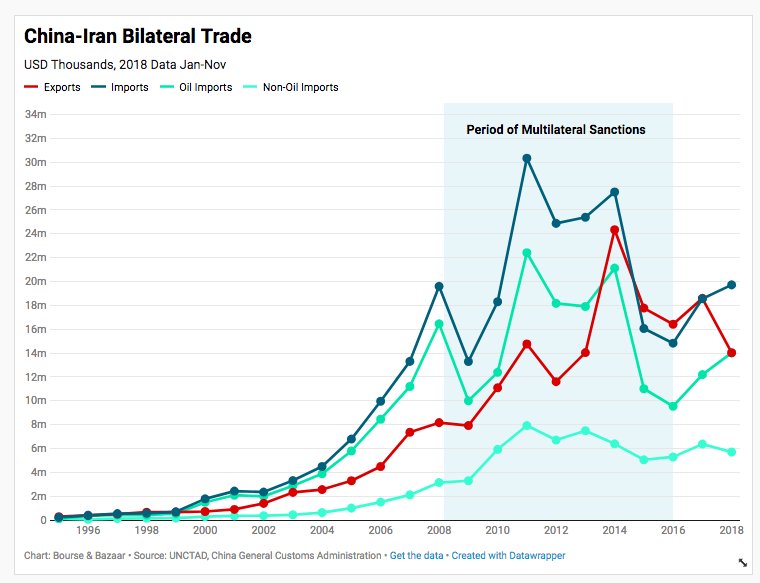

bourseandbazaar.com/research-1/201…

bourseandbazaar.com/articles/2019/…

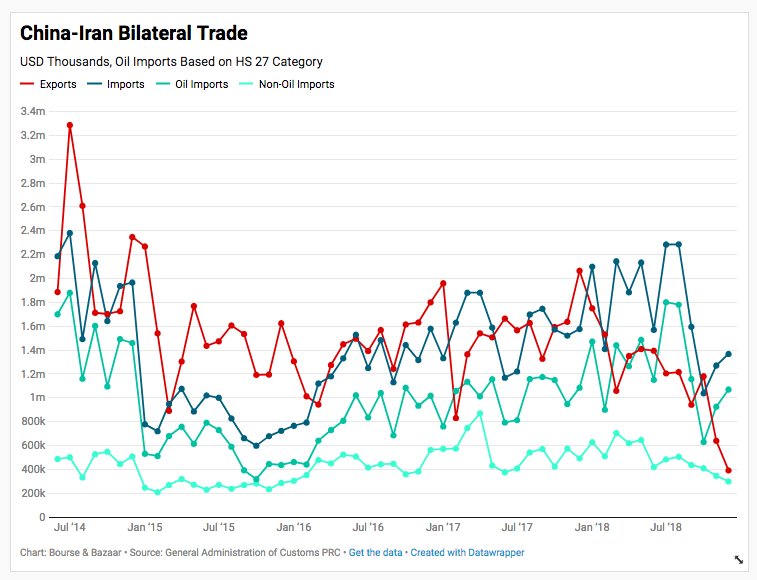

-October: $1.18b

-November $638m

-December: $391m

Data from the General Customs Administration of China.

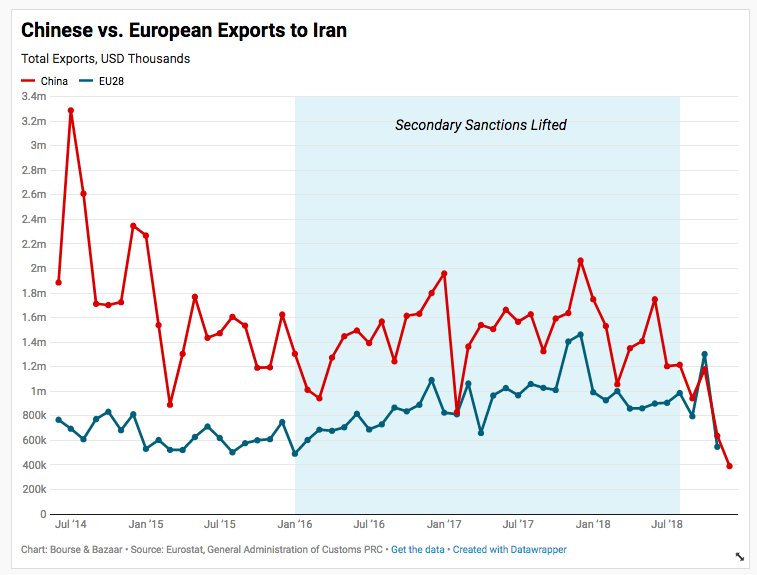

-The China-US trade war

-The new, more global profile for Chinese enterprises

-The desire to see Europe take the lead on sanctions pushback

bourseandbazaar.com/articles/2018/…

Iran will soon notice.

Download the full report here:

bourseandbazaar.com/research-1/201…