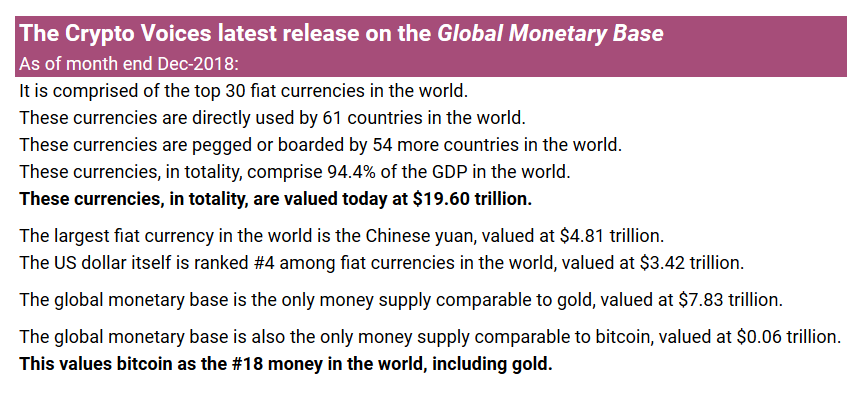

But isn't it more of a #SecurityGoingDown meme?

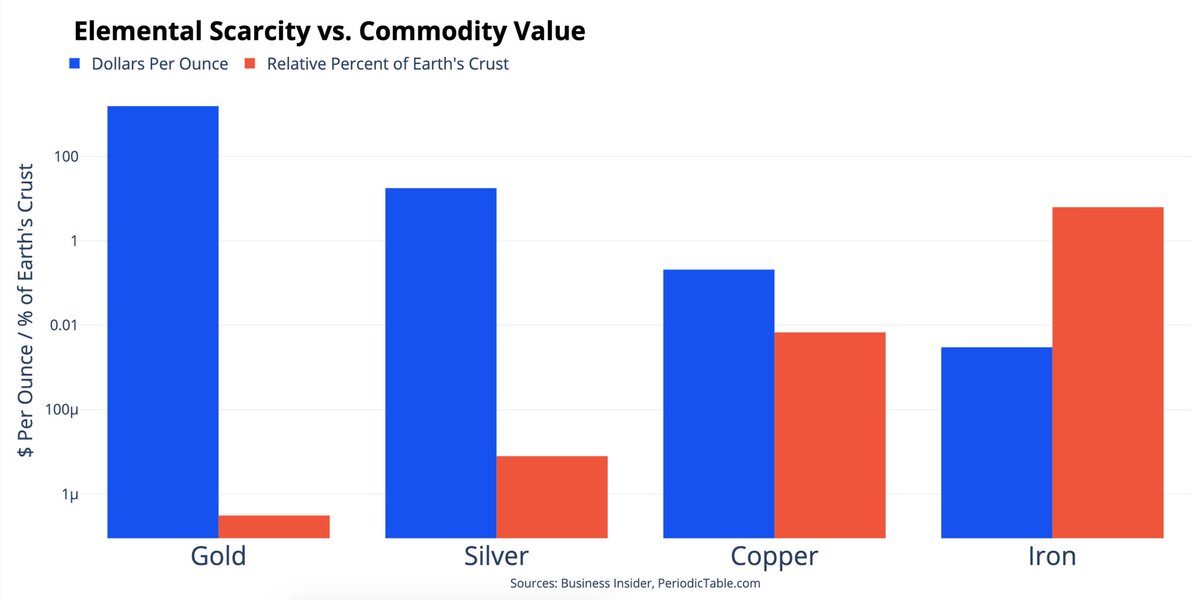

Let's look at the fundamentals and some actual numbers:

