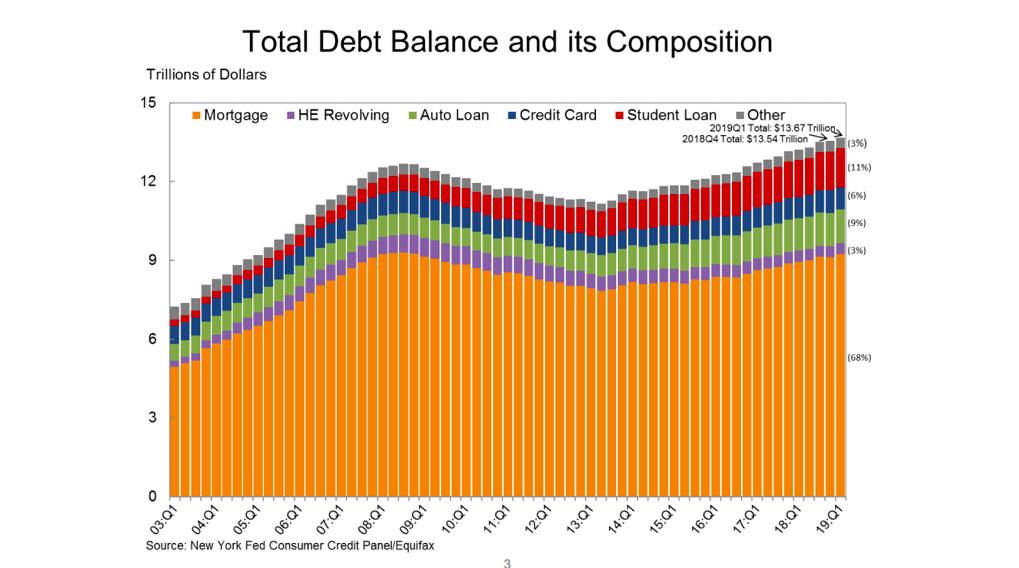

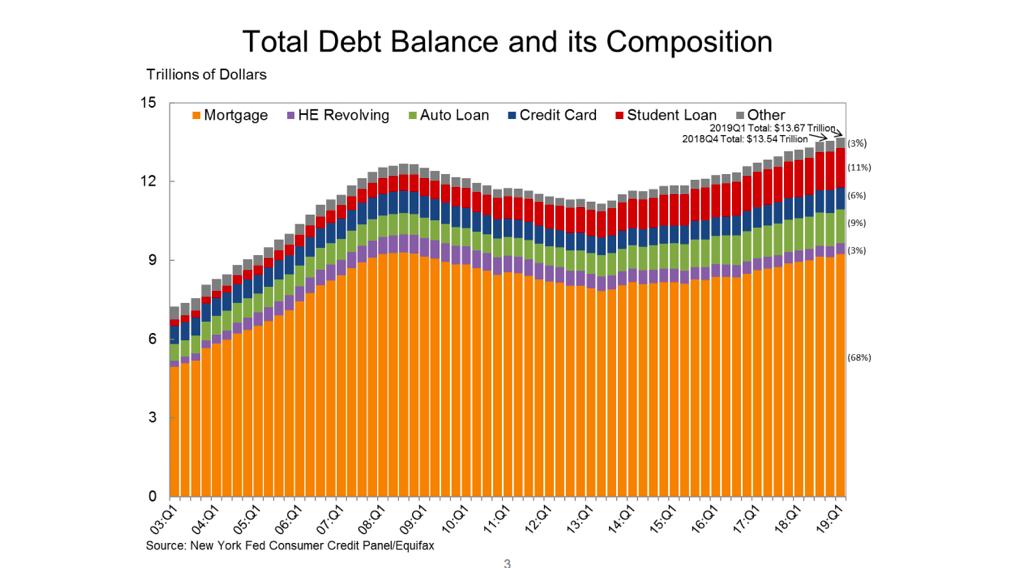

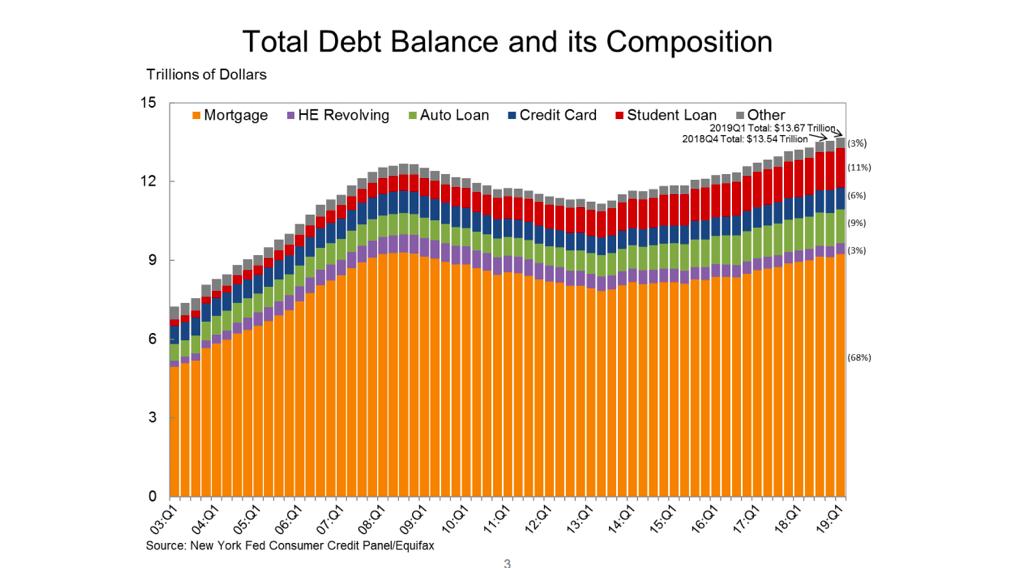

