Here's what analysts are expecting:

1) Majority expect 10bps rate cut to -50bps (minority 20bps cut)

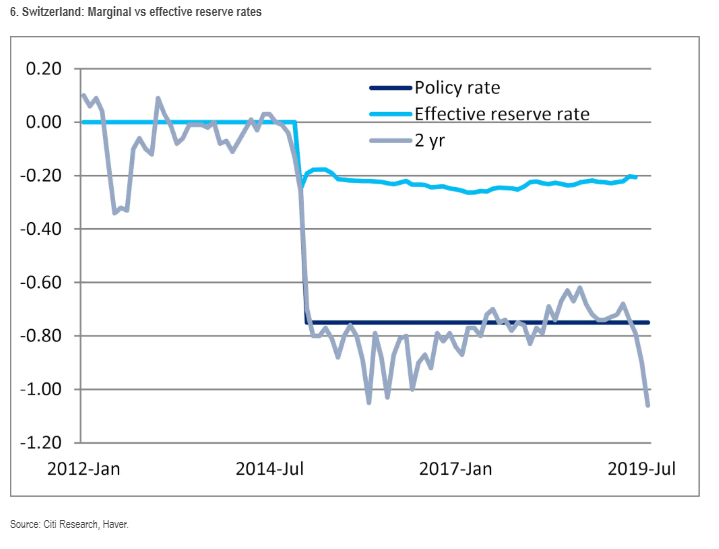

2) Tiering

3) Restart of Asset Purchases : sov +corp bonds of EUR 30bn x 12 months (risk of LESS given recent hawkish commentary)

4) Enhanced Fwd Guidance

The interest rate mkt is expecting 50% probability of a 20bp cut (or 15bps priced in for Sep) and another ~10bps in December, troughs at 34bps cuts next summer

Rate cut to 1/ target EUR & 2/ extra kicker for TLRO3 which starts in Sep 3/ stimulate credit demand

@LHSummers recently called negative interest rate policy 'black hole economics' because marginal positive is offset by counterproductive side effects incl misallocation

The Bild recently led with a headline : SAVE OUR SAVINGS

Banks paid >€20bn to ECB since negative deposit rates were first applied in 2014

which bring us to my last point..

Most notably, De Galhau (who is more of a centrist) expressed caution about possibility of restarting QE

Reminder: In Jan 2015 first QE announcement the total package size was EUR 1.1T

_+Other important consideration: Issuer limits

ft.com/content/c19132…

#Draghi may well use his last magic wand to hammer home one word: FISCAL

End.