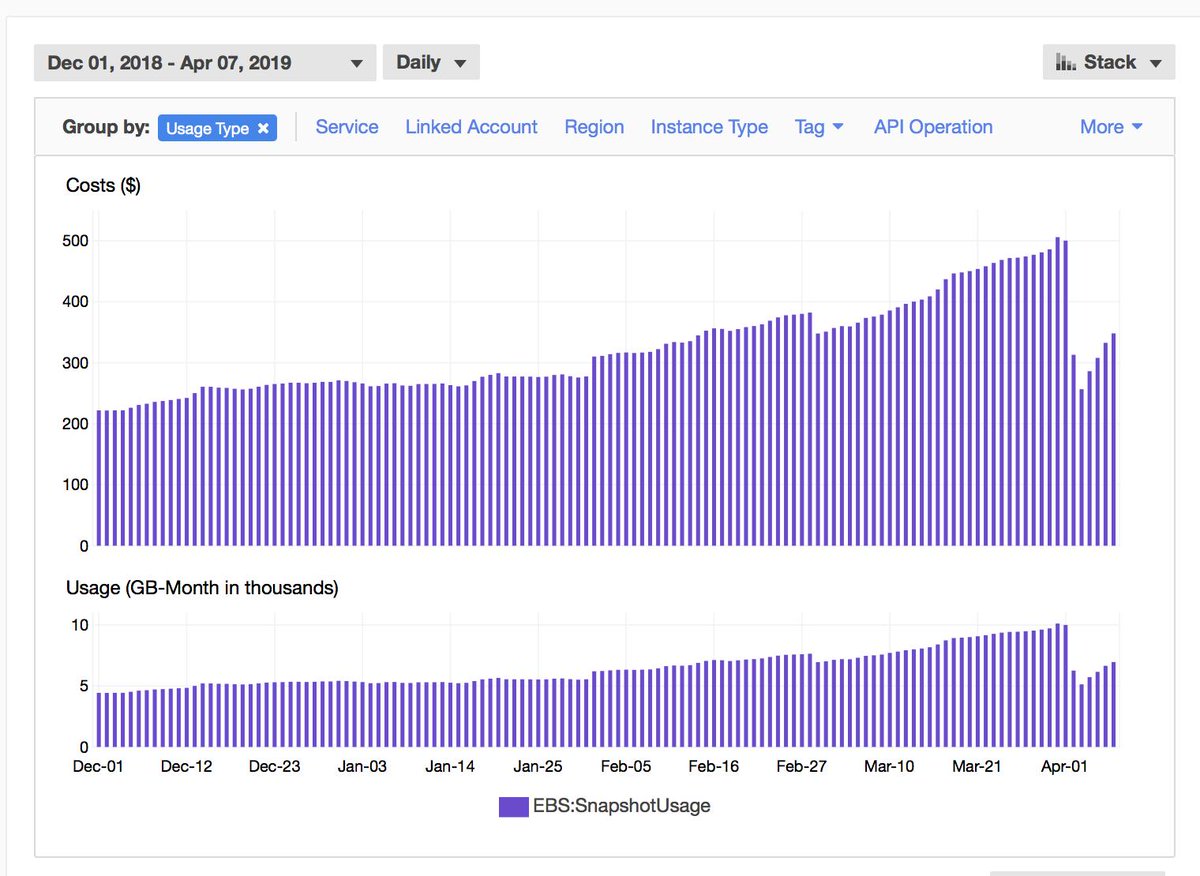

screenshots.duckbillgroup.com/bhI4y7sroiMy

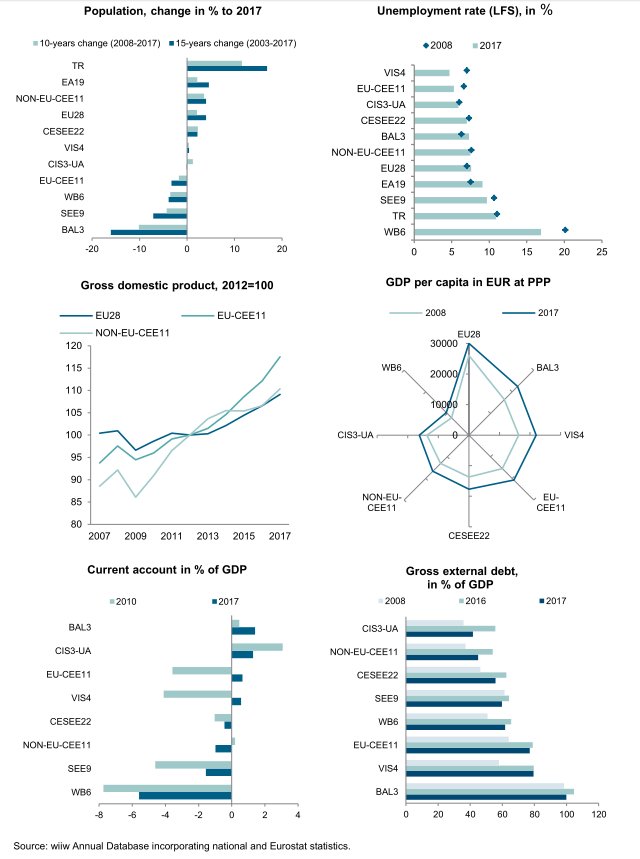

"Please note that all comparisons are against the same period for 2018."

Unfortunately it's technical guidance, not "don't read your damned resume and then put a question mark on the end."

"QoQ, is there anything you'd call out in terms of specific types of workloads, regions, customer profiles, etc. that drove this strength?"

"No."

"Regarding AWS, your margins are below peak; where are you on your investment cycle?"

"Your growth is slowing, is that a function of increased competition? Talk about the competitive environment."

"We're still growing and happy with the revenue progress. Competitively we think we start with a lead due to our many years of investment..."

"Yes, we've done a lot to fix the Lambda coldstart problem."

Note that their Slide Person is also apparently their Console UX person.

AWS: "Roughly four years, and oh my god you're adorable. Just ADORABLE! You don't tell us how to run a cloud, we won't tell you how to rig LIBOR."

"Yes, and we've been running a public cloud for almost twice that long. Sit. Down."