Where is this number ₹1,45,000 Cr coming from? Is it real or fake as usual? And, why now?

(1/17)

This for the April-June period (Q1-FY19-20). You can imagine what's the next quarter going to be like. (2/17)

timesofindia.indiatimes.com/city/dehradun/…

That's a whopping of ₹95,000 crores deficit!

Now, what will you do if you are smart like Modiji?

Spin it around! (8/17)

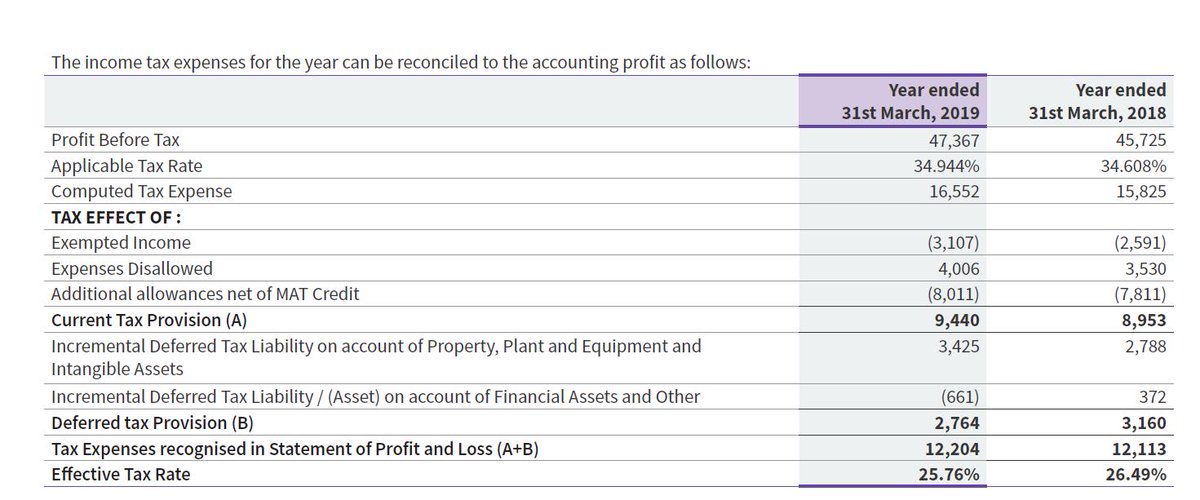

But, then try to do the math of the real gains for all companies. You'll realize the trick.

Will these companies get a benefit of 1.45 lakh Cr or less? If less, how much is that? (9/17)

It is Financial Institutions and FMCG companies who are going to get the most out of it.

(11/17)

timesofindia.indiatimes.com/business/india…

My optimistic wild guess is around 40k Cr. Experts, prove me wrong with math, but not with another wild guess. (13/17)

Now, that's the trick pulled out by govt.

Anyways I am losing 95-100k, spin and make it look like a great 145k sacrifice and be the Messiah of the economy. (14/17)

Do you seriously think that they were cash strapped before and going to give more credit now and revive the economy when there is no demand? (15/17)

It would have benefitted every company across the board. But then...

(16/17)

This slowdown is once in a lifetime, truly "Historic"!

(17/17)