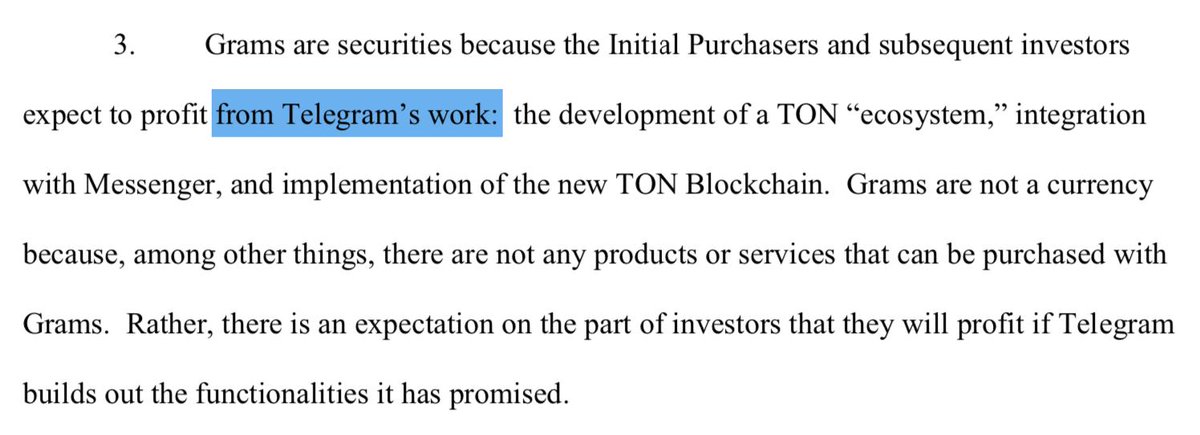

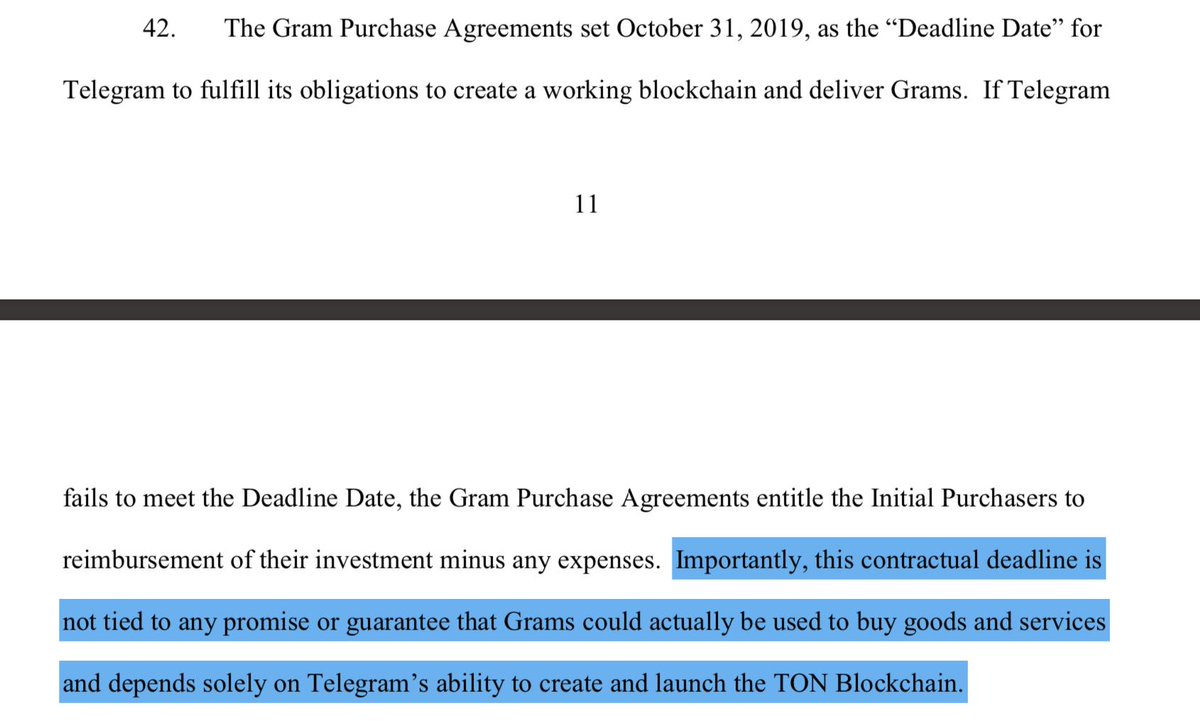

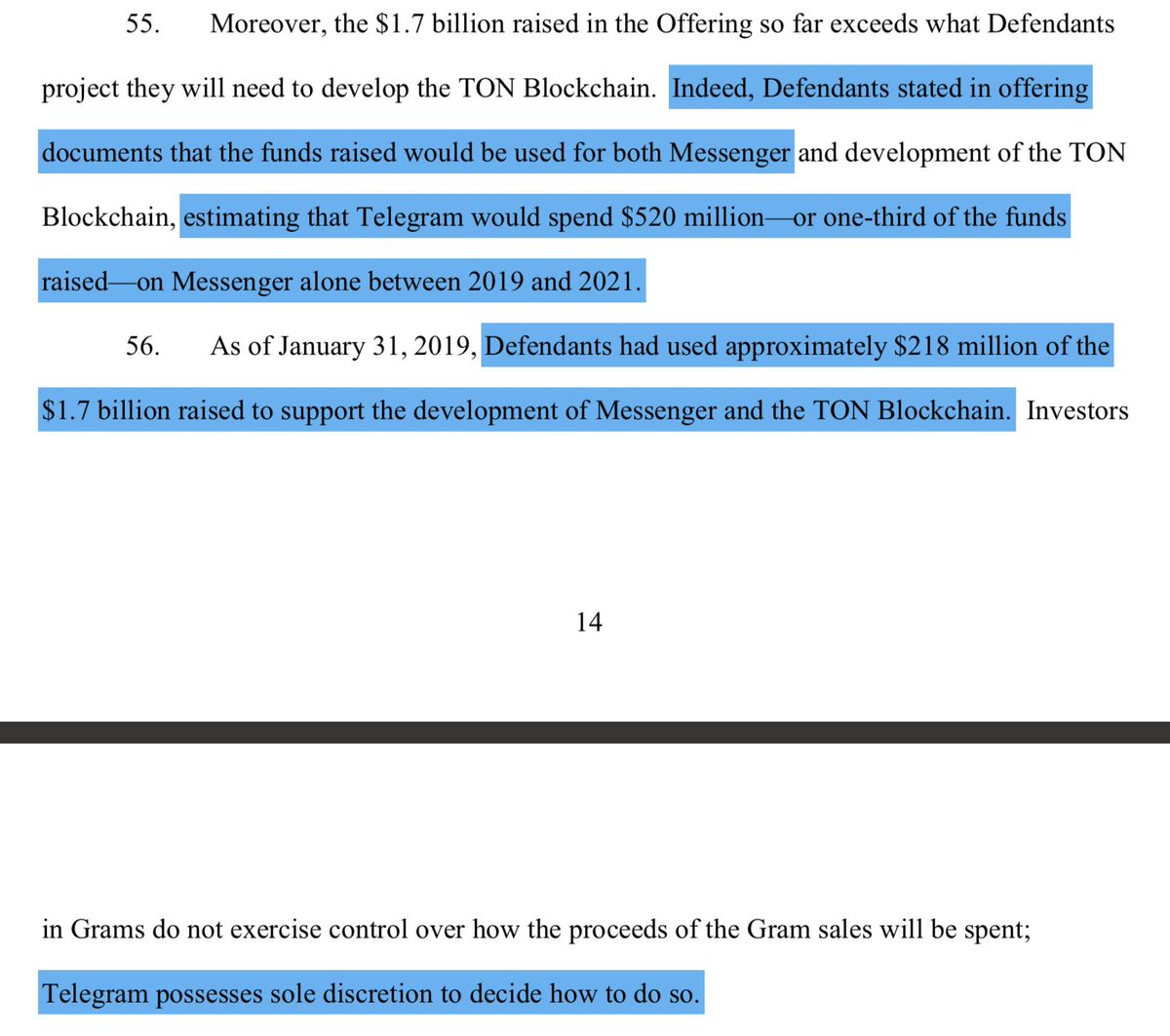

