⭐️One of the largest banks in the U.S., #SiliconValleyBank, has gone bankrupt. This is the largest bankruptcy in the United States since the 2008 financial crisis.

It has raised question marks on the existence of 1000's of startups in the US and in India too.

#Thread

#BankCrash

It has raised question marks on the existence of 1000's of startups in the US and in India too.

#Thread

#BankCrash

1. California banking regulators pulled the shutters on #SiliconValleyBank (SVB), a lender to some of the largest tech companies in the world, on 10th March, making it the largest bank to fail since the global financial crisis of 2008.

2. US regulators closed #SiliconValleyBank and took control of its deposits, a move which puts nearly $175 billion in customer deposits under the Federal Deposit Insurance Corp’s control.

3. About #SiliconValleyBank

The 1983-founded California-based Silicon Valley Bank catered to the startup and venture capital (VC) funded tech world and provided multiple services to VC and private equity firms while also offering private banking services to HNI, s.

The 1983-founded California-based Silicon Valley Bank catered to the startup and venture capital (VC) funded tech world and provided multiple services to VC and private equity firms while also offering private banking services to HNI, s.

4. The firm has business with close to half of all the venture-backed startups in the US and 44 percent of US venture-backed technology and healthcare firms that went public in 2022.

#SiliconValleyBank

#SiliconValleyBank

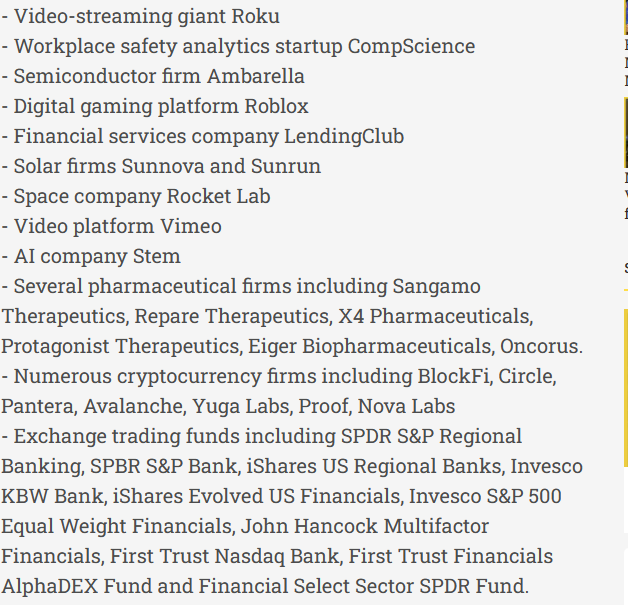

5. As of 31 December 2022, the bank had assets close to $212 billion with clients like Shopify, Pinterest, VC firm Andreessen Horowitz, Crowdstrike, and Teladoc Health.

#SiliconValleyBank

#SiliconValleyBank

6. During the massive funding boom in 2021, SVB filled its safe with large deposits amounting to $189 billion, which eventually peaked at $198 billion.

#SiliconValleyBank

#SiliconValleyBank

7. What went wrong?

Subsequently, it decided to heavily invest in the bond market, where bonds had been issued at lower interest rates. At the end of 2022, the bank’s balance sheet had amassed securities worth $91.3 billion. /n

#SiliconValleyBank

Subsequently, it decided to heavily invest in the bond market, where bonds had been issued at lower interest rates. At the end of 2022, the bank’s balance sheet had amassed securities worth $91.3 billion. /n

#SiliconValleyBank

7(a) Like most other banks, SVB kept just a small percent of their deposits in hand and invested the rest with hopes of a profitable return.

#SiliconValleyBank

#SiliconValleyBank

8. In 2022, the US Federal Reserve started raising interest rates to cool inflation, its most aggressive rate-hiking campaign in four decades. The move drove down bond-holding values which were initially issued at lower rates of interest /n

#SiliconValleyBank

#SiliconValleyBank

8(a) and moreover, the Fed’s move to raise interest rates also led to VC firms considerably reducing the number of cheques they issue. The companies that did receive money over the “funding winter,” received much lesser than they usually would.

