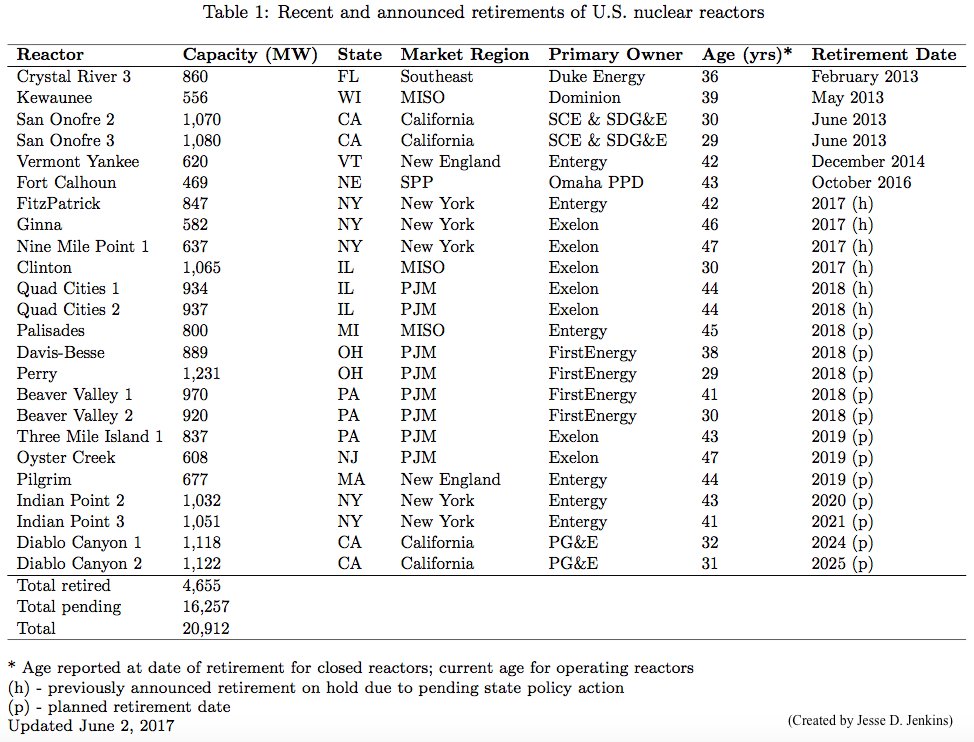

So what's killing nuclear power in the U.S.?

Abstract & paper here: ceepr.mit.edu/publications/w…

Slides presented at #ASSA2018 here: dropbox.com/s/b6192hrvn331…

NY & IL have already intervened. CT, NJ, others debating action now.

But what forces are really to blame for driving nuclear to the brink?

