MEGA THREAD 1/

bloomberg.com/news/articles/…

ft.com/content/9b2c29…

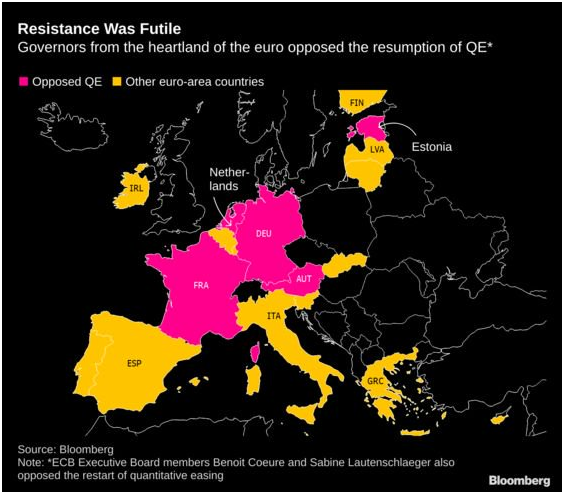

QE resumption was opposed by representatives from France, Germany, Netherlands, Austria, Estonia and members on the Executive Board including Sabine Lautenschlaeger and markets chief, Benoit Coeure. 4/

bloomberg.com/news/articles/…

Austria’s new central-bank governor said that the ECB's latest easing package was possibly a mistake and can be changed after incoming President Lagarde takes over from Draghi 6/

bloomberg.com/news/articles/…

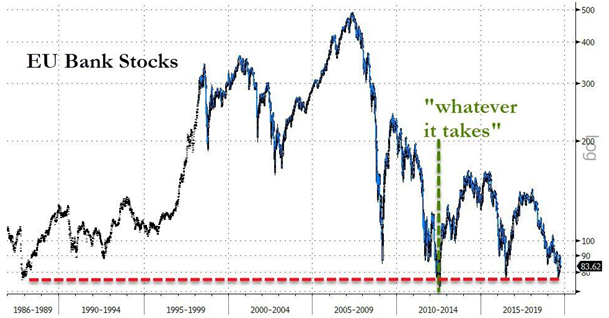

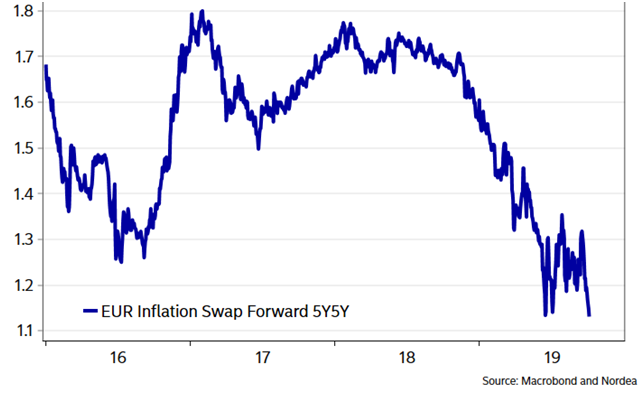

"The ECB is creating a dangerous bubble and should not have cut rates by 10bps nor added a new purchase program of €20 billion per month. " 8/

app.hedgeye.com/insights/77925…

wsj.com/articles/germa…

ft.com/content/5fb1a4…

gnseconomics.com/en_US/2019/10/…

bnnbloomberg.ca/video/there-we…

bloomberg.com/news/articles/…

“The reason why we’re not doing fiscal [reforms] is because you’re making it easy for people to spend money they don’t have,” 17/

ft.com/content/03c8f1…

"A group of former senior European central bankers has published a memo attacking the loose monetary policy of the European Central Bank, which they argued was “based on the wrong diagnosis” and risks eroding its independence." 18/

ft.com/content/71f90f…

"QE, which the Bank for International Settlement recently agreed does not flow to the real economy, but pours more liquidity into asset markets, making the rich richer. Unless QE allows governments more room for fiscal spending - which is de facto debt default." /END