🧵 on some of the major smart contract chains, their different approaches, and how HOPEFULLY (for the love of all that is holy) we are moving away from simply "X chain is superior because it did XXXX TPS on a closed environment testnet"

#Ethereum #terraluna #Solana #AVAX

#Ethereum #terraluna #Solana #AVAX

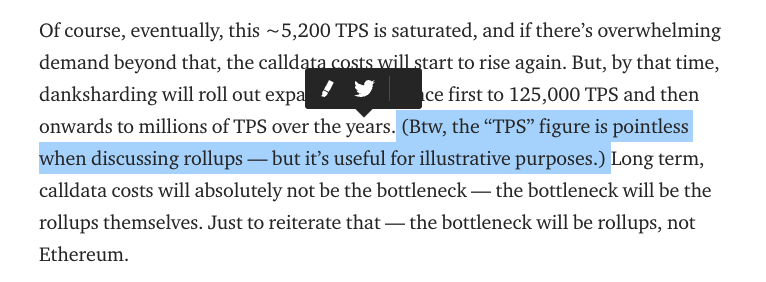

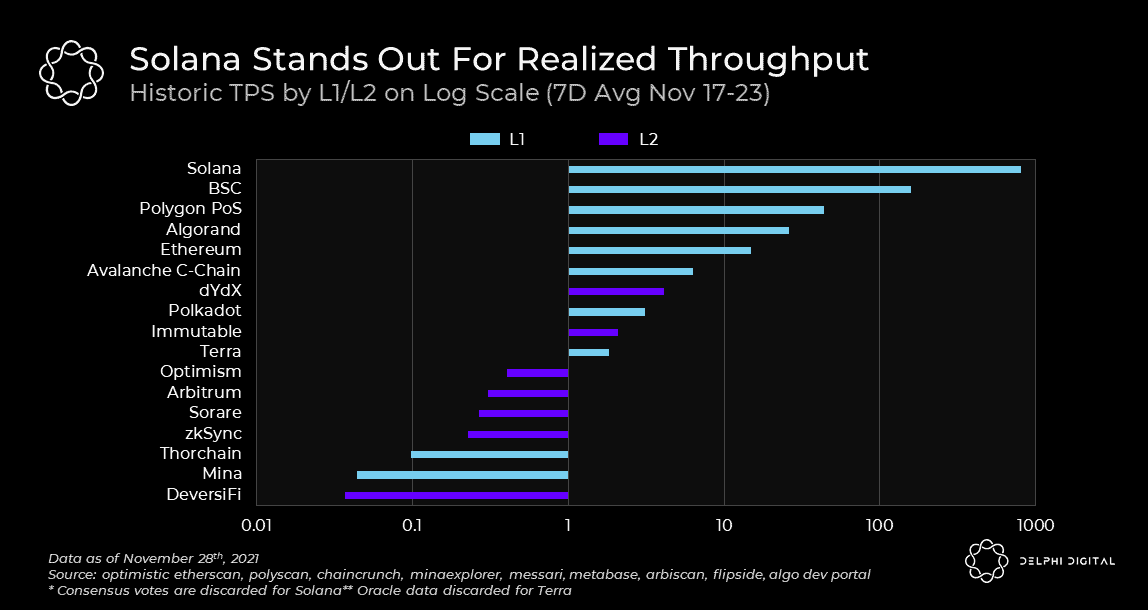

As @epolynya has alluded to several times, #TPS numbers are almost meaningless now. Especially anything under 100k.

At the risk of having this thrown in my face 5 years from now, TPS is essentially solved.

At the risk of having this thrown in my face 5 years from now, TPS is essentially solved.

This is due to many things but some reasons include:

- #modular designs (@CelestiaOrg, #ETH + #rollups, and @avalancheavax to an extent)

- Rollups, in general, and how they can somewhat "defeat" the #ScalabilityTrilemma

- @IOHK_Charles & his giga brain (ok maybe not this 😉)

- #modular designs (@CelestiaOrg, #ETH + #rollups, and @avalancheavax to an extent)

- Rollups, in general, and how they can somewhat "defeat" the #ScalabilityTrilemma

- @IOHK_Charles & his giga brain (ok maybe not this 😉)

So, rather than the question being "What's your TPS?"

