/1

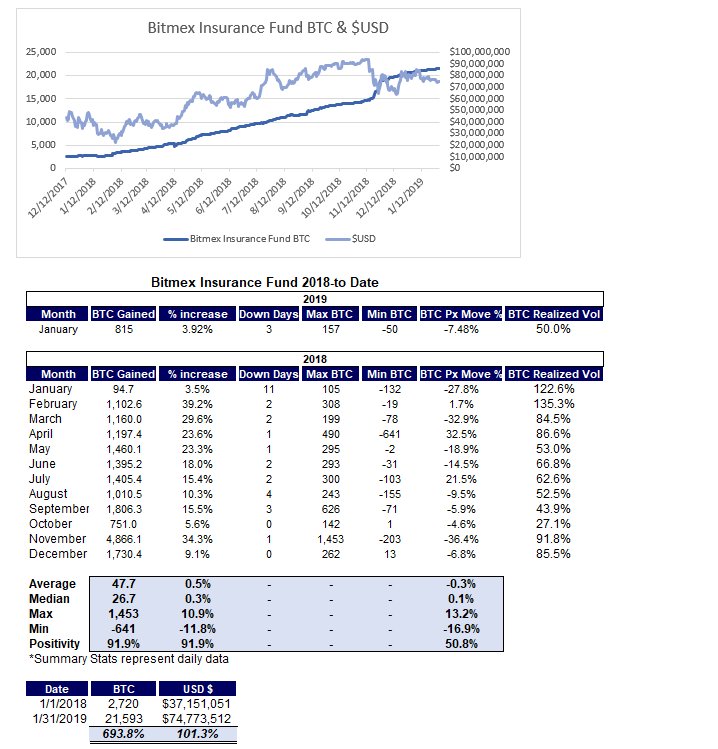

Bitmex ceased to be a fully functioning exchange for about 18 hours, and got completely fucked for a couple hours at the bottom. Completely disconnected from the rest of the market.

/2

/4

/5

/7

/8

/9

/10

/11

/12

/13

3/11/2020 - 35,508 XBT

3/14/2020 - 35,210 XBT

(though I will say there was some "USD value" of the fund used, that is pretty minimal)

/14

/15

/end