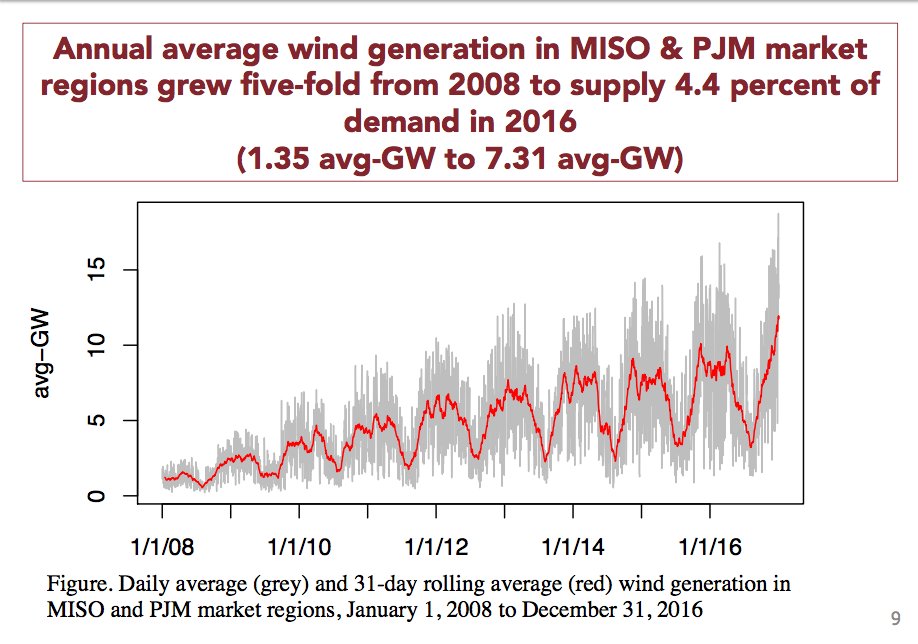

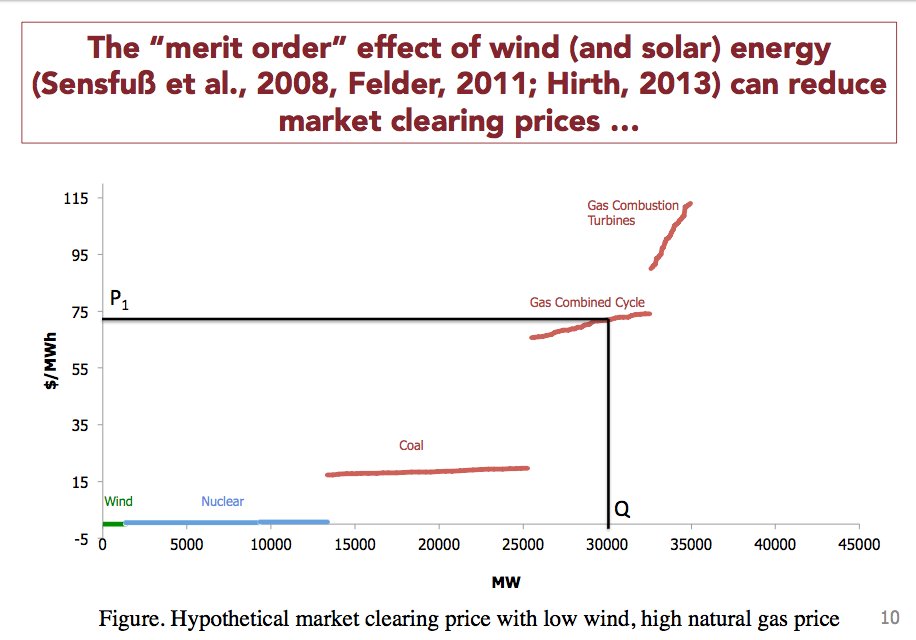

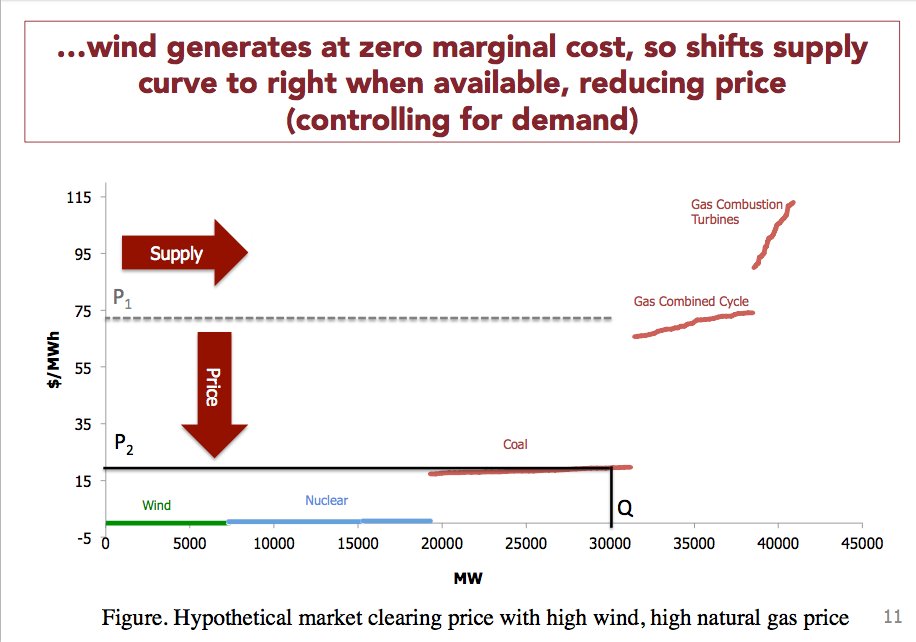

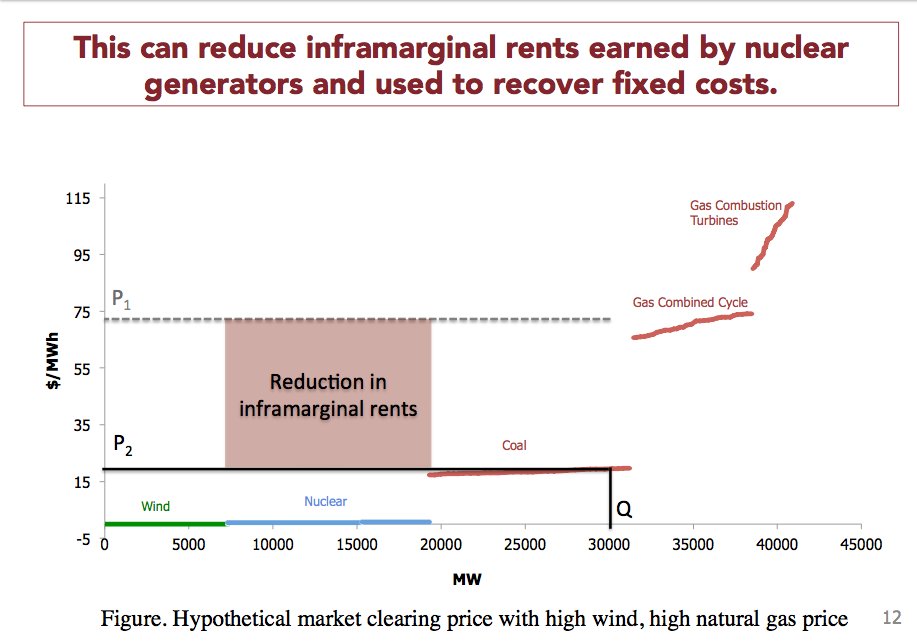

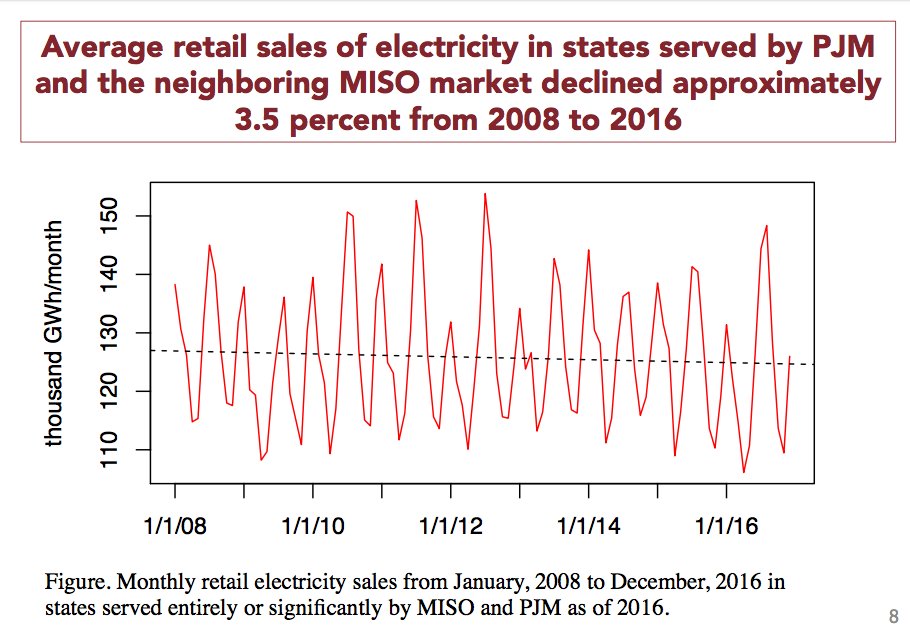

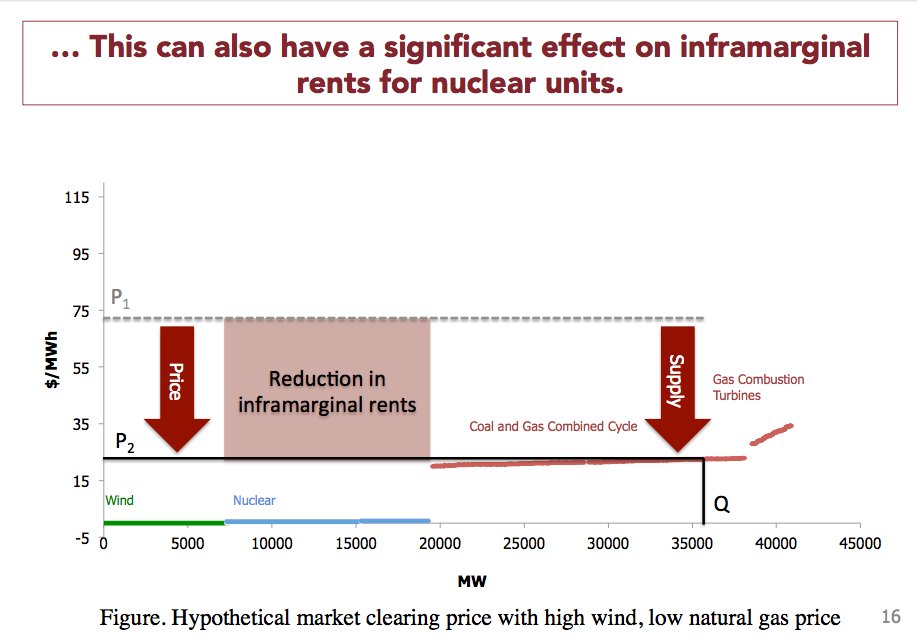

There are at least two other suspects in this case: stagnant demand for #electricity after the Great Recession and cheap #naturalgas unlocked by the boom in #shalegas production.

Lower demand obviously means lower prices. Straightforward effect. So that's suspect #2.

Despite Perry's assertions, DOE's "baseload review" concluded gas was biggest factor driving #coal or #nuclear plants offline energy.gov/staff-report-s…

Simulations by Haratyk at MIT sciencedirect.com/science/articl… & LBNL/ANL agree emp.lbl.gov/sites/default/…