#SiliconValleybank

#SiliconValleybank

9. The funding winter also put pressure on many of the bank’s clients to pull their deposits out. As a result, the bank was forced to sell its investments at a lower value. /n

#SiliconValleyBank

#SiliconValleyBank

9(a) In a surprise disclosure on Wednesday, SVB said that it had lost close to $2 billion after selling bond assets worth $21 billion.

#SiliconValleyBank

#SiliconValleyBank

10. Bears came calling!!!

A large number of investors like Y Combinator, Peter Thiel’s Founders Fund, and Coatue Management have advised the startups on their portfolios to withdraw deposits from SVB.

#SiliconValleyBank

A large number of investors like Y Combinator, Peter Thiel’s Founders Fund, and Coatue Management have advised the startups on their portfolios to withdraw deposits from SVB.

#SiliconValleyBank

11. So why there is Panic?

The bank announced a $1.8 billion loss the other day, a relatively small loss on a capitalization of $200 billion, but the news coincided with the announcement of the liquidation of another California bank, Silvegrate /n

#SiliconValleyBank

The bank announced a $1.8 billion loss the other day, a relatively small loss on a capitalization of $200 billion, but the news coincided with the announcement of the liquidation of another California bank, Silvegrate /n

#SiliconValleyBank

11(a) and caused panic among investors. Shares of SVB collapsed by 60% at the opening of trading, due to which trading was stopped, and now the bank's activity has been stopped by the regulator to protect customer deposits.

#SiliconValleyBank

#SiliconValleyBank

12. Attempts by #SiliconValleyBank to urgently raise capital in two days in order to be able to pay off obligations to their customers ended in failure. SVB's assets exceed $200 billion. Deposits amounted to 170 billion, and the lion's share of them was not insured.

13. Now the Federal Deposit Insurance Corporation seized the assets of #SiliconValleyBank on 10th March, marking the largest bank failure since Washington Mutual during the height of the 2008 financial crisis.

14. All these turbulent happenings took a toll on the stock of the #SiliconValleyBank and it went into a downward spiral with a 10th March loss in value of 60%+. SVB is the 18th largest bank in the United States and is the biggest bank in Silicon Valley-based on local deposits.

15. What is happening to other bank stocks in the USA listed on #NASDAQ?

The four largest US banks lose $47 BILLION in 1 day - caused by the collapse of Silicon Valley Bank.

#SiliconValleyBank

The four largest US banks lose $47 BILLION in 1 day - caused by the collapse of Silicon Valley Bank.

#SiliconValleyBank

16. It is feared now that after #SiliconValleyBank collapse could topple First Republic Bank next, as shares slump 40% in a month and investors voice concerns over losses on its investments

First Republic Bank, the 16th largest in the US, saw its shares plummet 50 percent.

First Republic Bank, the 16th largest in the US, saw its shares plummet 50 percent.

17. So, what happens to customer deposits with #SiliconValleyBank now?

Nearly $175 billion of the bank's customer deposits are now under the control of the Federal Deposit Insurance Corporation, or FDIC, which has assured the depositors full access to their insured deposits /n

Nearly $175 billion of the bank's customer deposits are now under the control of the Federal Deposit Insurance Corporation, or FDIC, which has assured the depositors full access to their insured deposits /n

17(a) after all the branches of the bank open on Monday morning. The financial body also said that cheques from the old bank would also be honored.

18. All depositors will have full access to their insured deposits from Monday. The FDIC also assured that uninsured depositors will be paid an advance dividend within the next week. /n

#SiliconValleyBank

#SiliconValleyBank

18(a) Uninsured depositors will receive a receivership certificate for the remaining amount of their uninsured funds. As the FDIC sells the assets of Silicon Valley Bank, future dividend payments may be made to uninsured depositors.

#SiliconValleyBank

#SiliconValleyBank

19. What are the US FDIC regulations to protect customer deposits in case of a bank failure?

#FDIC deposit insurance helps consumers to confidently place their money at thousands of FDIC insured banks across the country, and is backed by the full faith and credit of the US Govt

#FDIC deposit insurance helps consumers to confidently place their money at thousands of FDIC insured banks across the country, and is backed by the full faith and credit of the US Govt

20. FDIC deposit insurance coverage depends on two things: (1) whether your chosen financial product is a deposit product; and (2) whether your bank is FDIC-insured.