PoW relies on miners to actually run infrastructure

That costs money which miners must earn somehow

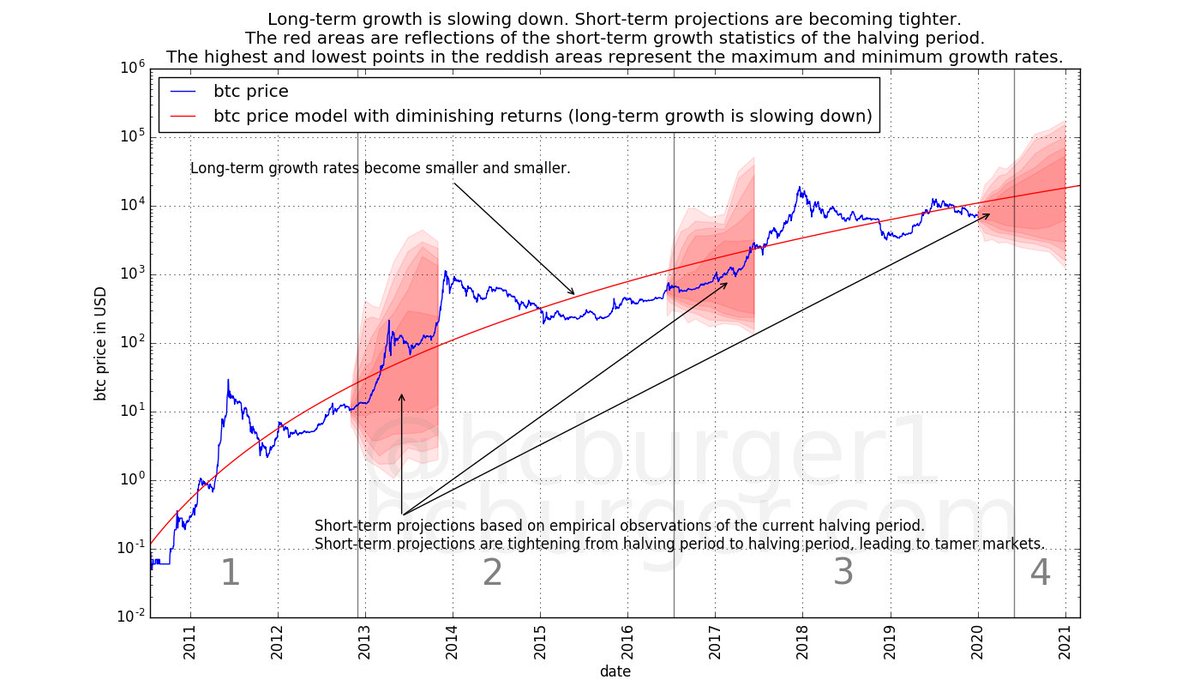

(1) block rewards, which are cut in half every 2 years and

(2) transaction fees, hopefully increasing to compensate (1)

If (1 + 2) * 3 goes down, miners go out of business

As that would reduce the security, let's look at the numbers:

cloud.google.com/blog/products/…

SELECT

block_number,

block_timestamp,

AVG(output_value / 100000000)

OVER (ORDER BY block_number DESC ROWS 999 PRECEDING)

FROM `bigquery-public-data.crypto_bitcoin.transactions`

WHERE is_coinbase = TRUE)

WHERE MOD(block_number, 1000) = 0

I reduced the data by averaging over 1000 blocks

Next, I exported that into a Google Spreadsheet

docs.google.com/spreadsheets/d…

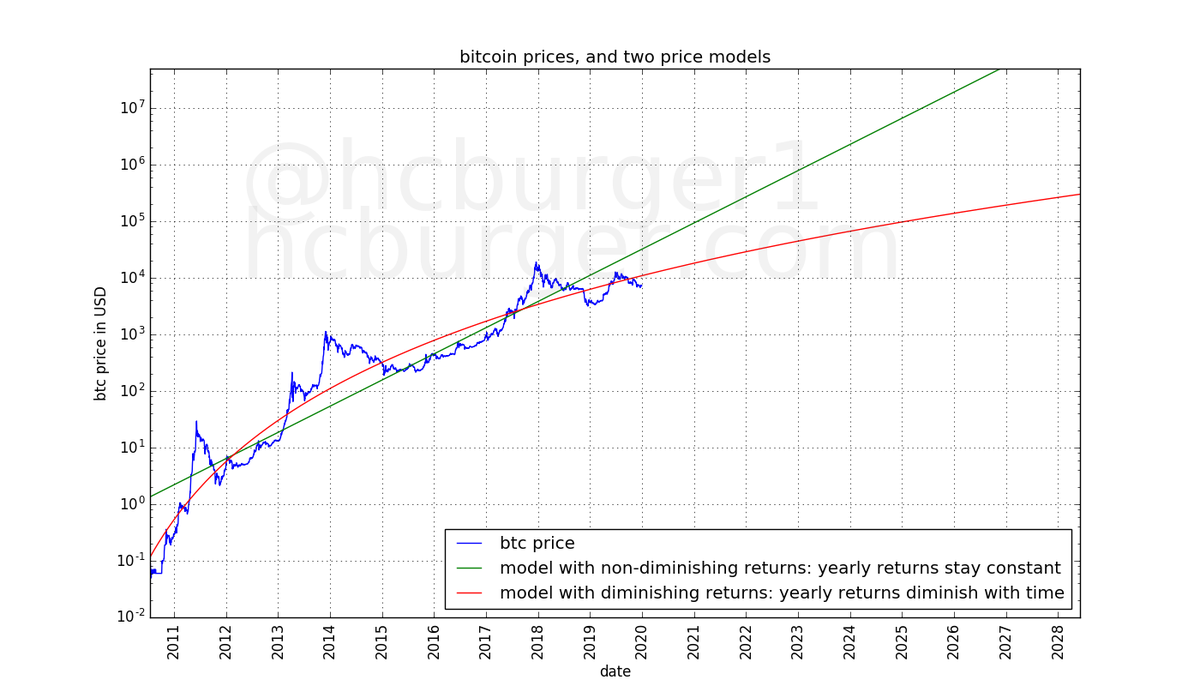

Is an increase of BTC price compensating halving rewards?

Let's add some historic price data to the chart

3 day resolution needs a simple LOOKUP in Google Sheets

docs.google.com/spreadsheets/d…

Long-term BTC cannot go up indefinitely

Let's I hope that fees will start working at some point