On May 26th @StateBank_Pak released #Pakistan's disaggregated #trade statistics for April '21. We now have 10 months of the FY21. Some analysis in #thread below. 👇👇👇

By #destination: substantial increases of shipments to #China and the #USA. Stability with #Afghanistan, and contractions in shipments to #UAE.

[#export growth to China and USA is confirmed by mirror data analysis] (3/n)

[#export growth to China and USA is confirmed by mirror data analysis] (3/n)

By #sector: #textiles and #apparel, and base #metals have been main drivers of #export growth. #Foodstuffs and #Vegetables (rice) still struggling, but with some promising trends. (4/n)

Zooming in: looking at monthly growth numbers shows (i) an impressive #takeoff of #textiles and #apparel, #minerals, and some mild recovery in #vegetable products and #foodstuffs. (5/n)

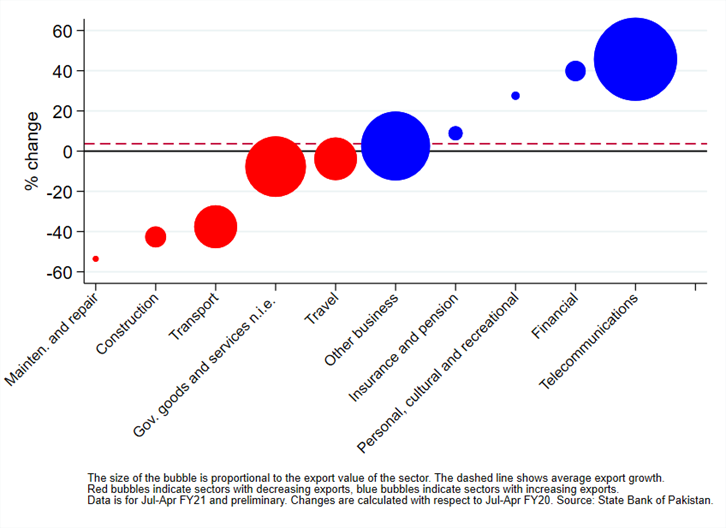

The #cindirella of the #export sector: services, also shows promising performance, particularly in #telecom and other #business #services exports that tend to be high in #knowledge content and #ValueAdded. (5/n)

#Import growth in #Pakistan during FY21 has been solid at 12% (although #services imports contracted).

But #mercantilists, worry not. (6/n)

But #mercantilists, worry not. (6/n)

Some of the #import growth is associated with inputs into #production, so more #domestic value added. e.g. #cotton, also food, and durables (#transport equipment). (7/n)

Zooming in: also some promising news in the take off of #imports of #machinery, and key inputs such as #chemicals, that show regardless of the classification used (@StateBank_Pak versus PBS). (8/n)

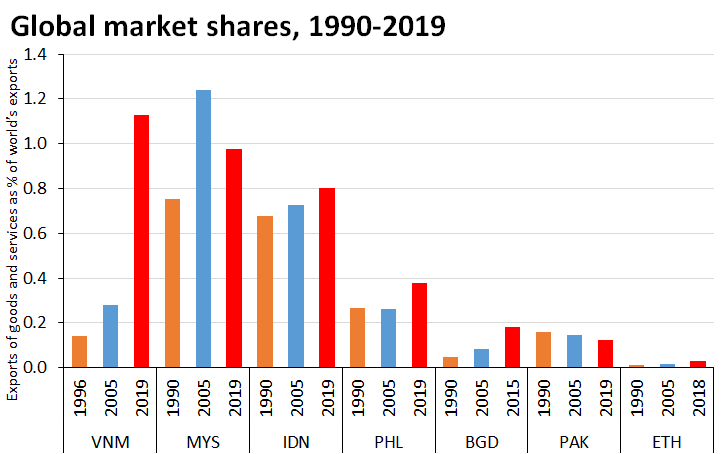

#Summary: good prospects, #exports & #imports growing (gIM>gEX, tho'). Balanced EX & IM growth requires reducing #anti-export bias of #tariff policy. Gradually cut duties on final goods. News below suggest, however, not enough being done to this end. dawn.com/news/1626138/g… (9/n)

• • •

Missing some Tweet in this thread? You can try to

force a refresh