European banks need dollar financing for their dollar assets (loans, bonds, derivative positions etc) or for their clients.

Usually, in non crisis times, they get dollars from USD repo markets or from fx swap markets.

some European banks can borrow directly from US Federal Reserve, but mostly will go to ECB.

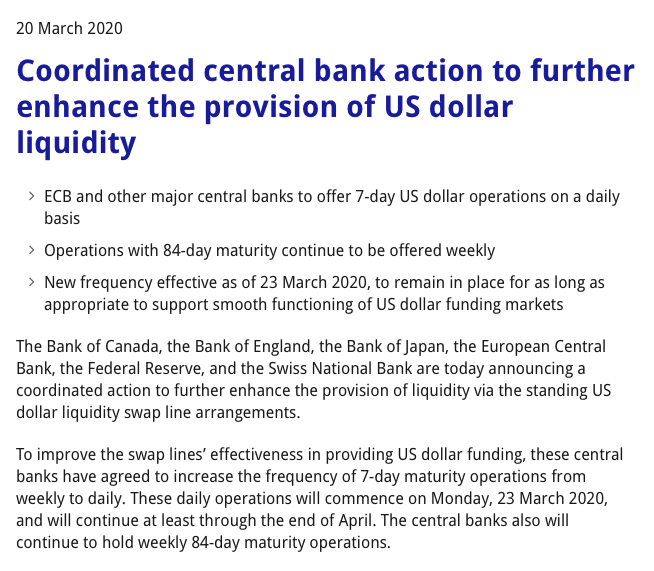

The Fed then agrees with the ECB to open up a swap line. for both, it's matter of financial stability

won't bore you with the details but IMF can here

imf.org/external/pubs/…

it started with weekly operations for 84 days maturity: it lends USD to European banks every week, in 3 months loans against collateral .

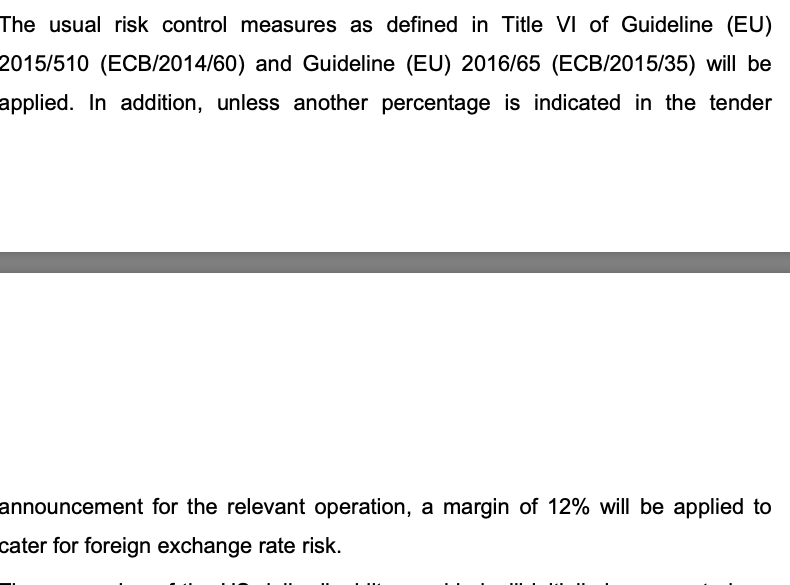

to access USD loans, banks have to provide collateral securities, in EUR or USD.

1. ECB asks 12% haircut related to fx risk (for every USD100, it requires banks to give USD120 of collateral at market value).

already hiking up the price of dollar liquidity

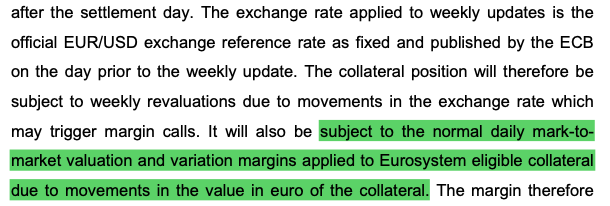

3. For any repo loan, ECB marks collateral to market. If price falls, ECB asks the bank to make up for the difference (margin call).

increasing funding pressures on borrowers.

1. FX related haircut

2.weekly margin calls on fx movements for loans>1 week.

2. daily margin calls on EUR/USD collateral

collateral valuation comes from 1990s push for private repo markets, and nearly destroyed the euroarea in 2008 onlinelibrary.wiley.com/doi/abs/10.111…

fessud.eu/wp-content/upl…

Ssubsidiaries of euro area banks dominating CEE financial systems had large EUR rollover needs. CEE central banks asked for ECB swap lines when currencies started falling

like Fed saying to ECB, I won't lend to you unless I get a say in how Euro countries design corona rescue packages

'The ECB cannot be a small god for everyone and for everything... no mandate to be a regional United Nations agency'

bit of postcolonial monetary discourse to MS required to adopt euro!