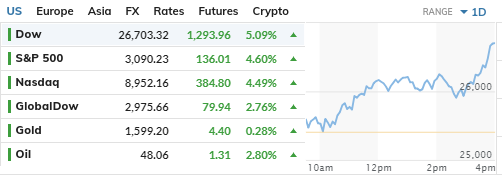

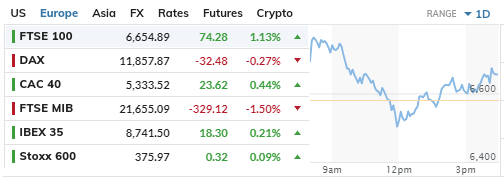

Since then we've seen even more action which I sum up in this THREAD!! /1

sebmarketwrap.blogspot.com/2020/03/global…

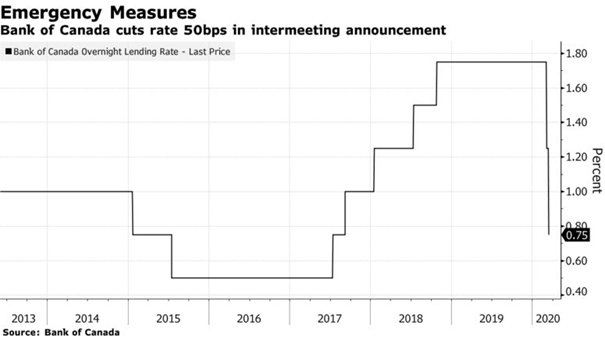

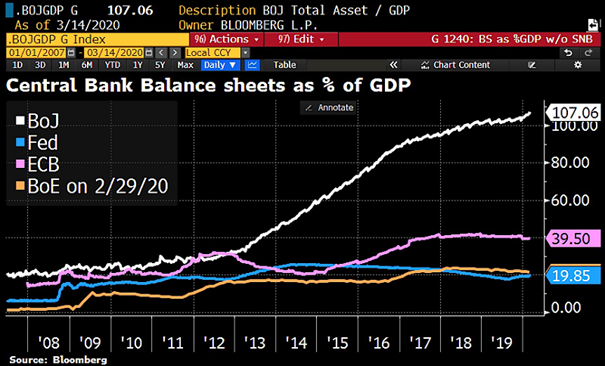

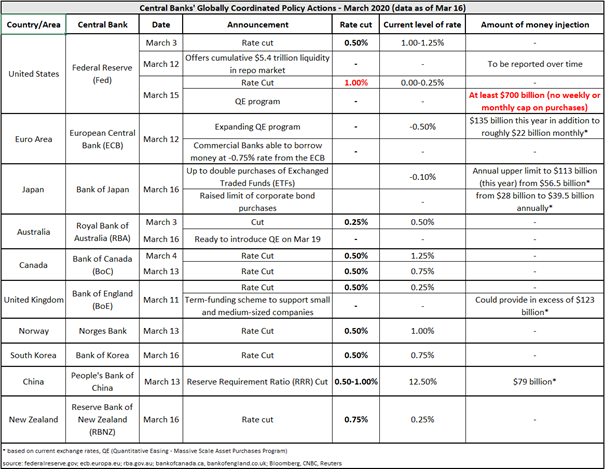

I was wondering whether the Fed will cut rates to zero (by 1.00%) and introduces full-blown QE (Quantitative Easing). There was still 9 days to the Fed meeting /5

sebmarketwrap.blogspot.com/2020/03/we-are…

"They may also increase the number of asset purchases, especially corporate bonds as companies in Europe may face real difficulties amid the European economy falling into a recession." /6

sebmarketwrap.blogspot.com/2020/03/we-are…

cnbc.com/2020/03/11/ban…

business.financialpost.com/pmn/business-p…

reuters.com/article/us-hea…

Yes, highly liquid funds(invest in assets with <13 mths maturity) need support /15

finance.yahoo.com/news/u-fed-mov…

it set a target for the yield on 3-year Australian government bonds of 0.25% (to achieve by bond purchases...

