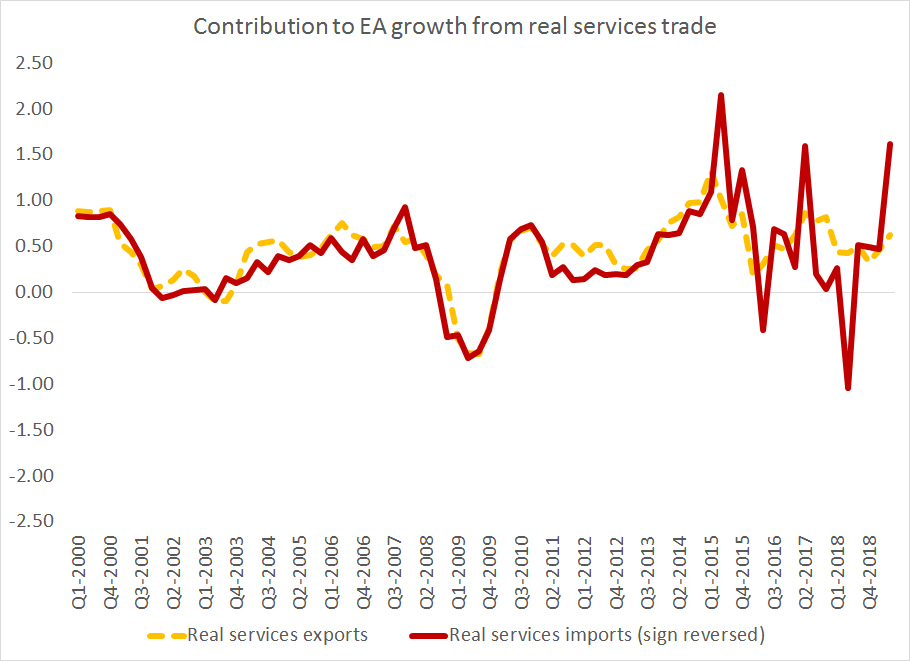

Well, consider the services trade data from the euro area, not a small part of the global economy ...

