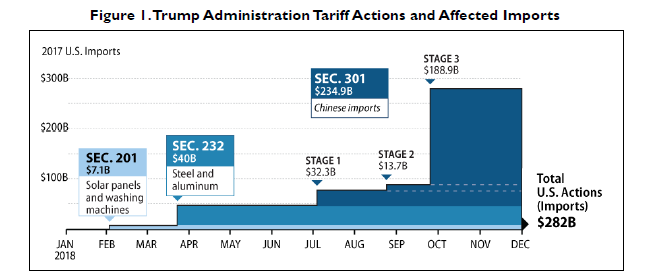

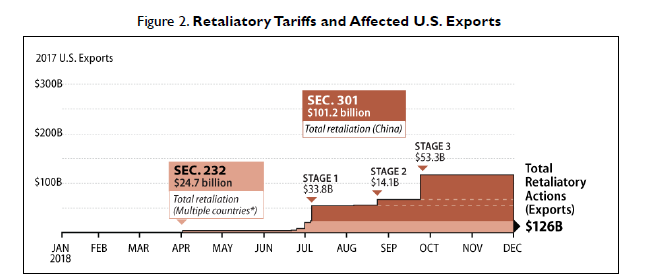

As I've been saying now for a year, Trump's tariffs - good summary below from CRS (fas.org/sgp/crs/row/R4…) - have so far been dumb, ineffective and painful (a little for everyone & a LOT for some) /1

bfi.uchicago.edu/wp-content/upl…

nber.org/digest/may19/w…

/2

So this has clearly been dumb/bad policy thus far /3

) /4

(anyway...)

Or that new Krugman column: /9

(leaving aside the long-term problems)

/10

So maybe this all stays contained & the pain, while real and significant (far moreso than last year), remains manageable.

But maybe not? /11

But I'm not holding my breath either.

Buckle up. /x