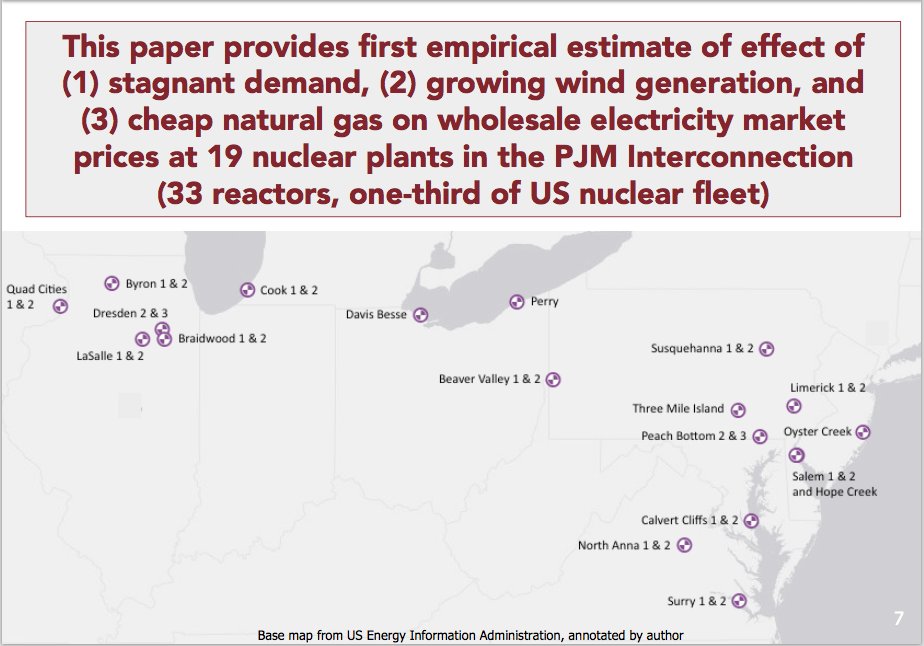

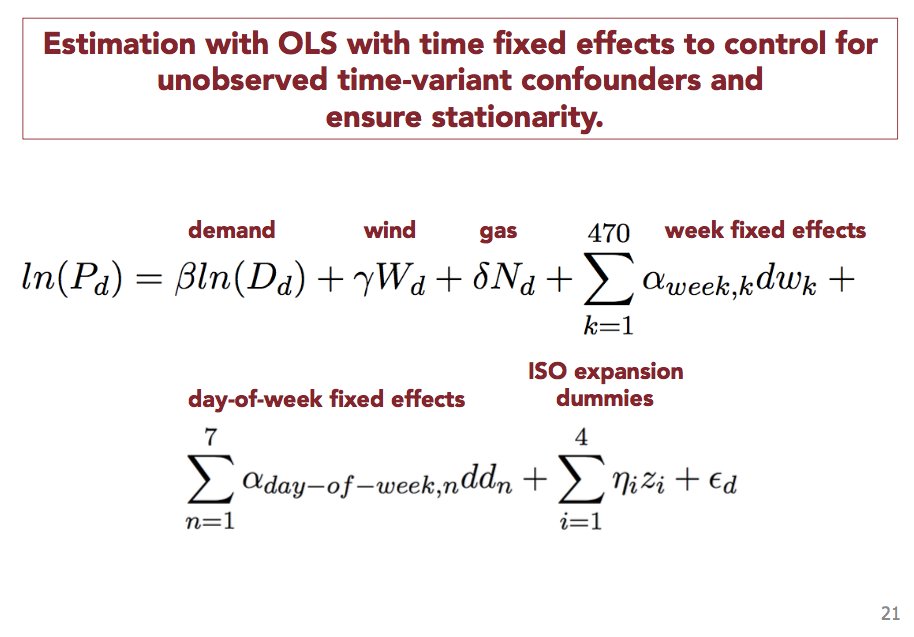

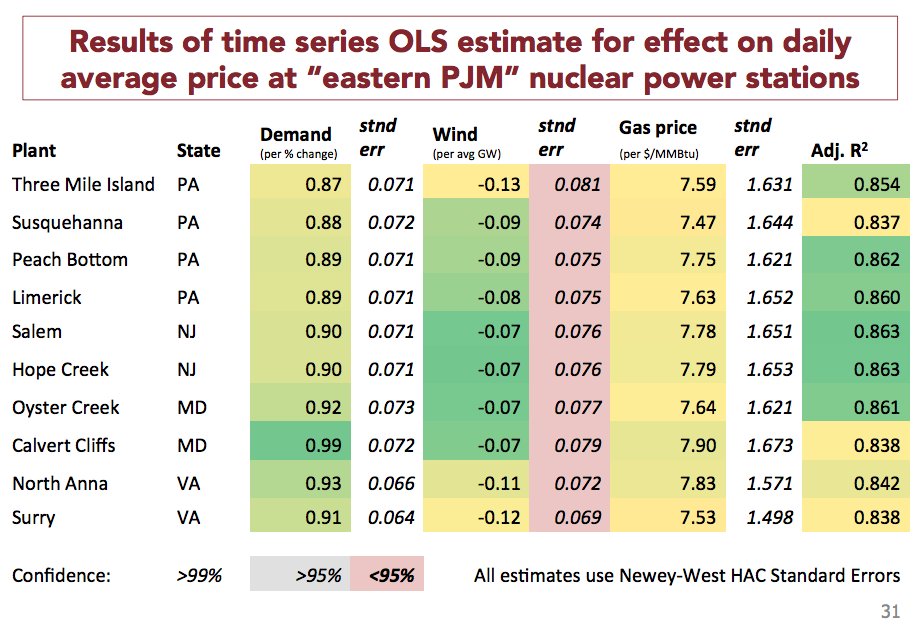

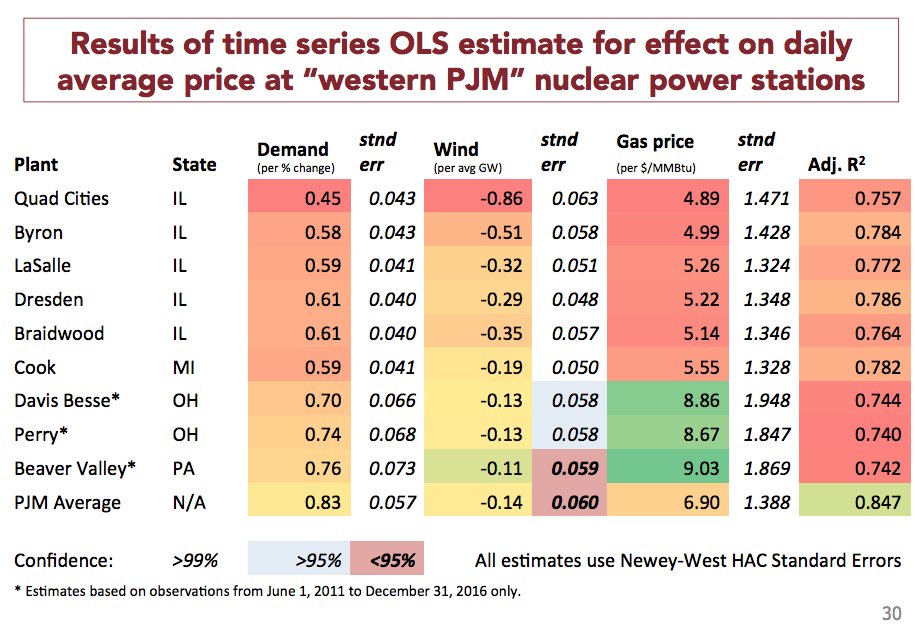

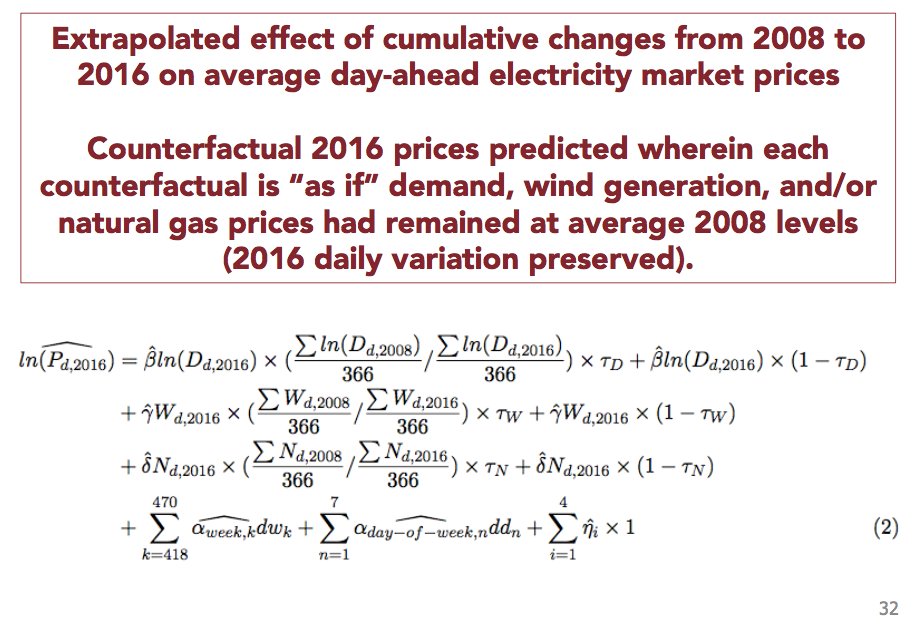

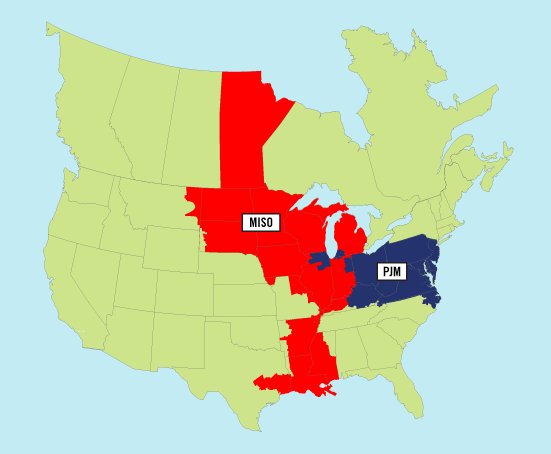