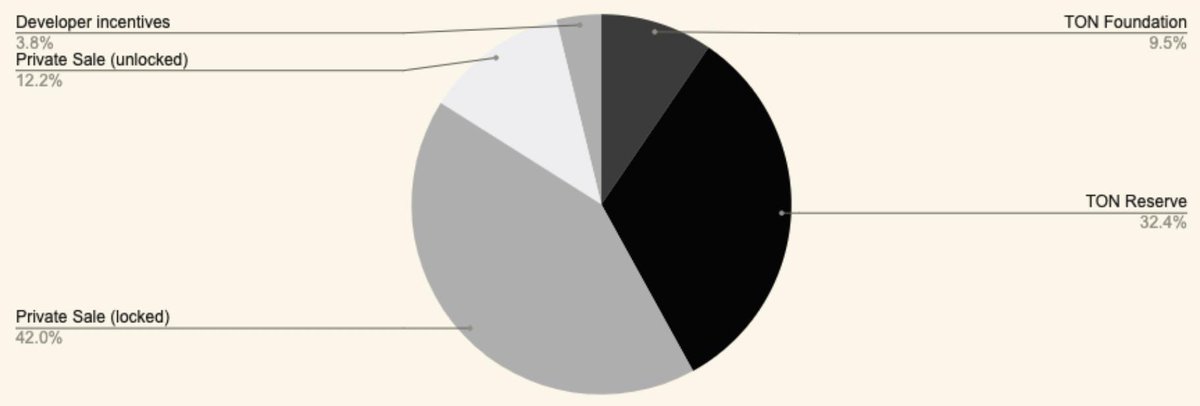

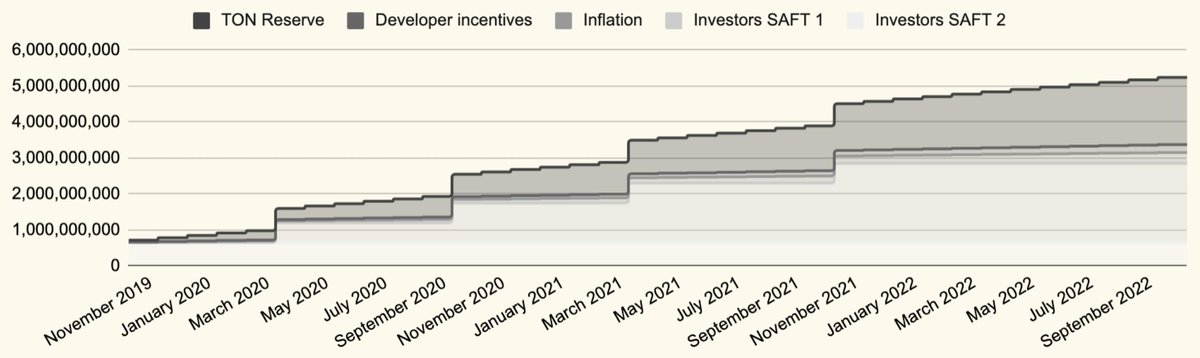

The filing focuses on GRAMs as a security because Telegram Inc. controls TON and fundraised for its Messenger in addition