#SiliconValleyBank

#SiliconValleyBank

20(a) Depositors do not need to apply for FDIC insurance. Coverage is automatic whenever a deposit account is opened at an FDIC-insured bank or financial institution.

21. What is FDIC coverage limit for bank deposits with a failed bank?

The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. The #FDIC provides separate coverage for deposits held in different account ownership categories.

The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. The #FDIC provides separate coverage for deposits held in different account ownership categories.

21(a) Depositors may qualify for coverage over $250,000 if they have funds in different ownership categories and all FDIC requirements are met. /n

21(b) All deposits that an accountholder has in the same ownership category at the same bank are added together and insured up to the standard insurance amount.

#SiliconValleyBank #FDIC

#SiliconValleyBank #FDIC

22. #FDIC issued a press statement on 10th March 2023 for taking over the operations and deposits of #SiliconValleyBank to ensure the panicked customers about the safety of their deposits with the bank.

23. The India Connection:

Nearly 60 YC-backed Indian startups have deposits stuck in #SiliconValleyBank. These particularly include startups backed by the famed Silicon Valley accelerator Y Combinator (YC). /n

Nearly 60 YC-backed Indian startups have deposits stuck in #SiliconValleyBank. These particularly include startups backed by the famed Silicon Valley accelerator Y Combinator (YC). /n

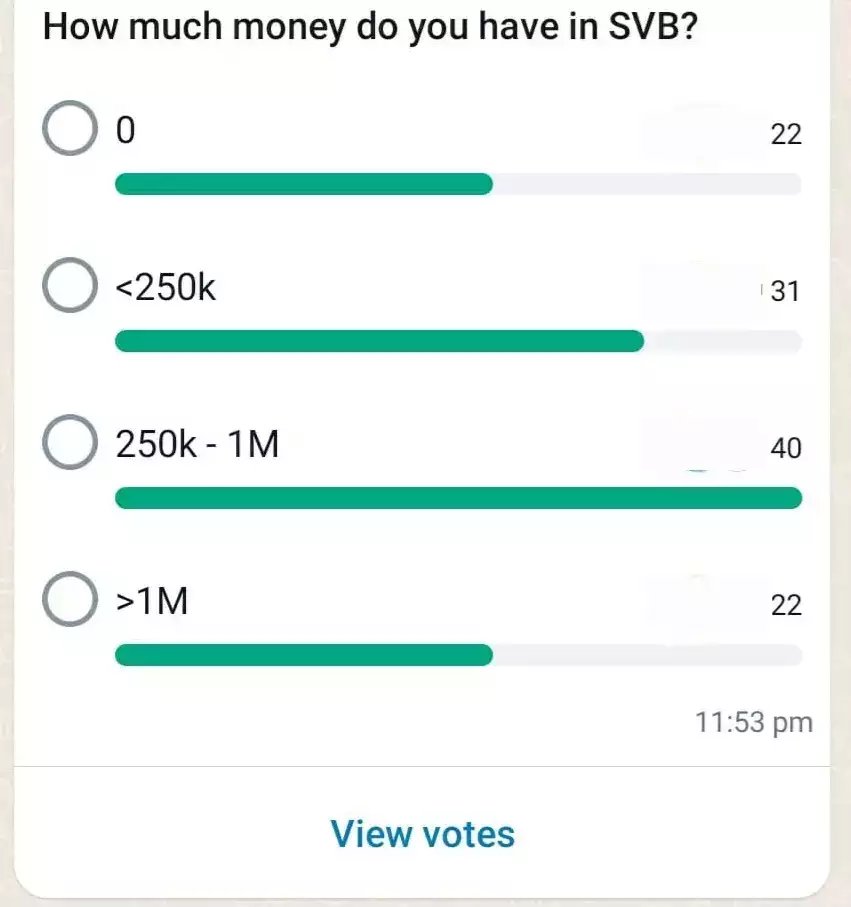

23(a) At least 40 YC-backed Indian startups have $250,000 to $1 million in deposits with SVB, while more than 20 of them have deposits of more than $1 million.

