80-20 setup

I am going to share one high probability reversal setup for swing traders.

Before i explain setup below are few rules.

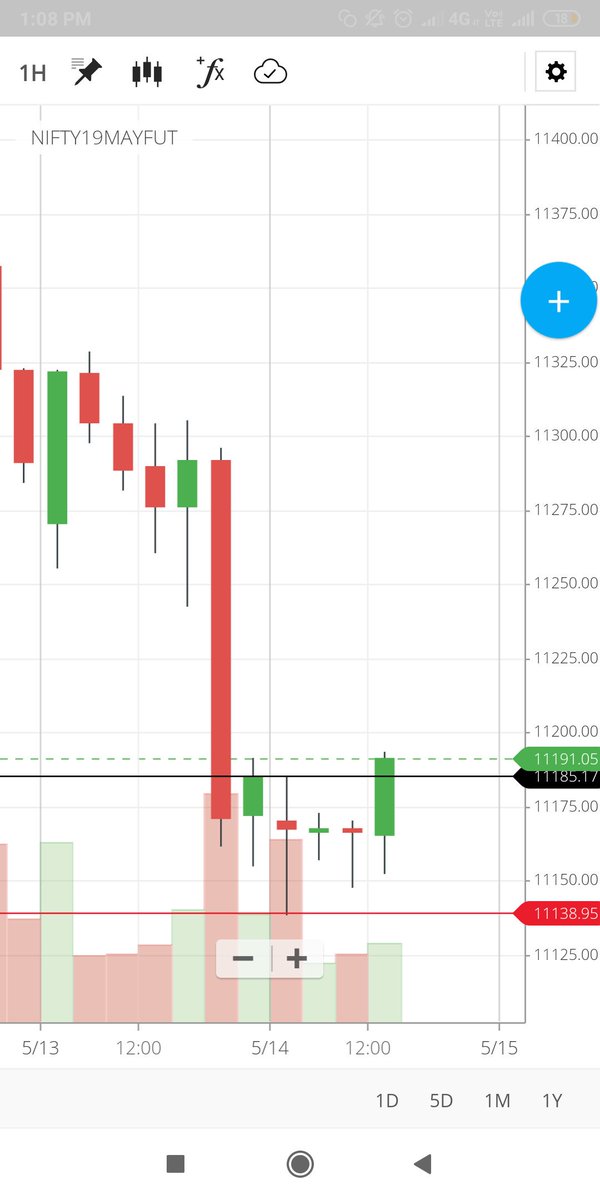

● Stock should have body of nearly 1% on Previous Day.

● For INDEX Body should be more than 0.5% on previous day.

(1/n)

1. On previous day underlying should have opened in lower 20% of the day range and should have closed in upper 80% of the day range.

2. On current day in first hour of the trading day stock should have crossed PDH.

(2/n)

4. Intial targets for swing trades can be 1:2 RR then trail your stops.

(3/n)

1. On previous day underlying should have opened in upper 20% of the day range and should have closed in Lower 80% of the day range.

2. On current day in first hour of the trading day stock should have crossed PDL.

(4/n)

4. Intial targets for swing trades can be 1:2 RR then trail your stops.

(5/n)

PDL : PREVIOUS DAY LOW

PDC : PREVIOUS DAY CLOSE

DH : DAY HIGH

DL : DAY LOW

(6/n)

Trade on standard stocks only, which has great volume.

(End of thread)

Titan sell below 1132 sl DH

Reliance buy above 1251.2 SL DL

YESBANK buy above 163.9 SL DL

INDUSINDBK Buy above 1440 SL DL

For swing traders

Carry position only if it's in profit.

DH : Day High

DL : Day Low

#Ultracemco

Buy reversal setup

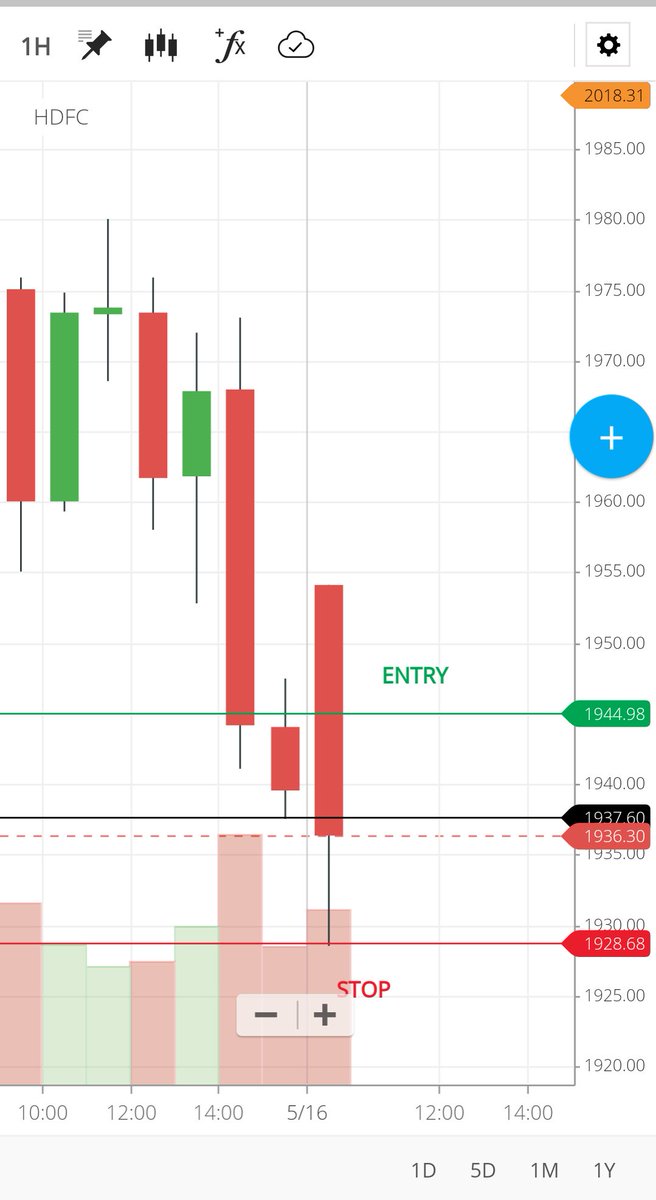

1. HDFC BUY ABOVE 1945 (PDC)

STOP DL

2. ULTRACEMCO BUY NEAR 4343 (PDC)

STOP DL

TRADE AFTER 1 Hour Candle completion only.

Reversal setup again🎷🎻🎺🎸

Sell will be triggered below 28958 (pdc)

Sl DH

sattoriyo ka index.😃😃😃

#GRASIM

#HDFC

#INDUSINDBNK

80-20 REVERSAL SETUP

SELL BELOW PDC (PREVIOUS DAY CLOSE)

SL DH (DAY HIGH)

REFER GRAPHS

GRASIM SELL NEAR 890 sl DH

INDUSINDBK sell near 1494-95 sl DH

HDFC (AVOID SELL)