While at 925mn debit cards are highly penetrated, credit cards is still a nascent industry ~ 50mn card base (3.5% per capita, unique cards ~60% of this), 1.2% of bank credit and 3% of spends/GDP.

1/n

2/n

3/n

4/n

5/n

6/n

7/n

8/n

9/n

10/n

11/n

All of which gets stronger as a player becomes larger.

12/n

13/n

14/n

15/n

The expense part usually consists of employee costs, rewards point costs (Hope that people don't use is strong here) and delinquencies. In fact, there was a time in India where credit cards went bust in 2008-2010 and there are signs of....

16/n

17/n

economictimes.indiatimes.com/industry/banki…

Better analytics..

18/n

>70% of CC customers in the...

19/n

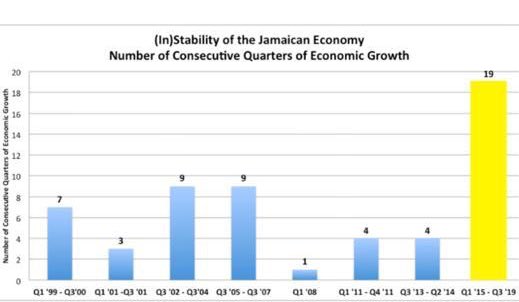

However, lenders need to be disciplined in underwriting as unsecured lending is vulnerable to liquidity squeeze.

20/n

Reward points per card is higher than HDFC/ICICI at Rs. 540 compared to

22/n

GNPAs have remained stable at ~2.5% and NNPLs at 0.8% levels. They have one of the best provisioning among all card players as well.

RoAs are strong at 4-4.5% levels.

Overall, a good company and a good sector to look forward to.

23/n

24/24

--END--