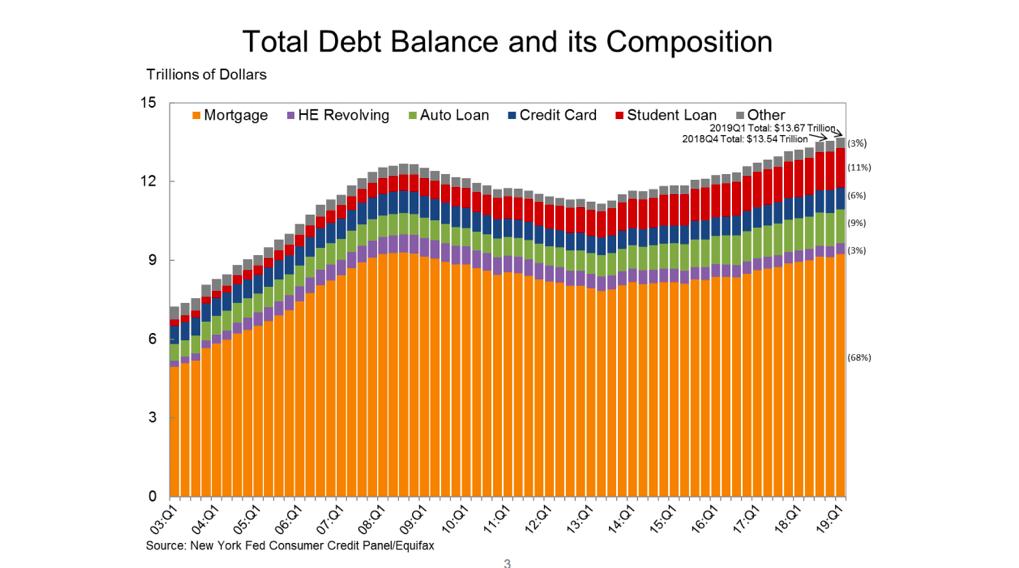

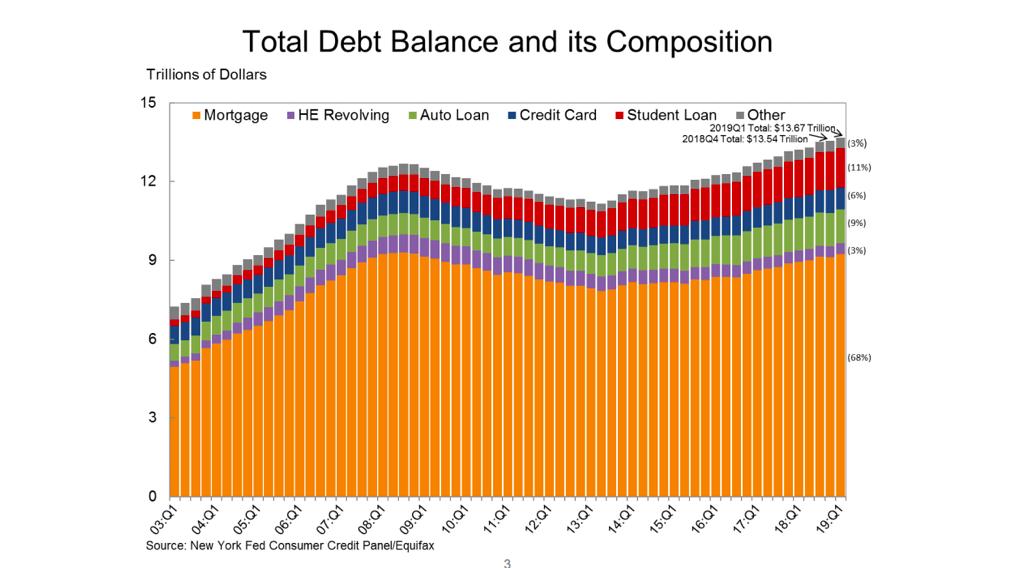

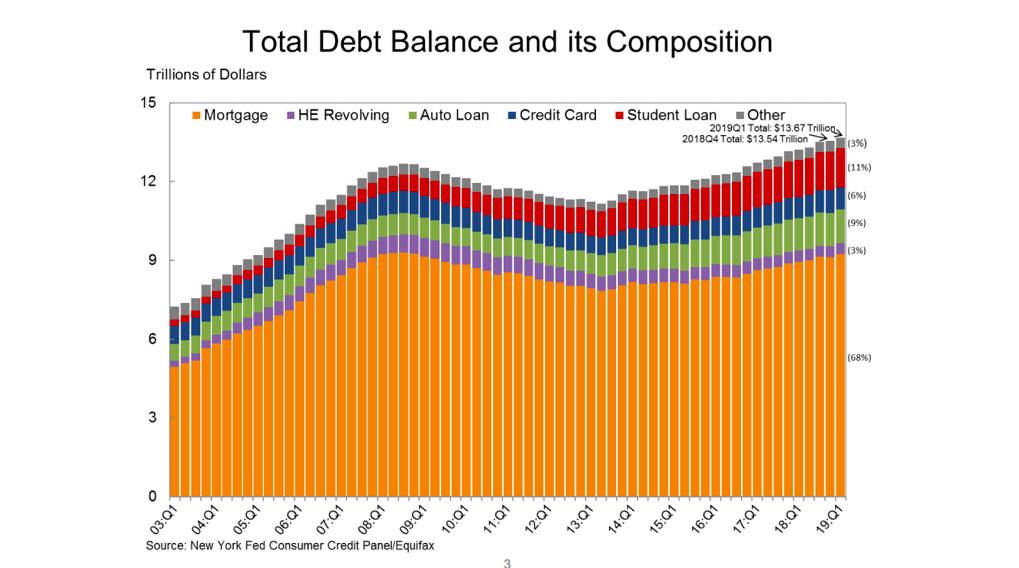

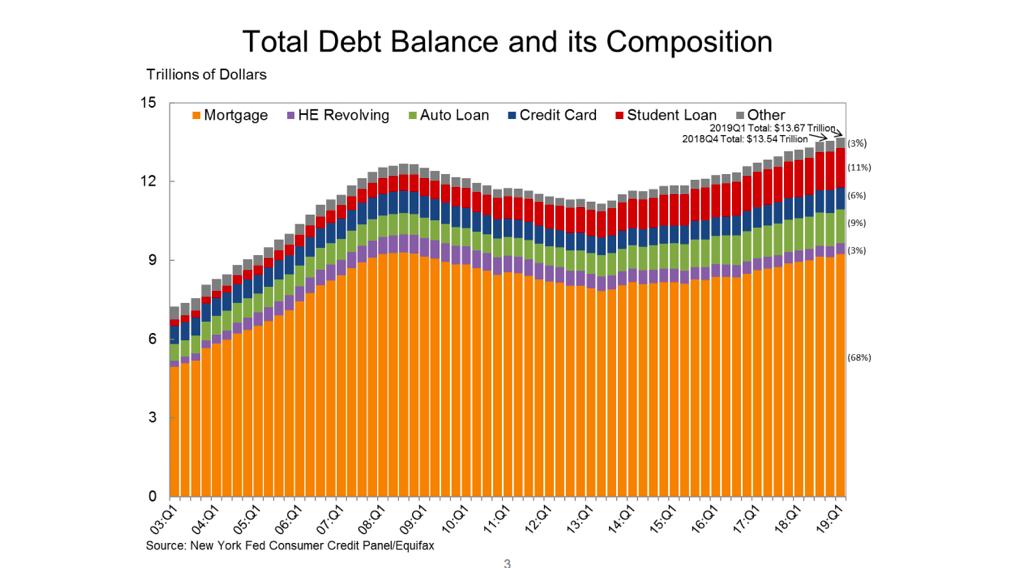