My read of the SEC's Telegram filing (IANAL)👇

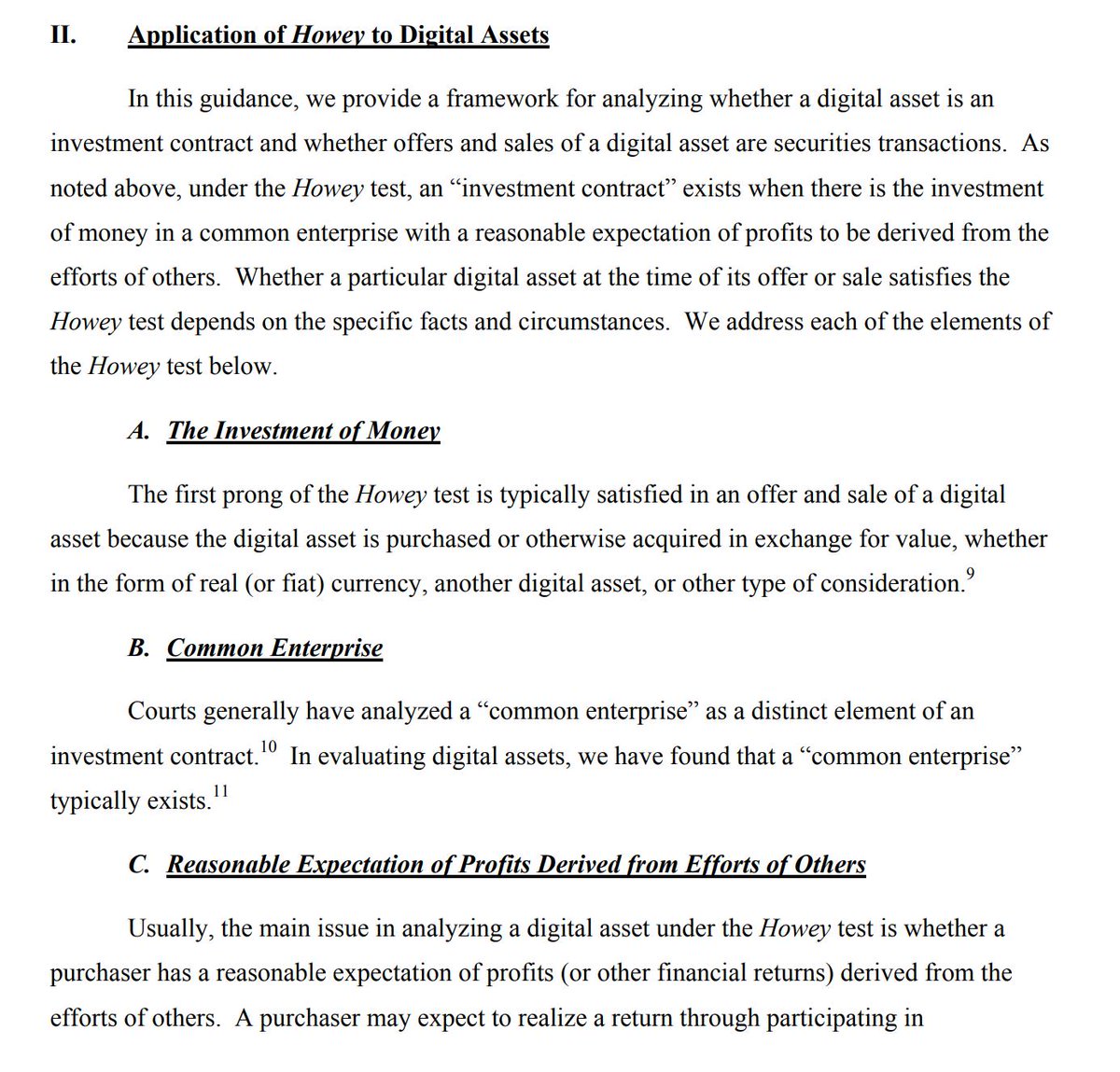

A/ investment of $

B/ in a common enterprise

C/ with the expectation of profit

D/ based on the efforts of others

A - obviously

C - VCs want a profit

The crux of it is B/ common enterprise and D/ efforts of others

Thus, it is a common enterprise and profits are driven by efforts of others

For the same reasons ETH is not a security (Ethereum is sufficiently decentralized so there is no common enterprise) GRAMs are a security (Telegram is a clear common enterprise with clear managers driving GRAM value)

