There are issues with your tweets here. A bunch of them in fact.

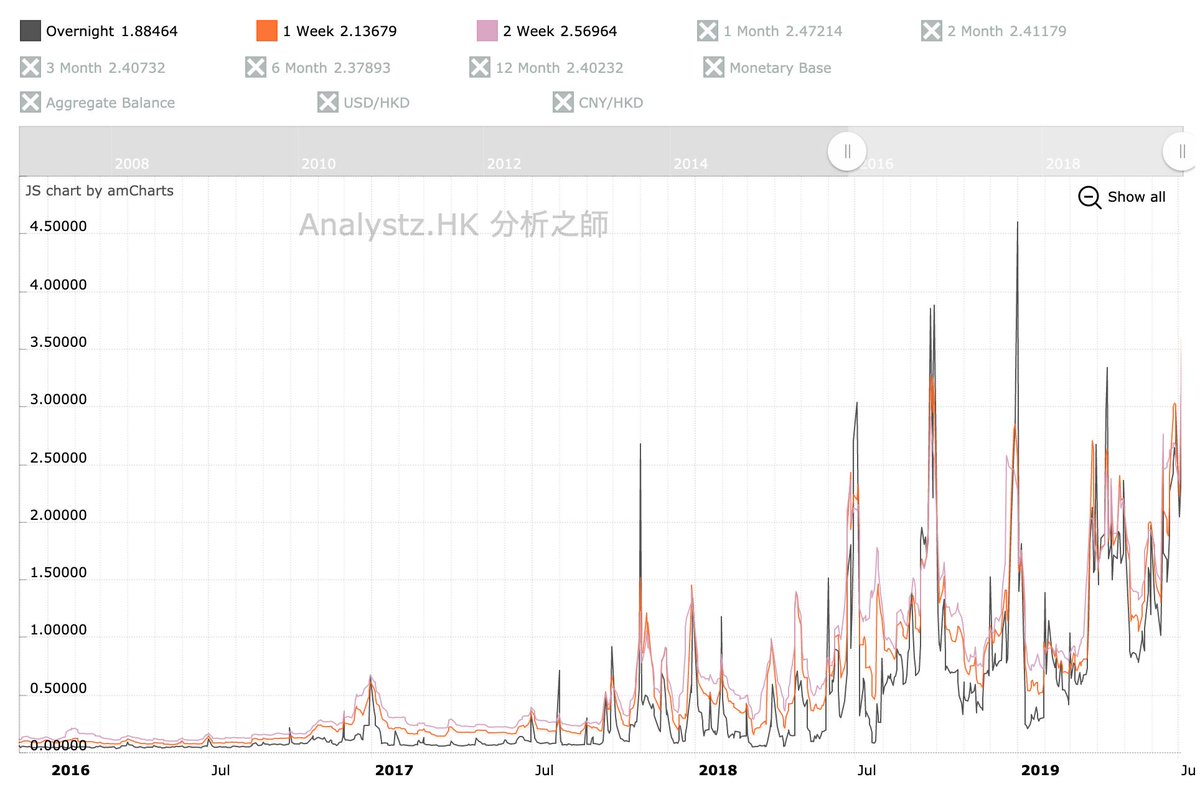

About HIBOR, the press, mortgages, defaults, the peg, and how it works.

1) 1MO HIBOR-PLUS-spread (90-95%)

2) BankPrimeRate-MINUS-spread (5-10%)

KEY DETAIL: almost all HK mortgages have a clause which says that if the rate you'd pay this month on #1 goes above the rate you'd pay on #2, you pay #2.

You use the word "Default": Do you have ANY data, articles, etc which suggest that default on mortgages in HK are, or will be "problematic"? Any at all?

And if 1mo is 2.98 and 2mo is 2.67, 1mo in 1mo is ~2.36. You can book that now.