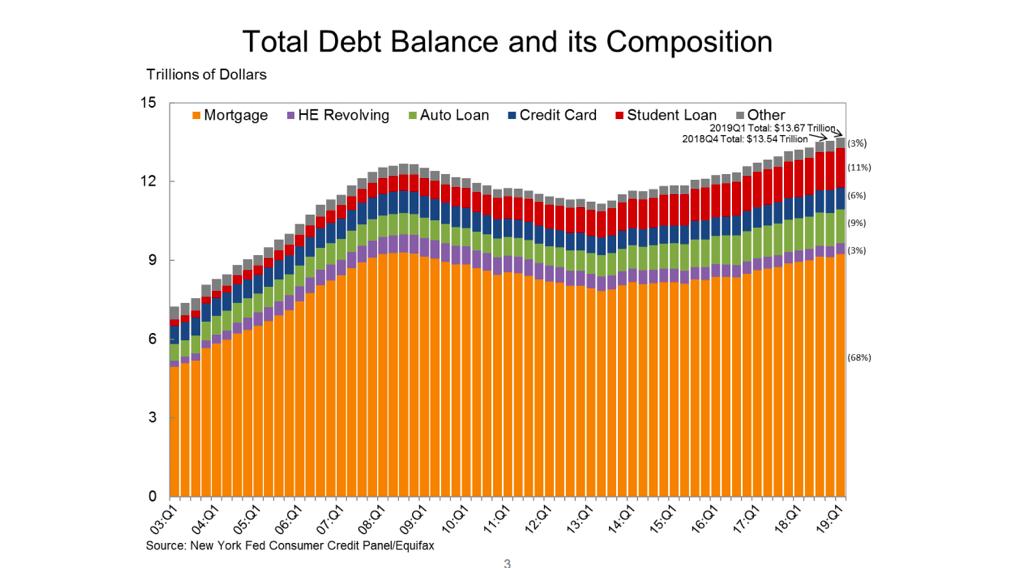

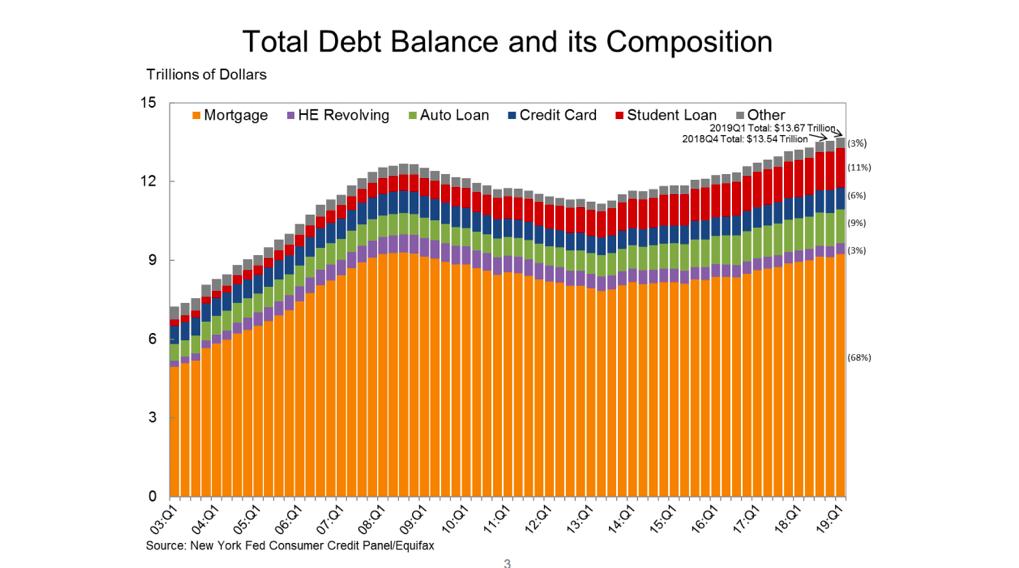

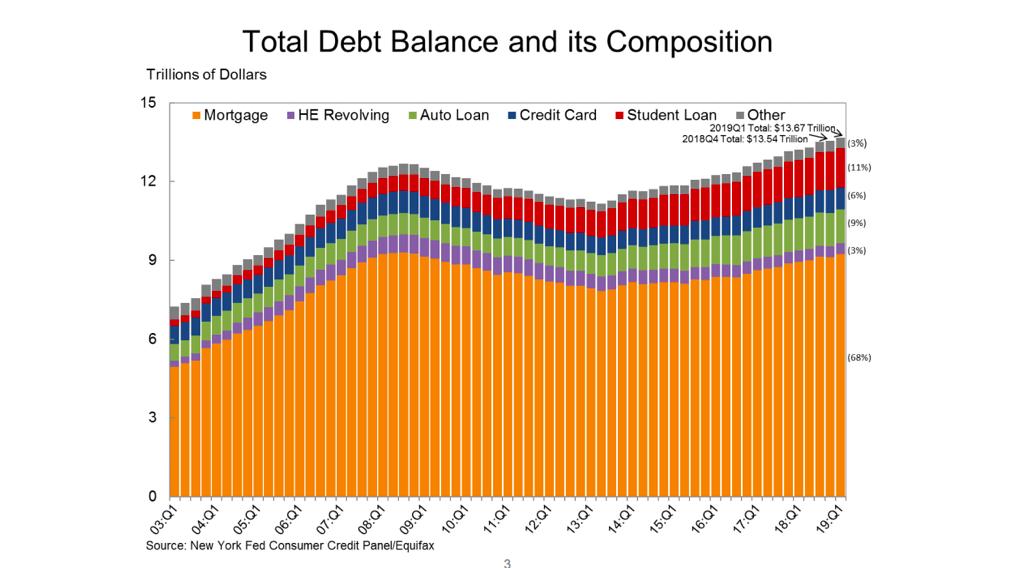

increase in auto loan balances ($6 billion), a $29 billion increase in student loan balances, offset by a $22 billion decline in credit card balances. #HHDC

Get real-time email alerts when new unrolls are available from this author!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!