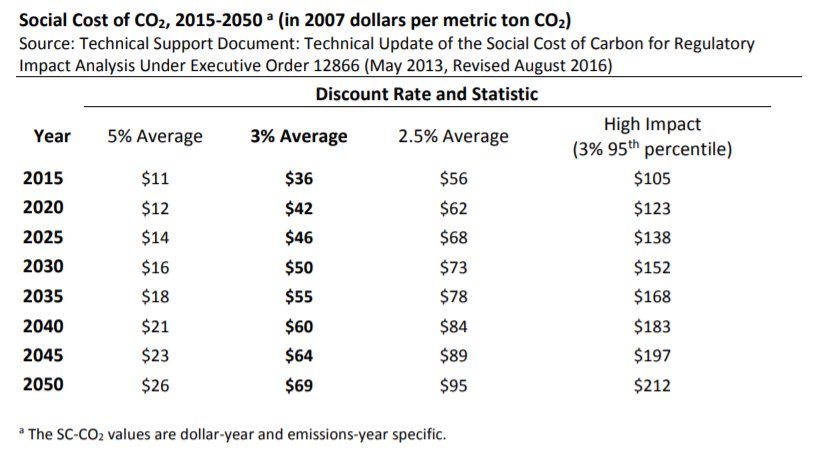

So it's a big deal that we dont fully price the damages from CO2. Why do we keep falling short with carbon pricing?

1. Subsidies for additional mitigation above what a constrained carbon price would deliver reduce further climate externalities. If marginal reduction in externalities exceeds marginal distortions from the subsidy, welfare and efficiency improve.

Feedback welcome.

Seen good research on this topic? Please share and I'll append to this thread.

Are you a PhD student in economics, political science, or public policy looking for a good dissertation topic? Hit me up and let's chat...