There will be a separate urdu Thread.

1. Login to iris.fbr.gov.pk

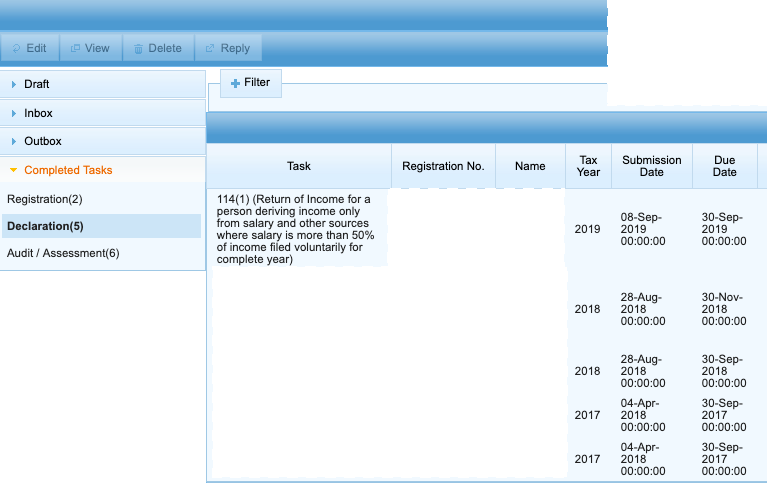

114(1) (Return of Income for a person deriving income only from salary and other sources where salary is more than 50% of income filed voluntarily for complete year)

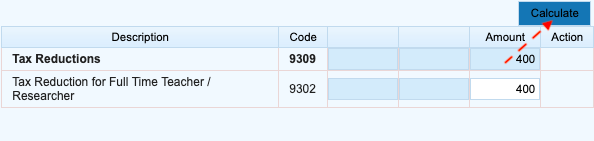

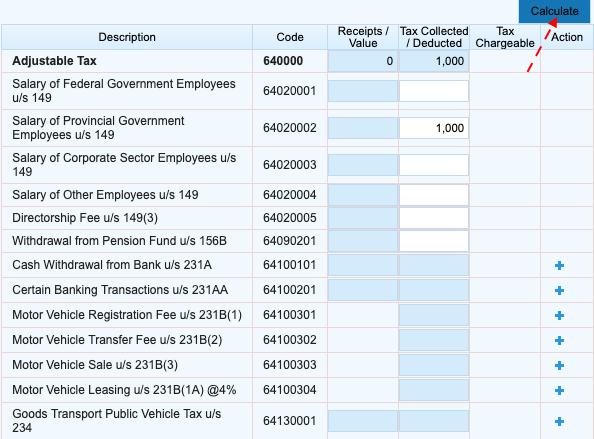

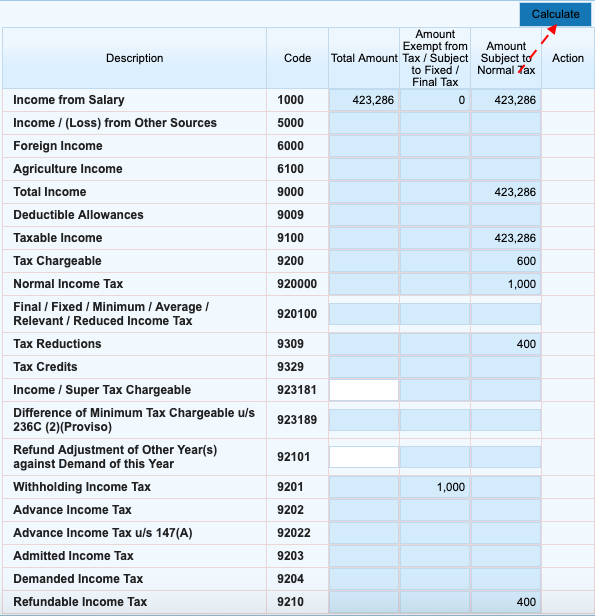

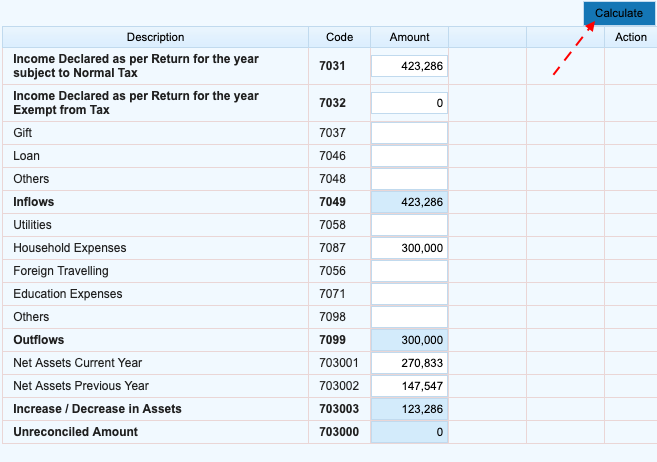

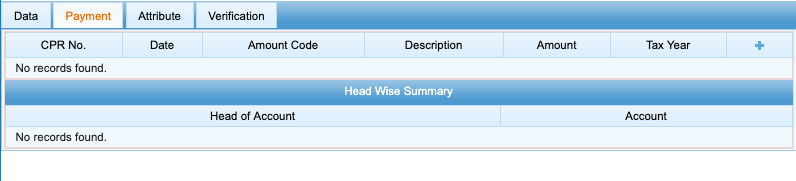

6. Under “Tax Chargeable/Payments” sections apply for related allowances, reductions, credits and Adjustable Taxes if any applicable to you, else skip

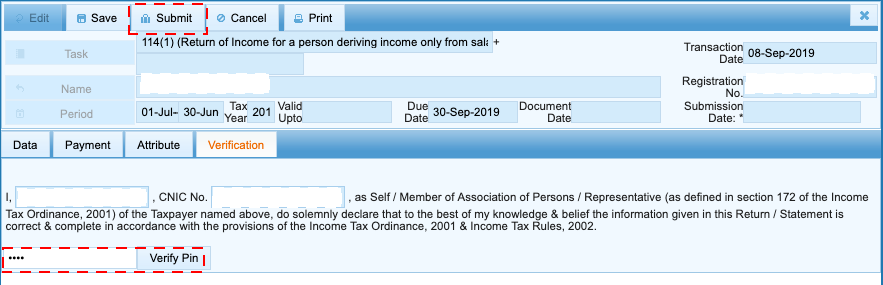

(Step 9 part 1/2)