#SiliconValleyBank

#SiliconValleyBank

24. Silicon Valley bank has directly invested VC-based funding into 21 Indian Startups, mainly SaaS based in addition to other technological domains.

economictimes.indiatimes.com/tech/technolog…

economictimes.indiatimes.com/tech/technolog…

24. Some of the Indian Saas startups have already started firefighting for their funds stuck with #SiliconValleybank. But for some of the early-stage startups, it might be too late and too big a loss to handle like reminiscent of the 2008 market crash.

25. #Paytm founder and CEO Vijay Shekhar Sharma on Saturday said that the #SiliconValleyBank, which was one of its first investors, fully exited with handsome returns on their total investment of only $1.7 million. He clarified that the bank is not a shareholder anymore.

27. It seems like US banking turbulence ripple effects are yet to show its full impact on Indian Banking stocks but right now "Caution" is the word for the markets.

#SiliconValleyBank

#SiliconValleyBank

28. SVB was the bank to over 2,500 venture capital firms which includes the likes of Lightspeed, Bain Capital, and Insight Partners. SVB also managed the personal wealth of several tech executives.

#SiliconValleyBank

#SiliconValleyBank

29. #SiliconValleyBank which was listed as one of the best banks in the US by Forbes a week ago has gone bust now and it's web of startup investments has already started bleeding the markets.

30. One crucial fact to keep in mind as SVB’s failure ripples across industries is that the bank was an investor in its own right. The company’s venture capital and credit investment arm has directly invested in several fund managers /n

#SiliconValleyBank

svbsecurities.com/transactions/p…

#SiliconValleyBank

svbsecurities.com/transactions/p…

30(a) and portfolio companies for more than 20 years. The firms that have benefited from its money include Sequoia Capital, Accel, Kleiner Perkins, Ribbit Capital, Spark Capital and Greylock. /n

30(b) The bank’s global fund loan banking book was comprised of 56% of loans to venture capital and private equity firms as of the end of last year.

#SiliconValleyBank

#SiliconValleyBank

31. CEO of Mumbai-based Verak Insurance Rahul Mathur said that his company was among those affected by SVB’s close and tweeted, “FDIC (Federal Deposit Insurance Corporation) limit is $250K. Some startups could be at risk of losing big money."

https://twitter.com/Rahul_J_Mathur/status/1634414225836630017?s=20

32. Snapdeal’s Kunal Bahl said that SVB lent the company money when their business hit a severe cash crunch in 2012. Investors weren't convinced we could pull it off. /n

#SiliconValleyBank

#SiliconValleyBank

https://twitter.com/1kunalbahl/status/1634182056837279744?s=20

32(a) Silicon Valley Bank extended a small debt line to us that kept us going. Hope they get past this phase.

#SiliconValleyBank

#SiliconValleyBank

https://twitter.com/1kunalbahl/status/1634462241507651584?s=20

33. Gokul Rajaram, a board member at Pinterest and Coinbase, tweeted, “India-based founders don’t know who to turn to as an alternate to SVB. Likely true for founders in other countries too.”

#SiliconValleyBank

#SiliconValleyBank

https://twitter.com/gokulr/status/1634216133430759424?s=20

33(a) “From what I hear, SVB was the only bank who’d bank a Delaware C Corp with founders who didn’t have a SSN. Unique, tech-forward bank. Shame what’s happening (sic),” Rajaram added.

https://twitter.com/gokulr/status/1634216133430759424?s=20

33(b) Gokul Rajaram also warned against US Market analyst watchdog Jeffrey's highlighting that some hedge funds are prying on devaluated assets of #SiliconValleyBank

https://twitter.com/gokulr/status/1634361237067948032?s=20

34. Meanwhile massive line forms outside #SiliconValleyBank in California as customers panic.

• • •

Missing some Tweet in this thread? You can try to

force a refresh