#MachineLearning(#ML,#DeepLearning) is used in stock trading algorithms/system intraday or EOD based system. Mostly these systems are predictive systems.

(1/n)

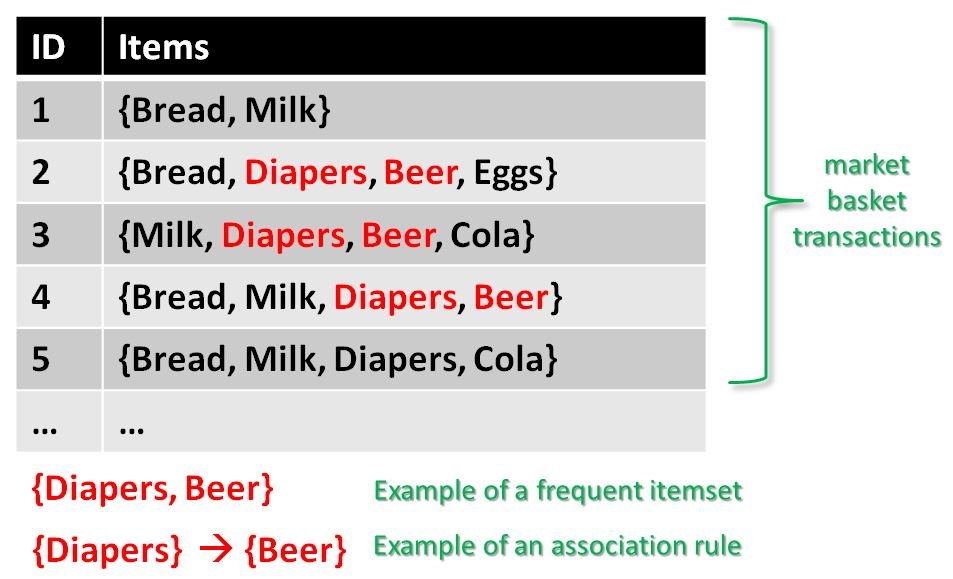

Input: your historical system trade data with various system parameters(like, rsi, supertrend , atr, etc) along with status or trade(winning or losing)

(3/n)

1. Connect to your db or csv, loads the trade data e.g input features (columns-rsi,supertrend,atr or any other parameter you feel is making difference in decision) (5/n)

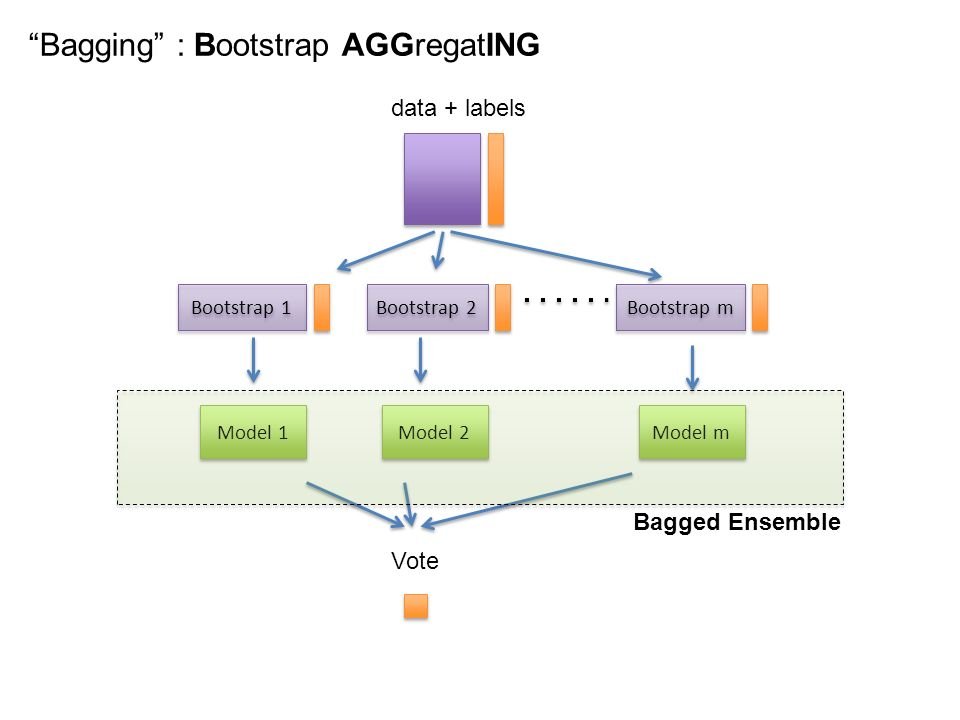

3. Use train data for training to Machine learning models

(6/n)

- SVM(with linear, polynomial,rbf)

- Logistic regression

- Decision tree/Random forest

- K-nearest Neighbor

- Naive Bayes

....baggin and boosting algos....and many more

(7/n)

6. Now use test data to see the performance of your models on unseen data.

(7/n)

(8/n)

1. get the input data in same format before putting trade/order

2. give this input data to above selected model

3. if output is winning then place order else don't

(9/n)

(10/n)

- Trade data has a pattern with respect to winning/losing trade

- Broadly, it is possible to separate winning trade and losing trade.

- Missing classification errors (type-i or type -2 ) are not significant

(11/n)