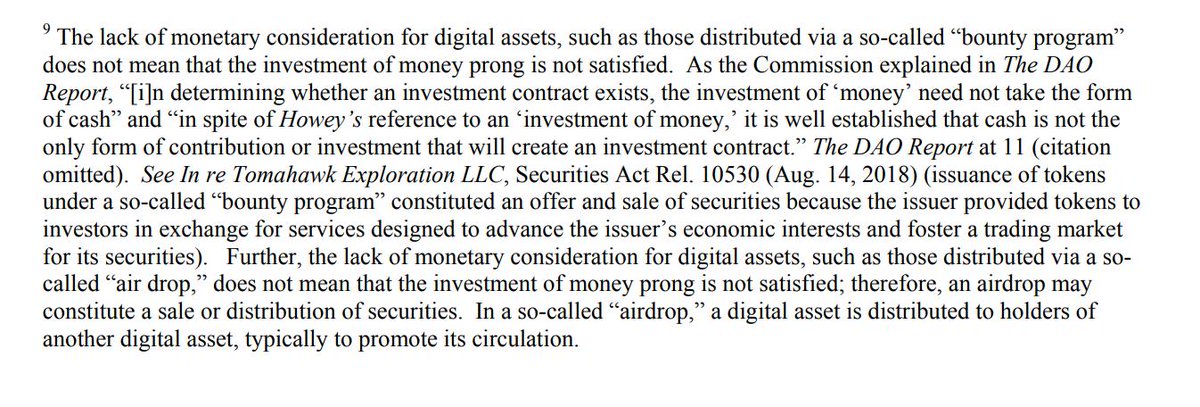

If you think tokens are like pre-selling airline miles to bootstrap an airline, then your fight is not with the SEC anyway

It's obviously not easy and IANAL, but I am optimistic

A/ Don't have the company and foundation controlled by the same people

B/ Don't use funds to finance an existing company

C/ Don't have only company employees committing code

D/ Have others outside the entity that raised funds building apps on the chain

E/ Try to have use cases at launch so there is utility, rather than future utility

F/ Avoid promising investors a return

G/ Avoid conversations with exchanges altogether

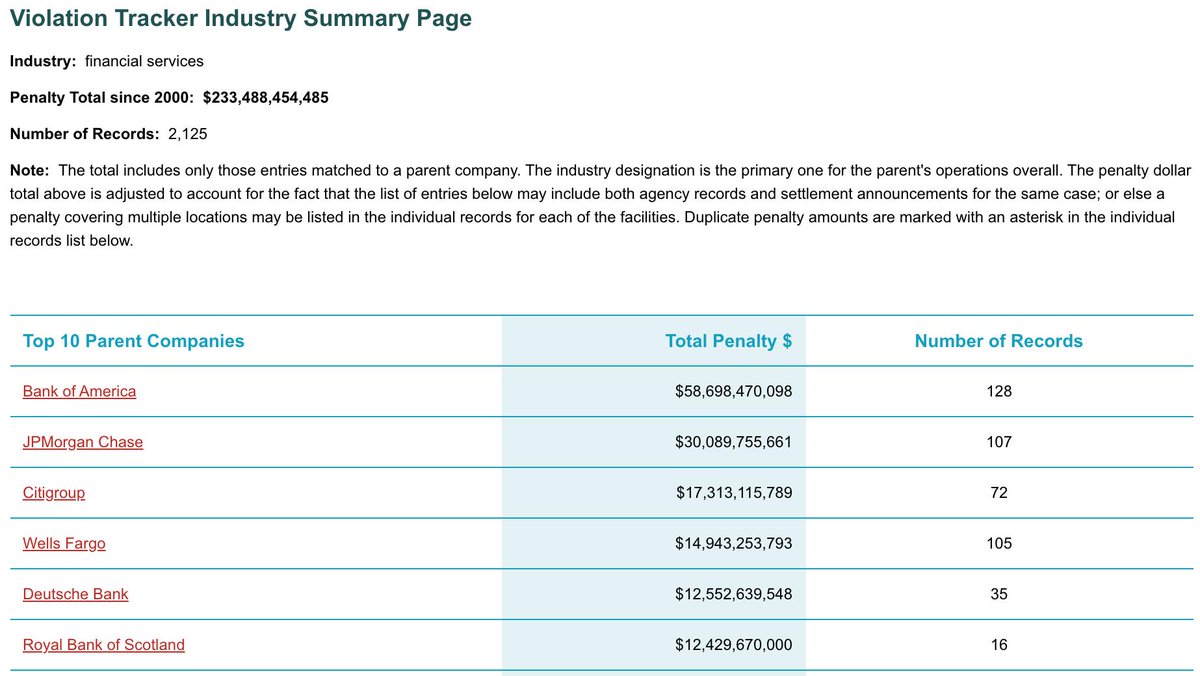

And it is not crazy to imagine avoiding all of the issues the SEC has with Telegram, yet the SEC still asserts a token is a security because of Howey - most likely because of the common enterprise and efforts of others pieces

sec.gov/litigation/com…

And in case it was not clear, I am not a lawyer and this is not advice to anyone about what to do/not do.

To real lawyers, please correct any of the above if I misunderstood the filing in any way