My paper provides the first empirical evidence in this case, focusing on 19 nuclear plants in PJM market.

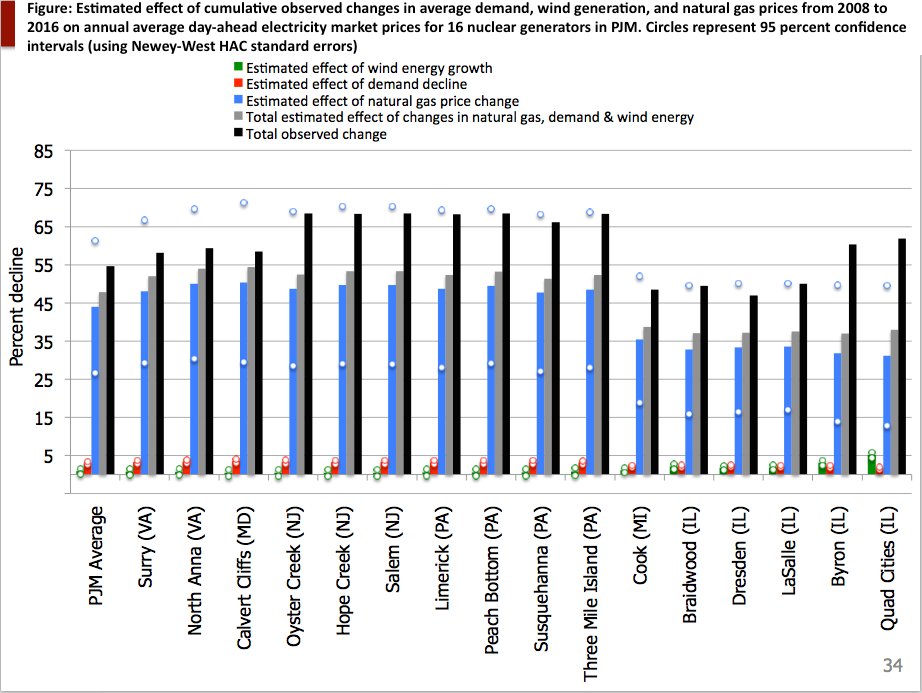

Here are my primary results.

The graphic makes it obvious: natural gas is the main killer. Effect of gas is order of magnitude larger than wind or demand.

For ALL OTHER nuclear plants in PJM, wind does not appear to have statistically significant effect on prices earned.

That said, stagnant electricity demand and expectations of future growth in wind generation going forward may be accomplices.

Case closed? /end

Link in thread above is unfortunately broken.