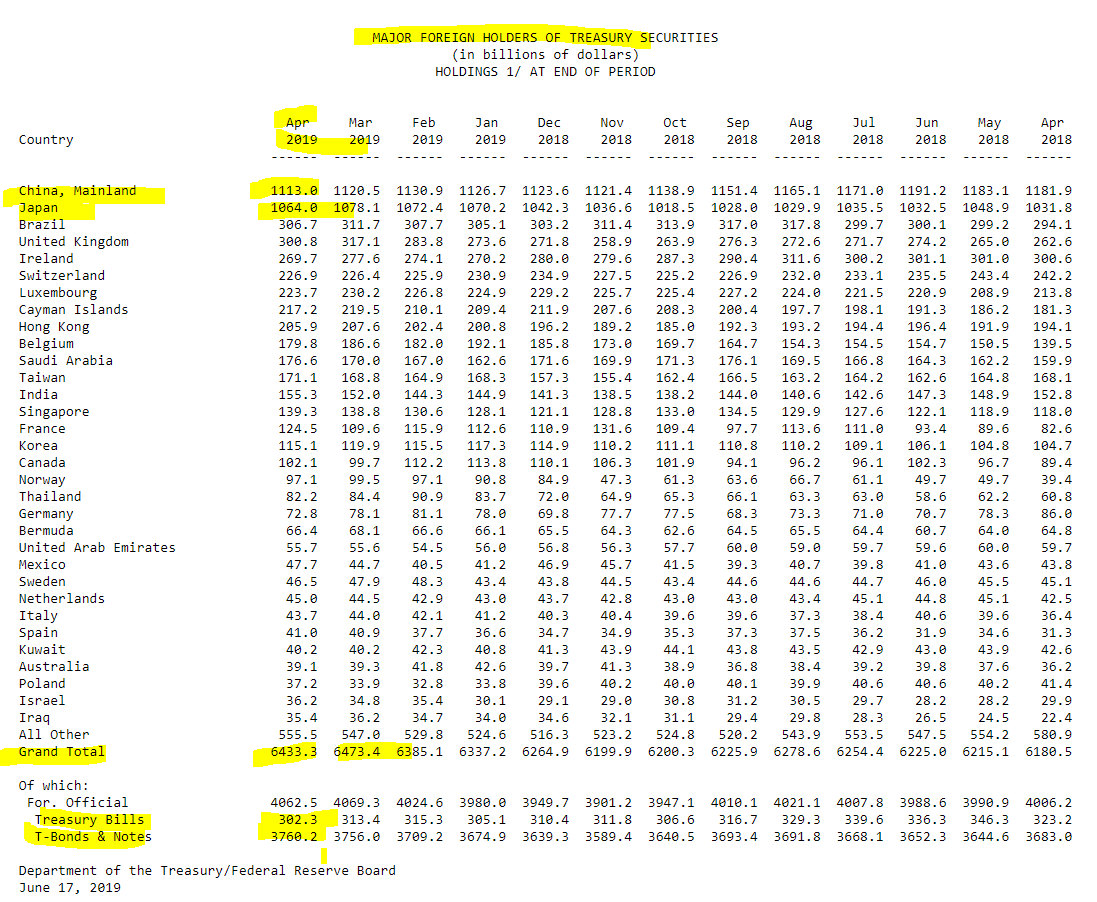

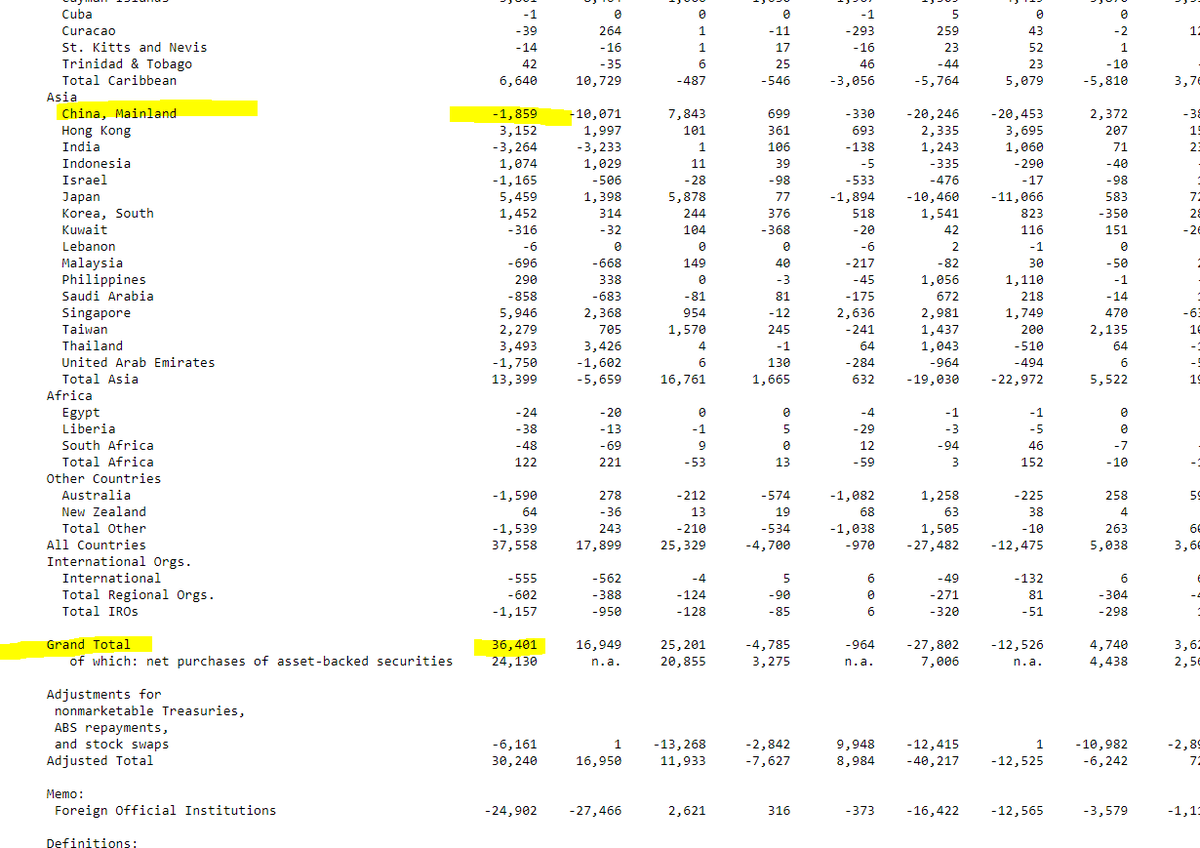

Who sold: Almost everyone, including China & Japan.

What did they sell? Shorter end, namely treasury bills (<1yr) & bought bonds👇🏻

Let's look!

