Trying to contribute to the public good that is #econtwitter, a short thread. 1/10

voxeu.org/article/wealth…

Ungated version: hec.unil.ch/mbrulhar/paper…

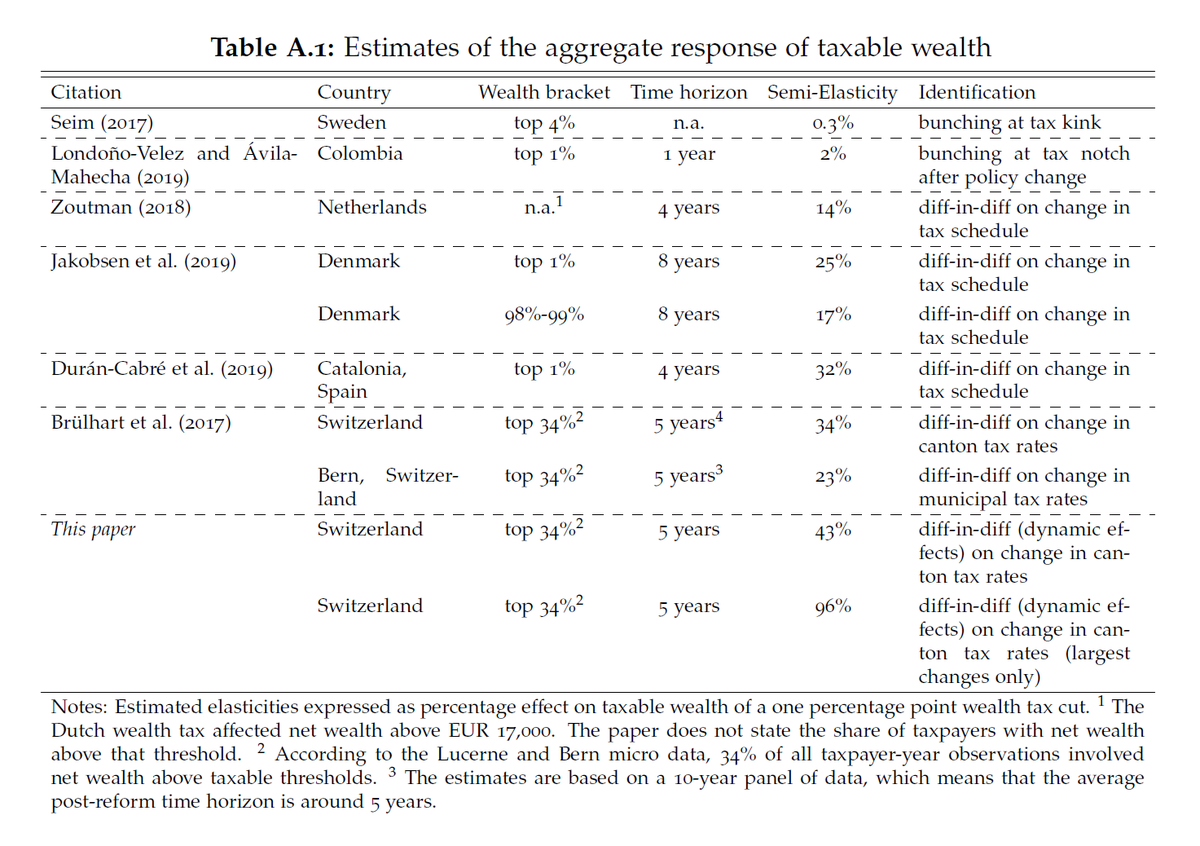

1. Cantons are small what enables high taxpayer mobility. Adding up direct and indirect (capitalization) mobility effects (and subtracting international mobility which accounts for one quarter) suggests 34% of response is due to intra-national mobility. 7/10

Together, these “Swiss peculiarities” account for 85% of aggregate response. If you mentally adjust their estimate accordingly, it certainly fits in with the lit. 8/10

gabriel-zucman.eu/files/saez-zuc…

voxeu.org/vox-talks/weal…

ft.com/content/c84372…

ft.com/content/87ccaf…

ft.com/content/01e3e3…