1/x

2/x

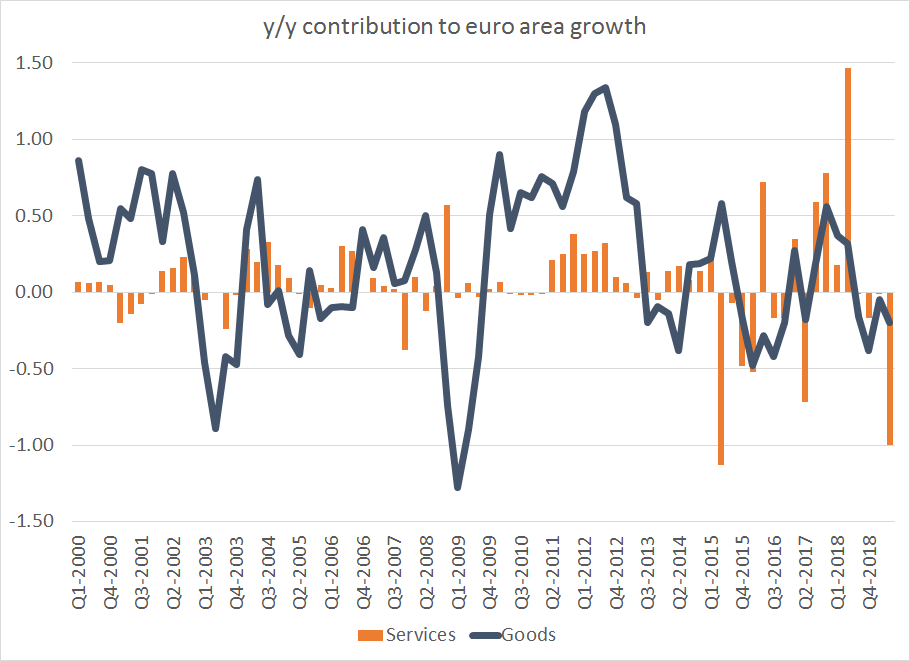

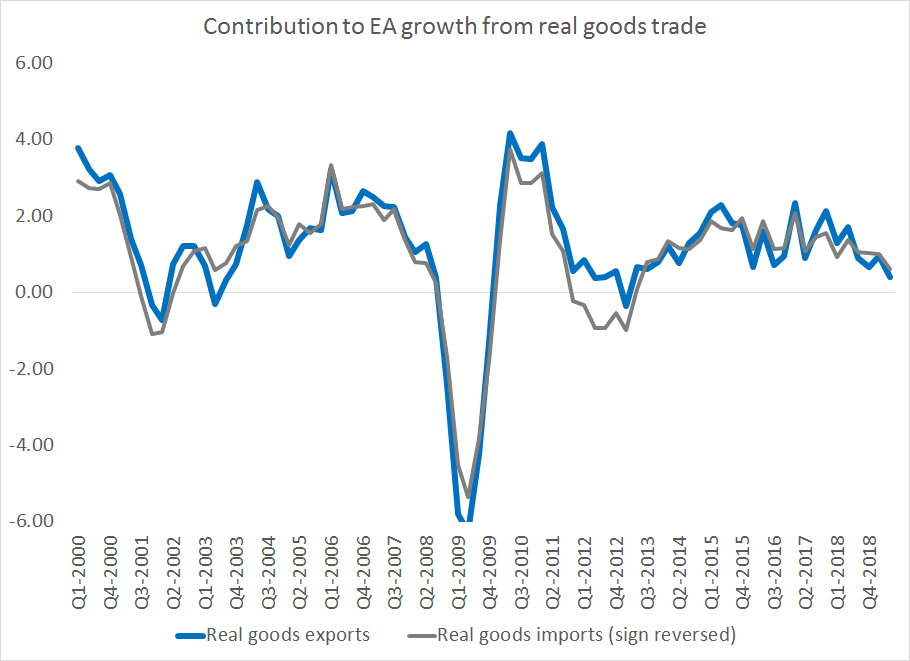

and the EA is an open economy, so goods trade ends up mattering more than it typically does for the US