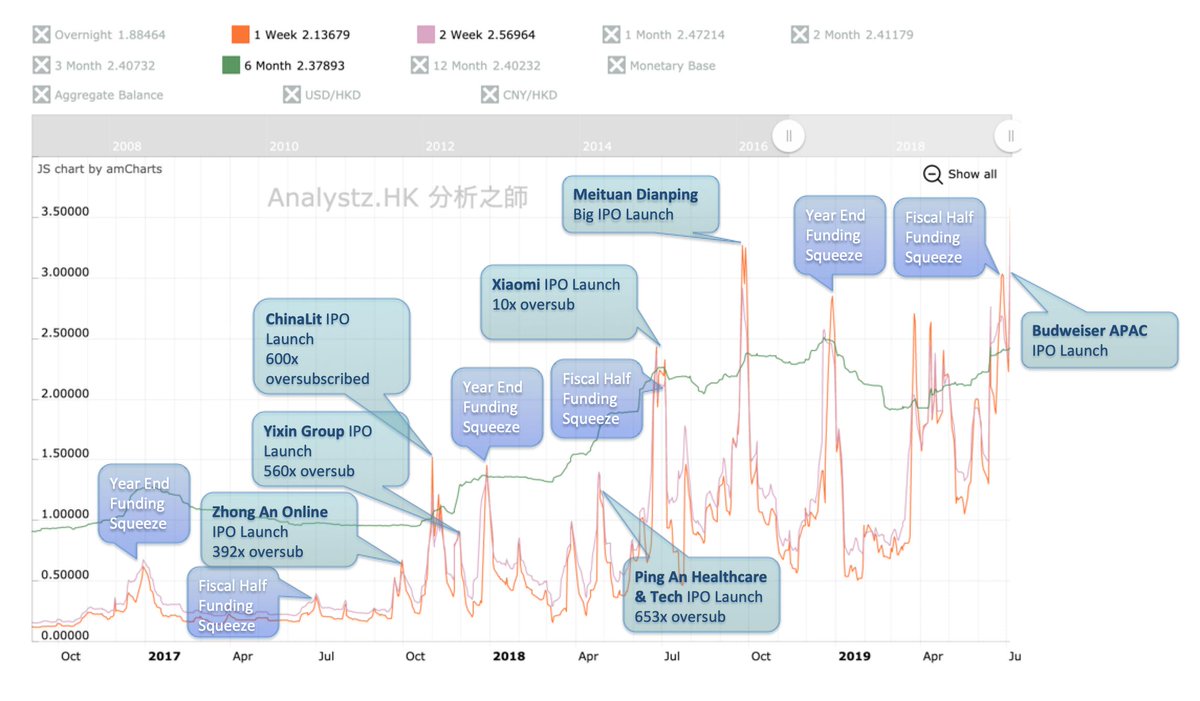

Because of the Budweiser APAC IPO. It's big at almost US$10bn.

I wrote about it yesterday in response to @Jkylebass' tweet.

It is NOT ABNORMAL AT ALL.

China Lit saw HK$ 520 BILLION come out of the short-term funding market for a week.

Brokers want IPOs to be hot, so they will lend you money so you can buy more. Sometimes 90% margin. You put up $10k. Broker puts up $90k.

If you get 1/100 of your order, you buy $1k. You paid 3% on $90k for 2wks which is $104.

If you only get $1k, your breakeven is +11.8% (comms, fees, interest). So it's a bet.

No clue about the 90%. I'll ignore for now. Unrelated to peg discussion.

HIBOR 1M occasionally diverges from LIBOR 1M. Flush liquidity in retail accounts does not auto-switch immediately.

Also...

And it has happened MANY times before and will happen MANY times again and local press and local market professionals are utterly aware and utterly prepared.

Want to try to arb that 110bp rate spread btwn 1wk HIBOR and 1wk US$LIBOR?

And when it comes off 7.85, they are out of the market, so HIBOR can do what it wants.