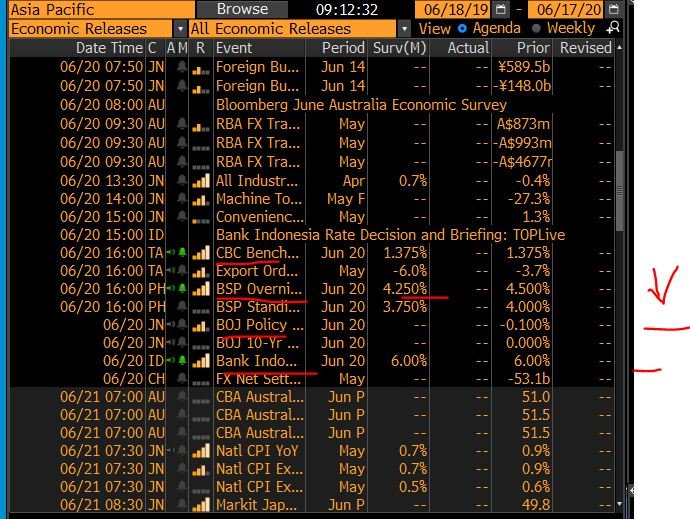

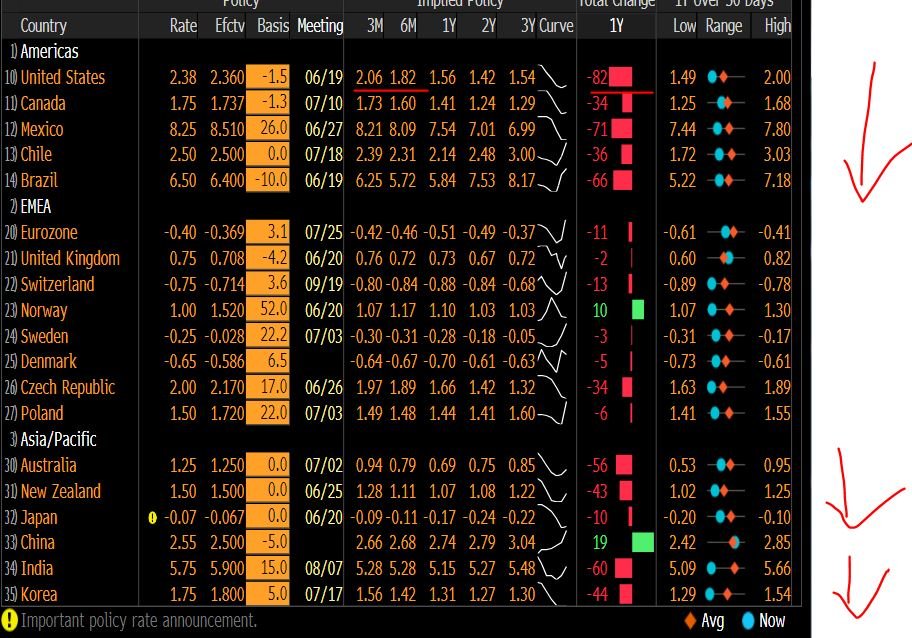

USA 🇺🇸 - lots of cuts are priced in in 1yr so either the world crashes or that's too many

Asia - lots for Australia & Korea'll cut too

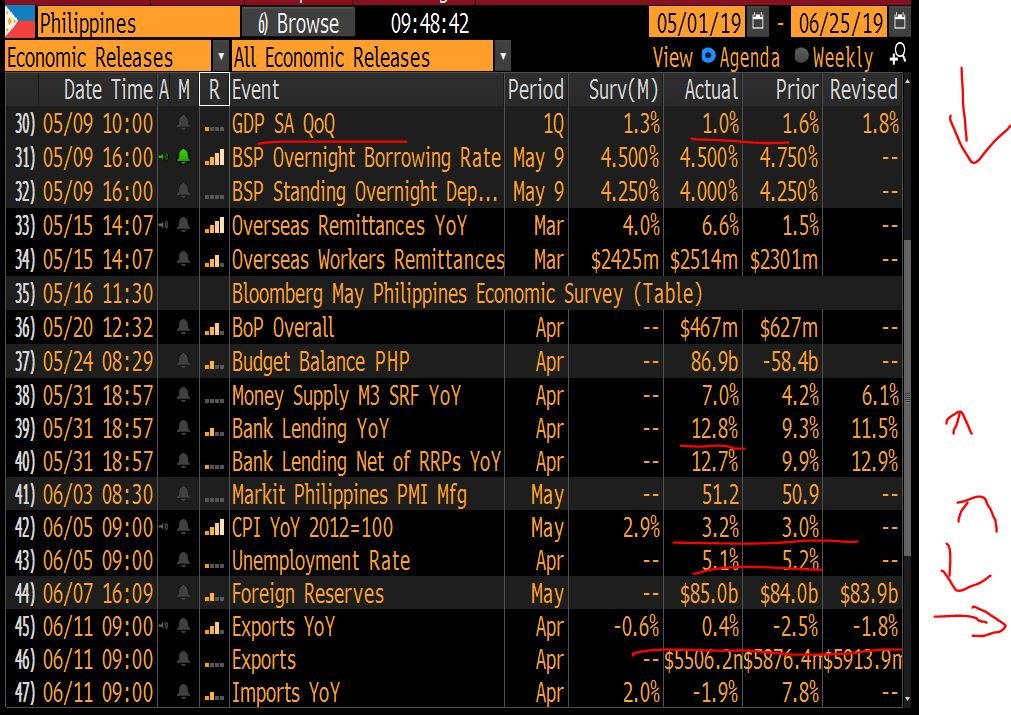

*GDP slowed to 5.6%YoY & details not good &so far the only good data is the bounce of credit growth

