1/25

2/25

3/25

(@justLbell) 5/25

6/25

7/25

(@justLbell) 8/25

9/25

10/25

11/25

12/25

14/24

(@justLbell) 15/24

16/24

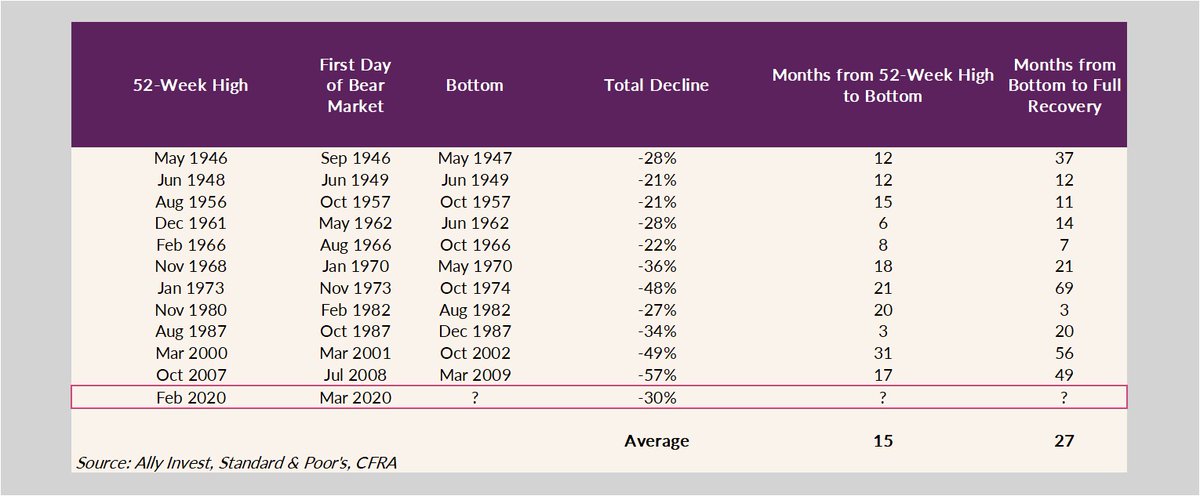

In the past 11 bear markets, it’s taken the S&P 500 an average of 15 months to bottom, and 27 months for the index to completely recover its losses.

17/25

(@justLBell) 18/25

19/25

20/25

21/25

(@justLBell) 22/25

23/25

24/25

(and legal asked me to post this before I go: ally.com/invest/disclos…)

25/25