So we have QE in Australia for the first time ever /16

finance.yahoo.com/news/australia…

bankofengland.co.uk/monetary-polic…

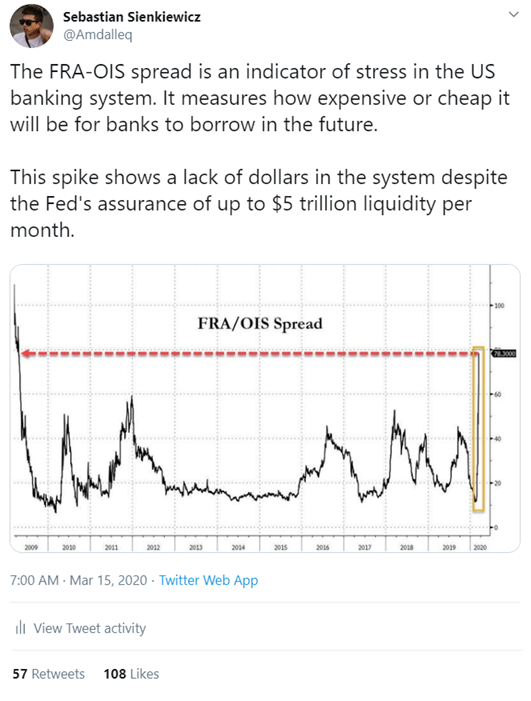

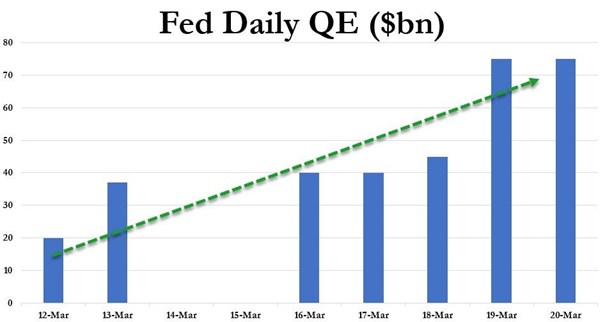

However, it does not change initial plans of buying $700bn of assets during the new QE program. 19/

newyorkfed.org/markets/domest…

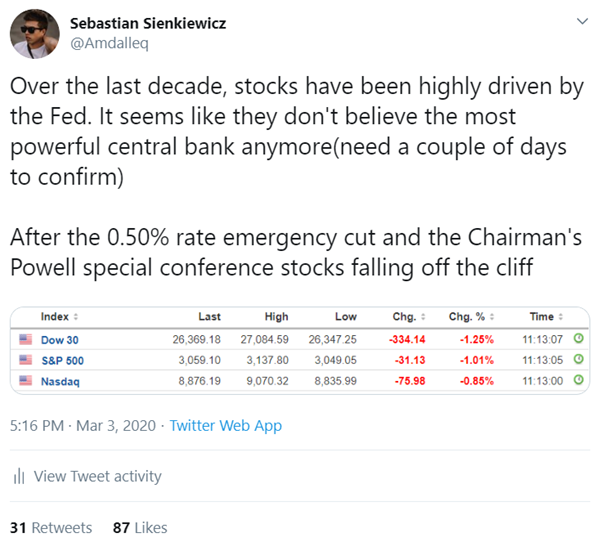

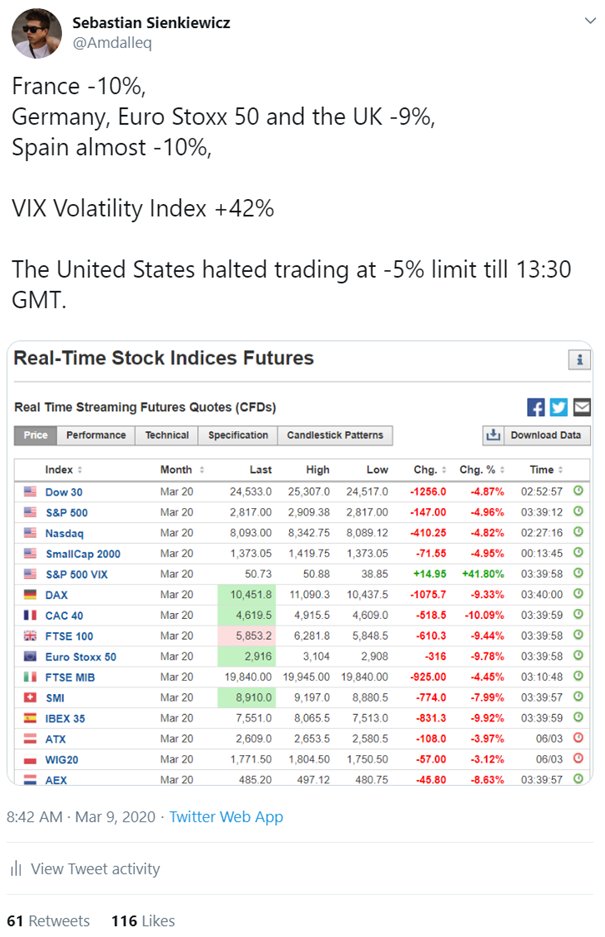

"..we came to the point where more central bankers' interventions intended to prevent, actually accelerate the plunge, increase the panic and massive distortions in the financial markets" /END

sebmarketwrap.blogspot.com/2020/03/global…

@DiMartinoBooth @EmmaMuhleman1 @bondstrategist @lisaabramowicz1 @gamesblazer06 @chigrl @biancoresearch @vol_christopher @TheBubbleBubble @themarketear