#BeyondHeadlines: There are not-so-obvious global reasons why the #OilMarketCrash is NOT good for #India.

Heavy #QE/ currency pressure + Intense #geopolitical tension

= #India, importer & friend to all oil producers, in the crosshairs.

Thread on these impacts of #OilPrice 👇

Heavy #QE/ currency pressure + Intense #geopolitical tension

= #India, importer & friend to all oil producers, in the crosshairs.

Thread on these impacts of #OilPrice 👇

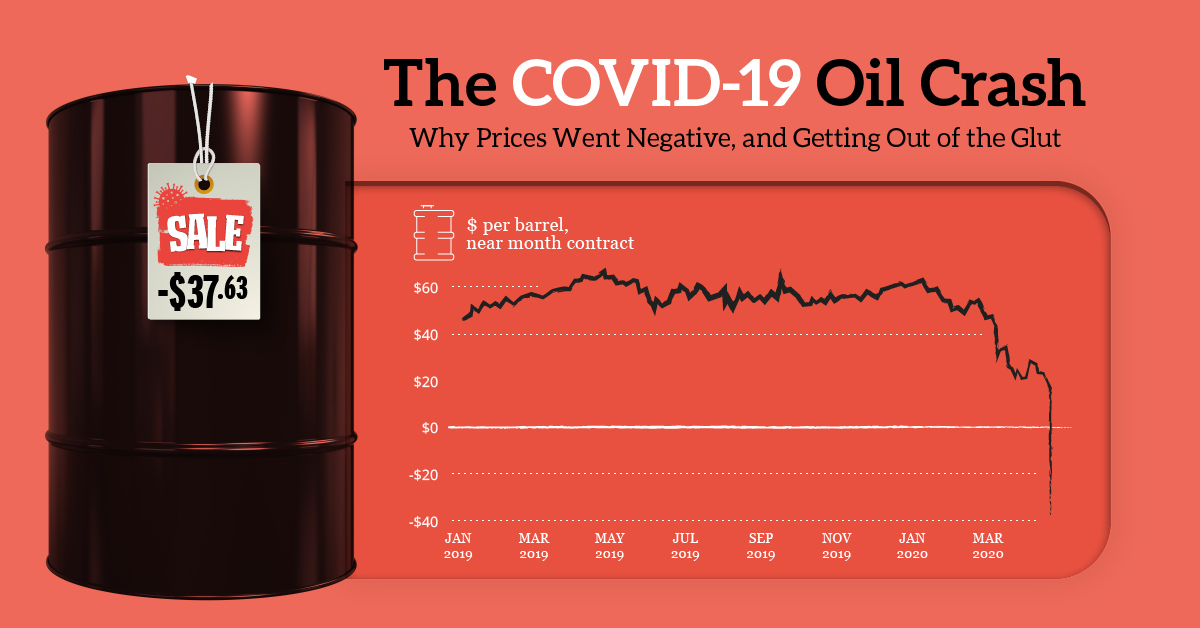

US #oilprice crashed negative for the 1st time in history. West Texas Intermediate (a US crude) traded as low as -$40.32 a barrel. So far the bulk of the losses are in US crude, -200 to -1000%! Global (Brent) crude has not gone down as much because global storage still exists.

#COVID19 #lockdown has sharply cut all travel & thus demand for oil. Excess supply of oil resulted in a shortage of #storage space, esp in North America. As they & slowly the rest of the world run out of storage, the demand for future oil contracts (futures) goes down sharply

This is going to massively impact the #stimulus and #quantitativeeasing pattern underway because:

1. Govts are going to buy up strategic #reserves to max capacity with the money from the existing and / or new #stimulus programs (See China and the US)

oilprice.com/Energy/Crude-O…

1. Govts are going to buy up strategic #reserves to max capacity with the money from the existing and / or new #stimulus programs (See China and the US)

oilprice.com/Energy/Crude-O…

2. Oil producing countries will face massive threat of job loss and companies shutting down. They will launch huge #stimulus to #bailout their economies which depend heavily on #oil. Political pressures, esp in places like the US which are going to election, will ensure bailouts

All this #stimulus will be funded for most part by currency printing or #QE, since almost every country is in #deficit. This will stretch govt balance sheets & lead to heavy inflationary & currency pressure in producing countries. This includes the dollar, which impacts the rupee

If countries don't bailout, they might see a lot of social unrest rising due to mounting job losses and other cuts in oil & ancilliary sectors.There could be a rise in protectionist measures like tariffs,canceling contracts on foreign supply etc. This escalates tensions globally

The fall in prices has come despite a historic and difficult #Opec-backed deal to cut roughly 10% of global crude supply. These countries lose, whether they cut supply or sell at low rates. almost all of them run budget deficits, so they cant rely on surpluses to tide them over.

All this is sets the stage for widespread impacts in the global economy. Geopolitical tensions over #China and #COVID19 are already underway. #OilPriceCrash adds more 'fuel' to the flame. India already had a tricky balancing act between the US, Russia, China, Middle East.

If all these tensions escalate, it could put India a very difficult to maneuver position. So while we might benefit in the short run with a fall in #oil prices, if our currency and geopolitics take a hit, we will face a much greater cost.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh