Thread on why the Biden Administration is wrong in asking OPEC for more crude oil supplies & why #OPEC was right sticking to its planned increases:

1- There are no crude shortages. There are no refiners who need oil and cannot get it. #OOTT #SaudiArabia

spglobal.com/platts/en/mark…

1- There are no crude shortages. There are no refiners who need oil and cannot get it. #OOTT #SaudiArabia

spglobal.com/platts/en/mark…

2- Demand is NOT higher than “supply”. Several media outlets and analysts are confusing “supply” with “production”.

US crude oil inventories increased by about 20 mb in recent weeks. They are about 40 mb above the level that would support a bullish case.

US crude oil inventories increased by about 20 mb in recent weeks. They are about 40 mb above the level that would support a bullish case.

https://twitter.com/anasalhajji/status/1455911742282862593?s=20

3- It takes months for additional crude production to appear in the market as gasoline. The US problem is in the refining sector, not only because of recent hurricanes but also because of chronic problems and heavy regulations. #oil #OOTT

4- Crude inputs into US refineries are 1 mb/d lower than that of 2018. The gasoline problem in the US is a refining problem, not a crude production problem. US crude oil exports remain strong. In proportion to production, they are near-record high.

https://twitter.com/anasalhajji/status/1455748823796621317?s=20

5- The sharp decrease in crude inventories doesn’t indicate a continuous bullish market when it was preceded by a massive build in inventories. It just indicates a “price recovery.”

Also, the five-year averages are meaningless. #OPEC

Also, the five-year averages are meaningless. #OPEC

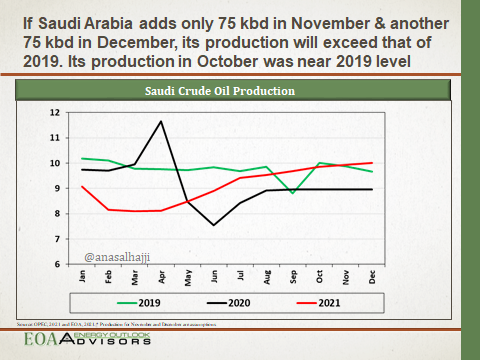

6- Saudi production in Q4 2021 will be higher than Saudi production in Q4 2019.

Even the IEA shows a recovery in demand that is SMALLER than recovery in OPEC production. OPEC has been increasing production in recent months. #SaudiArabia

Even the IEA shows a recovery in demand that is SMALLER than recovery in OPEC production. OPEC has been increasing production in recent months. #SaudiArabia

https://twitter.com/anasalhajji/status/1455748810022526978?s=20

7- The additional demand from gas-to-oil switching & private generation has nothing to do with OPEC production decisions. These are domestic problems in the consuming countries related to energy sources used in the power sector such as coal & natural gas. Oil is not one of them.

8- In addition, the additional demand for oil from gas-to-oil switching is about petroleum products, not crude. OPEC focuses on crude.

Even that additional demand is vanishing now as the problem of coal shortages in China and India is easing.

cnbc.com/2021/11/02/chi…

Even that additional demand is vanishing now as the problem of coal shortages in China and India is easing.

cnbc.com/2021/11/02/chi…

9- Increasing gasoline supplies requires higher refinery utilization. Crude oil prices are part of the cost of gasoline. But national & international refineries that use natural gas saw their costs skyrocket, leading to higher cost of gasoline. The lucky ones switched to LPG.

10- Production decisions are not only about what is going on in the market now, they are also about the future. Aside from the fact that #OPEC is bearish about the second half of 2022, look at the forward curve... additional production now will only make the situation worse.

11- The Biden administration cannot complain about high gasoline prices, blame OPEC while US crud inventories are rising, and US gasoline exports are going through the roof!

#Biden #Gasoline #OPEC #EnergyCrisis #OOTT

#Biden #Gasoline #OPEC #EnergyCrisis #OOTT

• • •

Missing some Tweet in this thread? You can try to

force a refresh