Dual Momentum – A Craftsman’s Perspective

Download here:

investresolve.com/global-equity-…

Everything that follows in this thread is based on HYPOTHETICAL AND SIMULATED RESULTS.

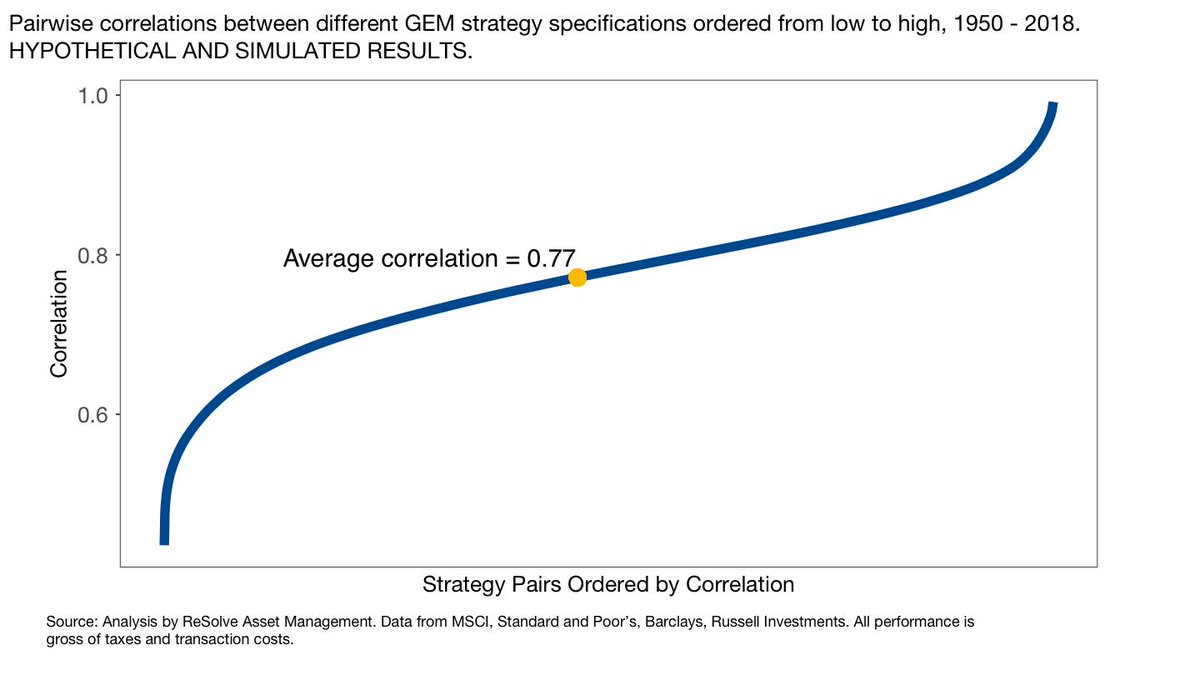

1.Verify the strength and robustness of the Dual Momentum concept and specifically the Global Equity Momentum strategy

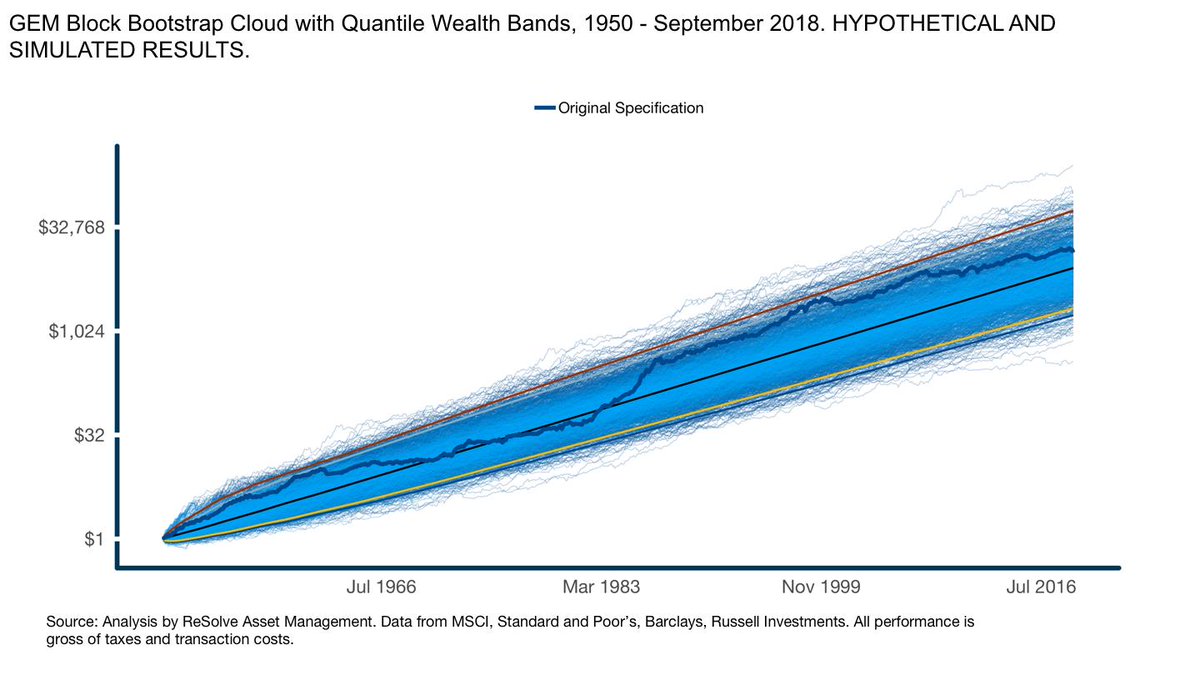

2.Describe how to use ensemble methods to preserve expected performance while minimizing the probability of adverse outcomes

See also investresolve.com/blog/winning-b…

It seems ALL SPECIFICATIONS HAVE EQUAL MERIT.

Also open for comments and/or questions here.

Download here:

investresolve.com/global-equity-…