3/x

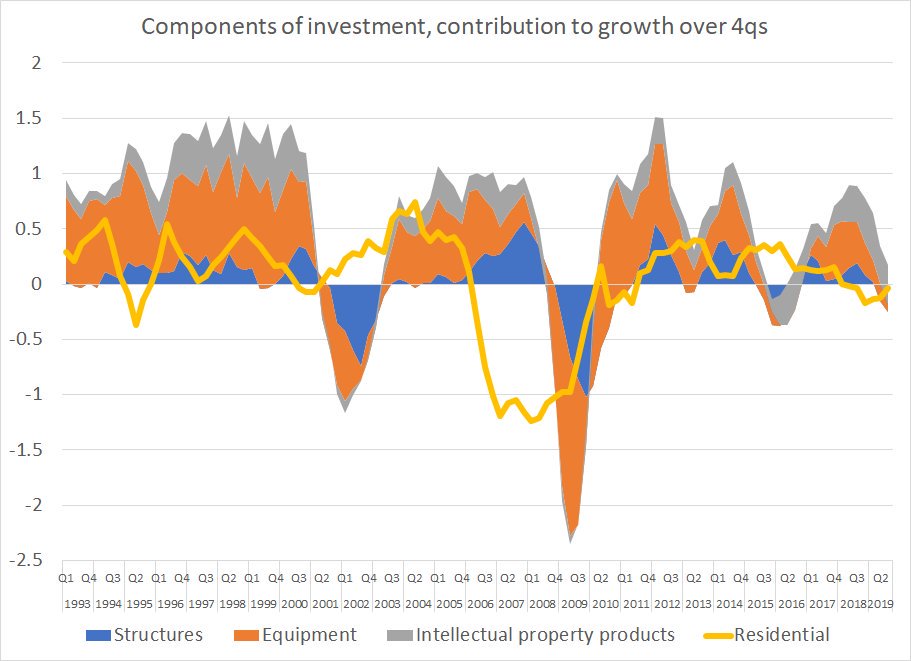

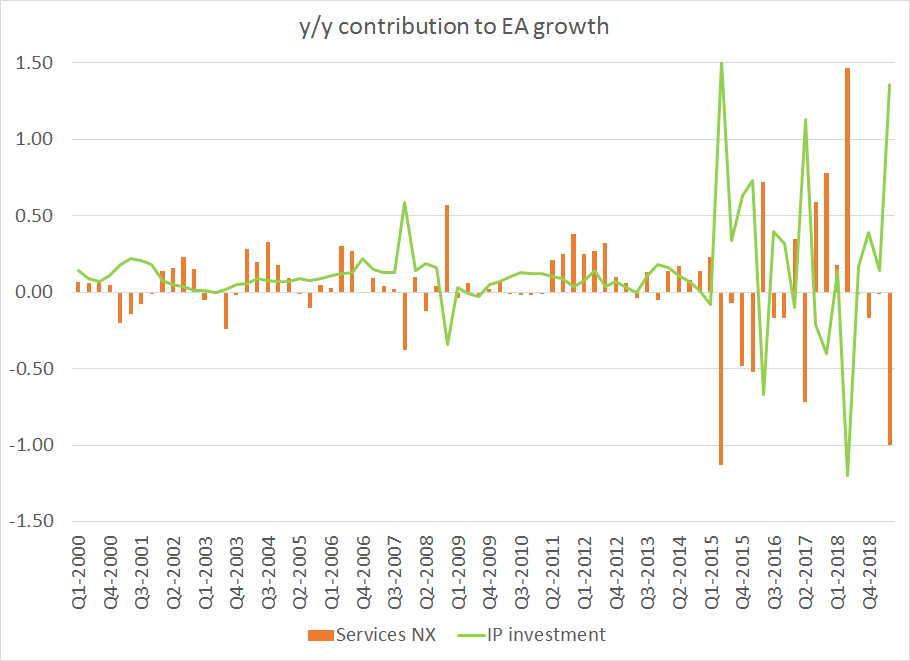

Well, there are three quarters when service imports jump and subtract over 1.5 pp (y/y, as a contribution, with sign reversed so a rise in imports is up in the chart) from EA growth.

4/x

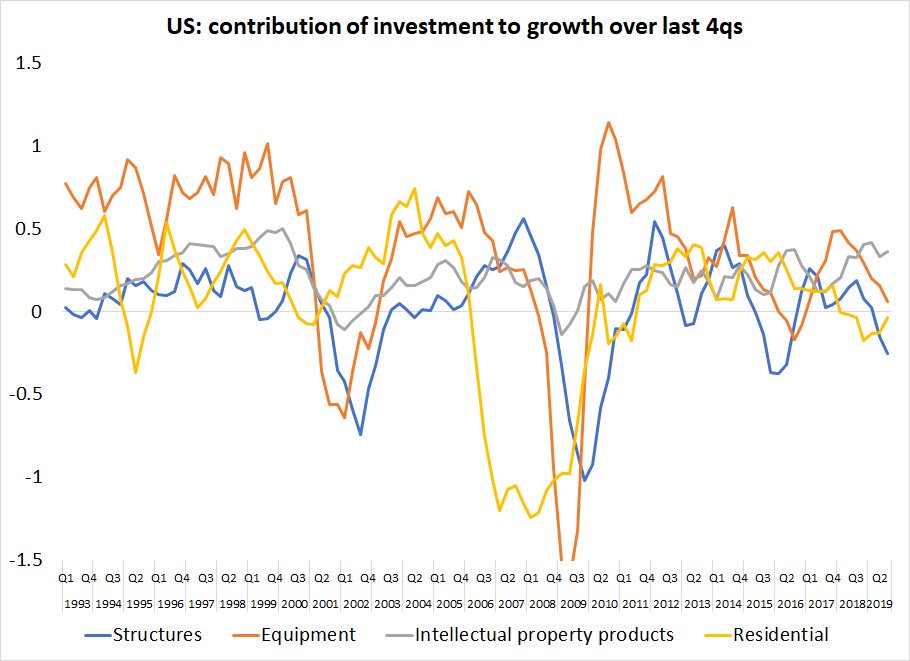

swings in IP investment.

(the first swing is from the Netherlands, the next two are from Ireland)

5/x

In all probability, one subsidiary of a US MNC is buying the IP rights of another subsidiary of a US MNC for tax reasons ...

If the second sub is outside the EA, that registers as a big investment in imported (IP) services ...

6/x

7/7