We now care about HOW you achieve it.

And, man oh man, have I been waiting on this day.

How many #Algorand, #Hedera, #EOS, #IOTA, #BSC, #TRON, #NEO permissioned chains does one need to know that centralized=faster??

@bantg

We now care about HOW you achieve it.

And, man oh man, have I been waiting on this day.

How many #Algorand, #Hedera, #EOS, #IOTA, #BSC, #TRON, #NEO permissioned chains does one need to know that centralized=faster??

@bantg

Now, convos are switching to validator costs, the "inclusivity" of the chain (i.e. permisionless-ness), chain/state bloat, data availability, robustness, uptime, idiosyncratic vs systemic risks, interoperability risks, composability, etc.

THIS is where the fun starts

@BanklessHQ

THIS is where the fun starts

@BanklessHQ

I've covered #ETH scaling and rollups quite a bit so won't rehash here.

If interested to learn how the Merge, shards, #EIP1559, PoS, Beacon Chain, and everything else work together, check out this piece

#Ethereum #l222 @ladyxtel

mirror.xyz/dashboard/edit…

If interested to learn how the Merge, shards, #EIP1559, PoS, Beacon Chain, and everything else work together, check out this piece

#Ethereum #l222 @ladyxtel

mirror.xyz/dashboard/edit…

But what about the others?

Let's start with #Terra since it's quite hot lately

Terra Core is built on the #Cosmos Software Development Kit (SDK) making it interoperable with other IBC chains in the #CosmosEcosystem

It's a DPoS chain using the #Tendermint consensus protocol.

Let's start with #Terra since it's quite hot lately

Terra Core is built on the #Cosmos Software Development Kit (SDK) making it interoperable with other IBC chains in the #CosmosEcosystem

It's a DPoS chain using the #Tendermint consensus protocol.

While Tendermint Core essentially ensures that transactions are recorded in the same order, across the distributed ledger, the Application Blockchain Interface (#ABCI) is the means by which developers interact with the transactions.

@CryptoHarry_

@CryptoHarry_

The ABCI is one of the main incentives to utilize the Tendermint Core consensus engine since it’s programming language agnostic in the sense that devs can choose to instantiate Tendermint in whichever programming language they choose.

@Remi_Tetot

@Remi_Tetot

Terra smart contracts use #CosmWasm technology and are written in Rust, Go, or Assembly. These contracts can execute on other IBC- linked chains.

Therefore, @terra_money and its tech is constrained to what the @cosmoshub can enable.

#CosmosEcosystem #Cosmonauts

Therefore, @terra_money and its tech is constrained to what the @cosmoshub can enable.

#CosmosEcosystem #Cosmonauts

#LUNA and #UST have performed well lately but I laid out why I think that is and why it may be temporary here

https://twitter.com/mt_1466/status/1499399814571724802?s=20&t=GuOscb7SxJVqDyhBOP4Nww

Ok, so how about @solana and #SOL?

- "Bonded" PoS

- Proof of History (#PoH) created 10x gains in TPS

- Fantastic "product" right *now*

- Deep pockets and can sleep well knowing @SBF_FTX is in their corner ( and @TusharJain_ @KyleSamani and @multicoincap )

- "Bonded" PoS

- Proof of History (#PoH) created 10x gains in TPS

- Fantastic "product" right *now*

- Deep pockets and can sleep well knowing @SBF_FTX is in their corner ( and @TusharJain_ @KyleSamani and @multicoincap )

But

- "50k TPS", while high now isn't long term

- #Solana's solution to get to 1M+ TPS doesn't exist

-High barrier to become validator

- monolithic design

- "VC chain" stigma

- Suffers under stress (uptime)

- not #EVM- compatible which puts them on an island

lotta #NGMI vibes

- "50k TPS", while high now isn't long term

- #Solana's solution to get to 1M+ TPS doesn't exist

-High barrier to become validator

- monolithic design

- "VC chain" stigma

- Suffers under stress (uptime)

- not #EVM- compatible which puts them on an island

lotta #NGMI vibes

And #Avalanche ?

