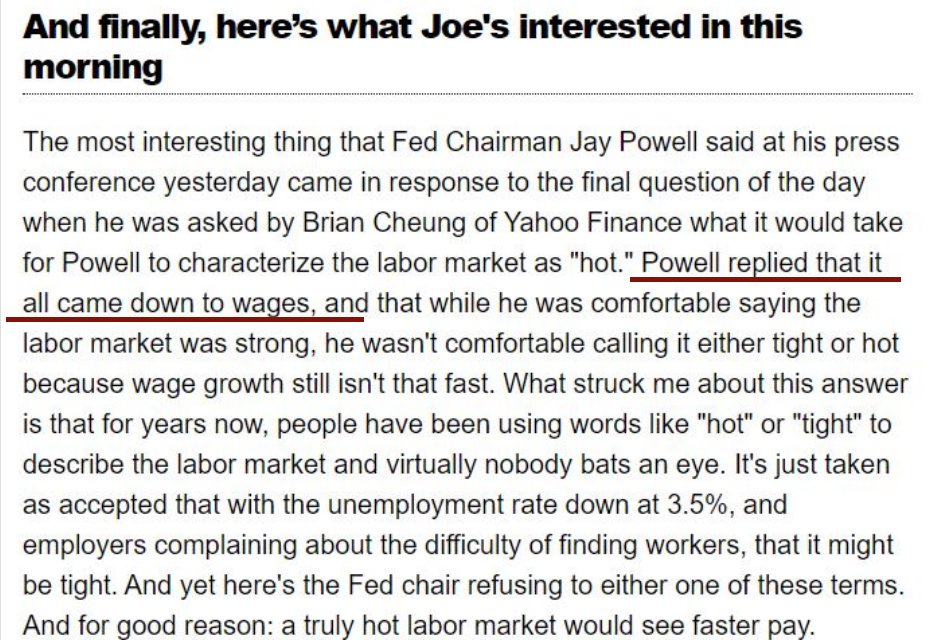

I realize many celebrate the Fed’s newfound comfort w/ low unemployment. I do too. But I don’t think this is a fundamental change in perspective. As @TheStalwart points, for Powell “It’s all about wages”. I.e. wage discipline is still the Fed's plan to fight inflation 1/n

❓Bottom line is this: why are we wedded to a policy that aims to slow down whatever advancements working people eek out in order to fight inflation. This has to stop. 6/n

cbsnews.com/news/american-…

pavlina-tcherneva.net/job-guarantee-…