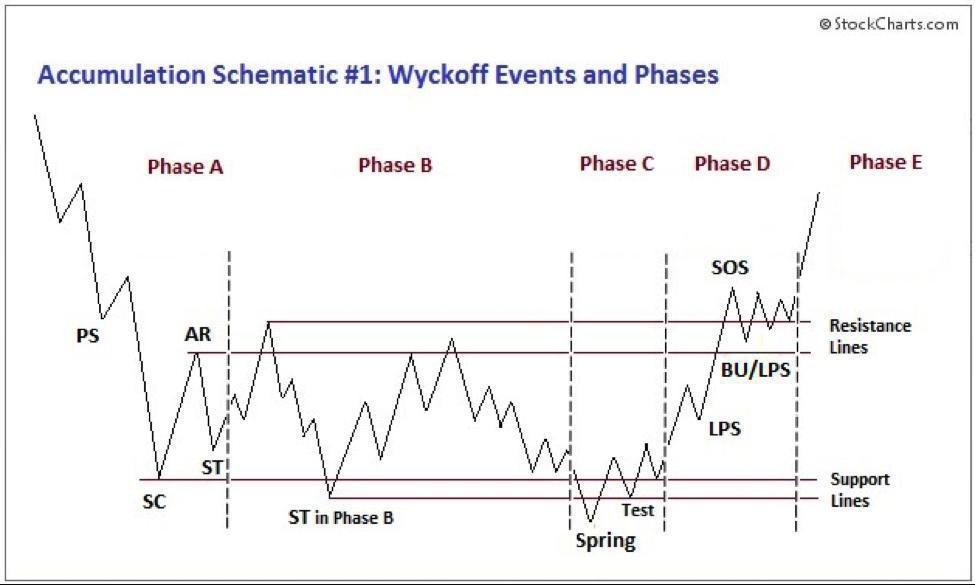

Swap vs. Future

You have N USD, you buy Y BTC at, you sell N USD worth of contracts at the trade price with notional = -Y BTC. Synthetic cash. With a future there's a bond-like fixed maturity, it's a longer term rate, with swaps there's payments.

Swap Cash Carry

Future Cash Carry

Long Curve (Short Swap/Long Future)

Short Curve (Long Swap/Short Future)

Cash carry means collateral is all hedged into USD, like cash, and you carry it, for the swap payments for the premium decay.

Also the rewards: swaps are positive when markets are bullish, so long collateral, get swap, earn future curve.

Instead you have a safe-ish basis *position.*

Basis trading has similar entrenchments to it that give a portfolio confidence.

Calendar spreads between say Sept./Dec. can hedge the curve collapsing.

Main thing in curve 101 is how much yield, wait out mistakes, and curve trading 201 is time the curve decently, and going multivariable is definitely 301. 401 is spreads of spreads, 501 involves arbitraging curve/box vega against options.