*CPI up a little to 3.2%YoY but still manageable & on target

*Exports weak

*BSP cut by 25bps already + 200bps RRR tiered through July 26

*Tomorrow: Will cut 25bps

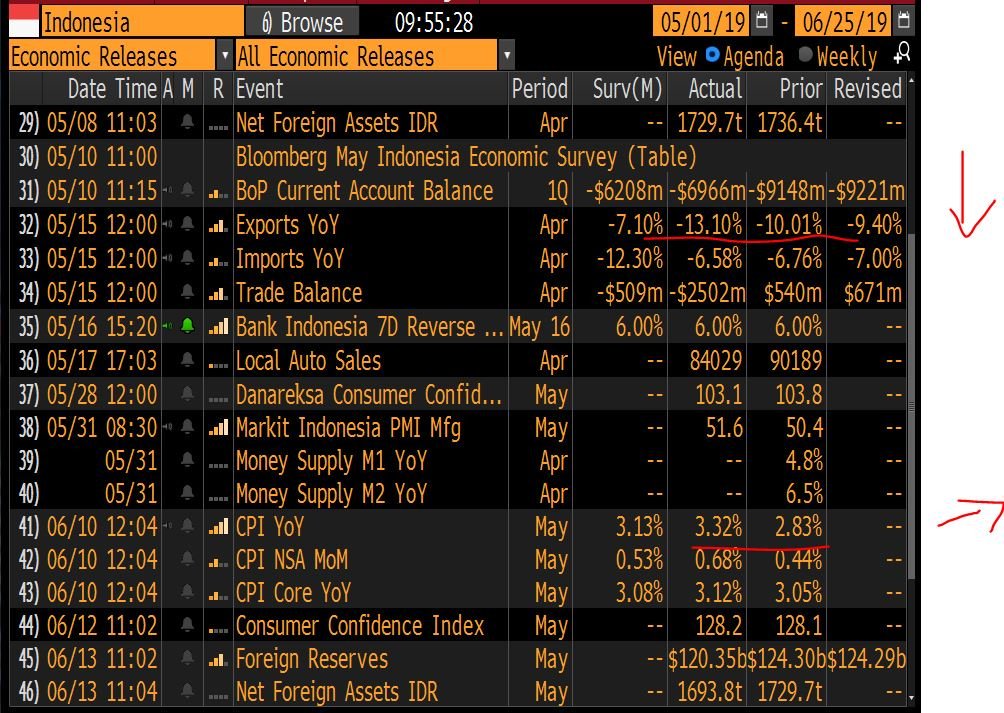

*Growth weak, as shown by contracting exports & imports 👇🏻

*CPI rising marginally but still low at 3.3%YoY

*Jokowi win means push to do infrastructure investment

*Needs to push funding costs 📉

*Rates to be slashed in July but chance of June cut 📈 given dovish tone

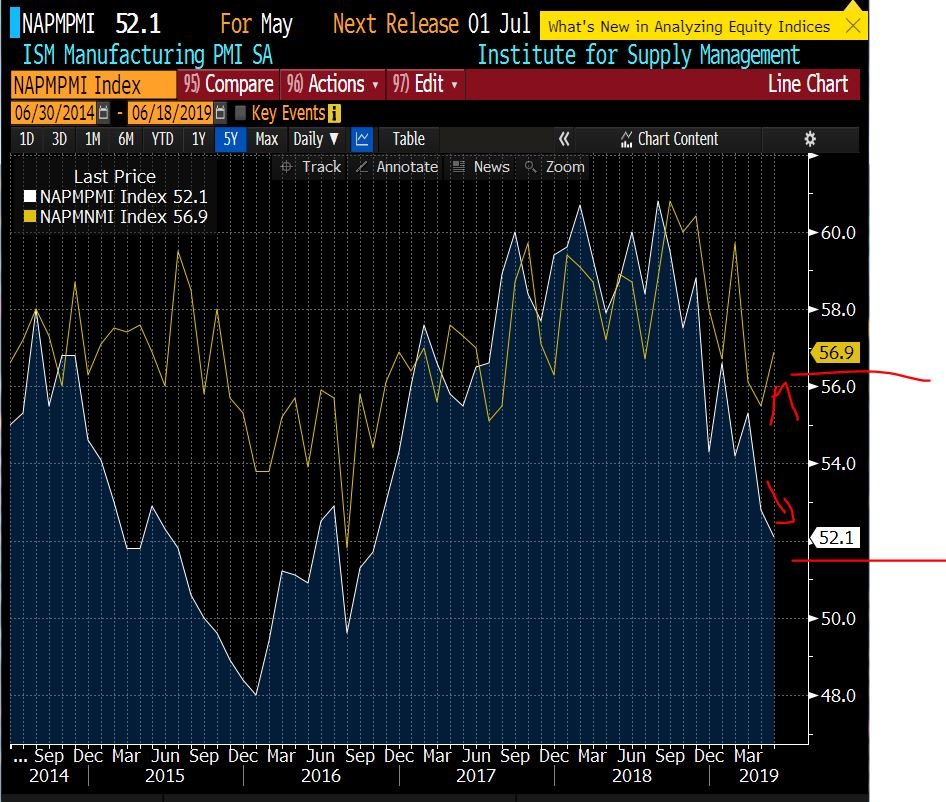

*Growth softening but still not weak enough for a cut yet as retail sales decent, CPI slowing to 1.8% but not collapsing, ISM manu 📉 but services 📈

*Fundamentals of US consumers better w/ pockets of weakness (household debt down a lot since GFC)

*Key is forward guidance.

👇🏻👇🏻👇🏻Tons of buyers in June of high quality fixed income.