- 3 separate chains, fast finality

- #Snowman Consensus and "sub-sampled voting" are legit

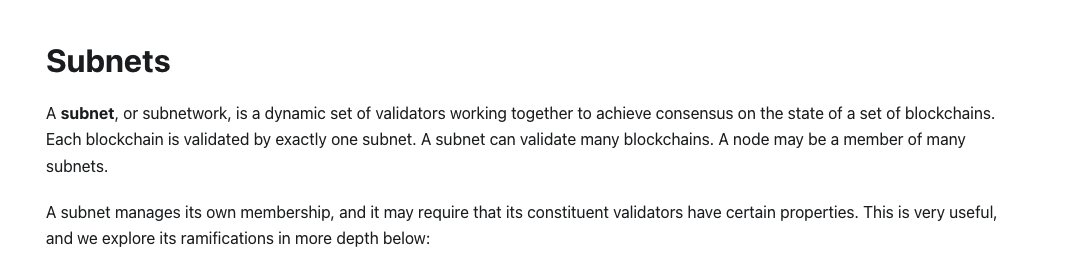

- subnets increase flexibility (more VMs)

- whole-heartedly reaping the rewards of being #EVM compatible 😂

- fair to say "modular" design due to #Subnets

@Jomari_P

- 3 separate chains, fast finality

- #Snowman Consensus and "sub-sampled voting" are legit

- subnets increase flexibility (more VMs)

- whole-heartedly reaping the rewards of being #EVM compatible 😂

- fair to say "modular" design due to #Subnets

@Jomari_P

But #AVAX downsides:

- validator cost is outrageously high

- most of @avalabsofficial success thus far has simply been its #ETH copy and paste C-chain

That's not necessarily a problem but we've seen this before with #BSC, #TRON, #FTM, & others

It, thus far, has proven fleeting.

- validator cost is outrageously high

- most of @avalabsofficial success thus far has simply been its #ETH copy and paste C-chain

That's not necessarily a problem but we've seen this before with #BSC, #TRON, #FTM, & others

It, thus far, has proven fleeting.

#Avalanche continued...

Of course, spinning up a brand new, fresh EVM chain with limited validator set makes for a great user experience.

But give it 6 years and (probably) trillions of txs. Then see what you have.

(Spoiler: higher fees and chain bloat)

Of course, spinning up a brand new, fresh EVM chain with limited validator set makes for a great user experience.

But give it 6 years and (probably) trillions of txs. Then see what you have.

(Spoiler: higher fees and chain bloat)

At least @avalabsofficial and @el33th4xor acknowledge this unlike, say @cz_binance and #BSC, which is refreshing.

But the Avalanche "pruning" solution doesn't exist.

And they may just be waiting for #ETH to solve it 😂

But the Avalanche "pruning" solution doesn't exist.

And they may just be waiting for #ETH to solve it 😂

https://twitter.com/peter_szilagyi/status/1491496857876455427?s=20&t=dAE4CK6BGZcFSV1Cr9A5kg

- Subnets look an awfully lot like @Cosmos zones and/or sidechains. There's much to be desired there.

Especially the (unknowable) relationships/interplay between each subnet, their tokens, validators, security, etc.

@CannnGurel @jadler0

Especially the (unknowable) relationships/interplay between each subnet, their tokens, validators, security, etc.

@CannnGurel @jadler0

Subnets are often praised for their customizability that enables "compliance," "KYC'd actors," and "permissioned chains" which I find incredibly uninteresting.

As mentioned previously, there are already 1000s of options if you want a permissioned chain/database.

As mentioned previously, there are already 1000s of options if you want a permissioned chain/database.

Similar to my #Terra critique, AVAX is currently being propped up by #Ethereum compatibility and $500M+ in incentives over the years with the latest #AvalancheRush news.

You can buy a lot of users that way.

You can buy a lot of users that way.

Ok, this thread ate up way too much of my time. I'll stop here. I look forward to tacking on a few more like #Cosmos, #PolkaDot, #NEAR, and others when I have the time.

Finally, while critical of these projects, doesn't mean they're doomed. And I hold some of them.

Finally, while critical of these projects, doesn't mean they're doomed. And I hold some of them.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh