#MarketReport 2023/04

1) In this thread, I'll cover comparative performance of

📌 #Stock Indices

📌 #Exchange Rates

📌 Treasury #Bills and Government #Bonds

both for April and since pandemic.

1) In this thread, I'll cover comparative performance of

📌 #Stock Indices

📌 #Exchange Rates

📌 Treasury #Bills and Government #Bonds

both for April and since pandemic.

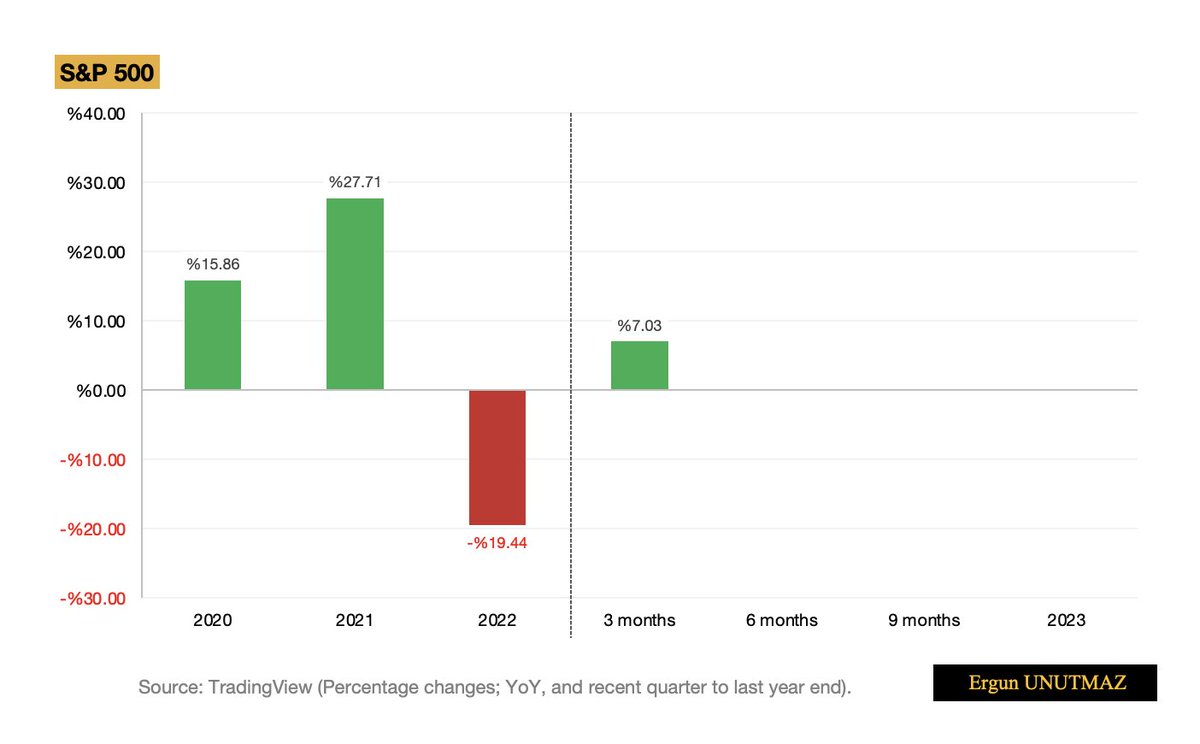

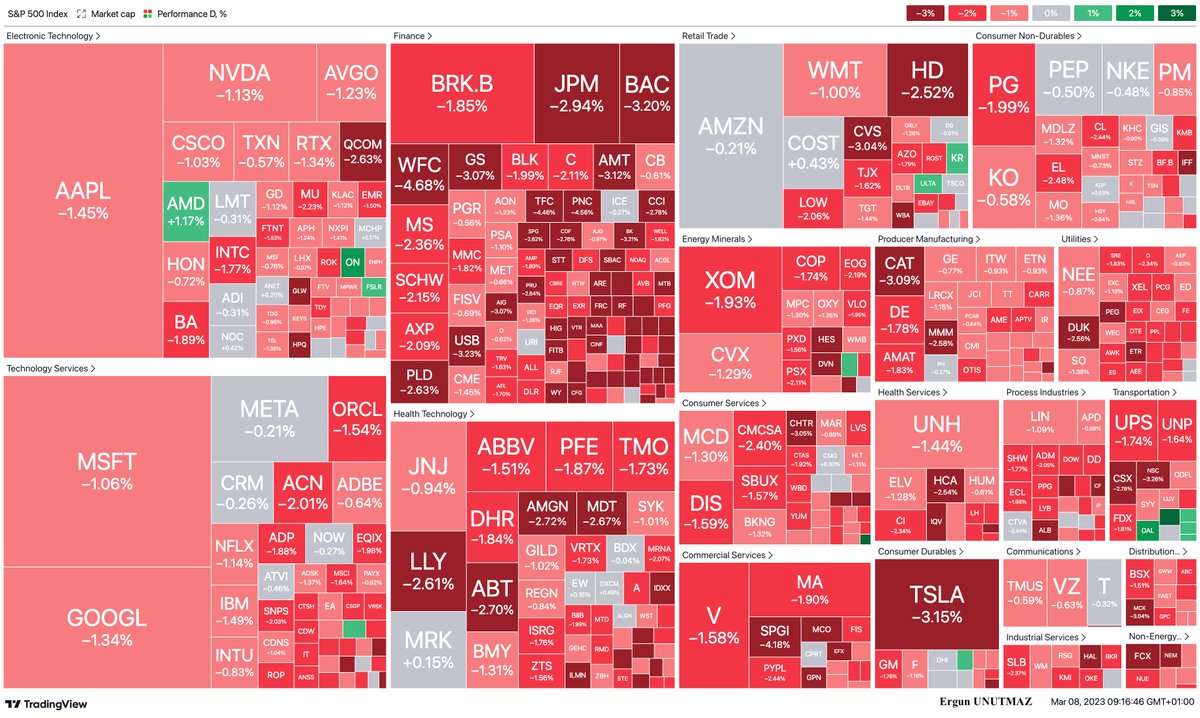

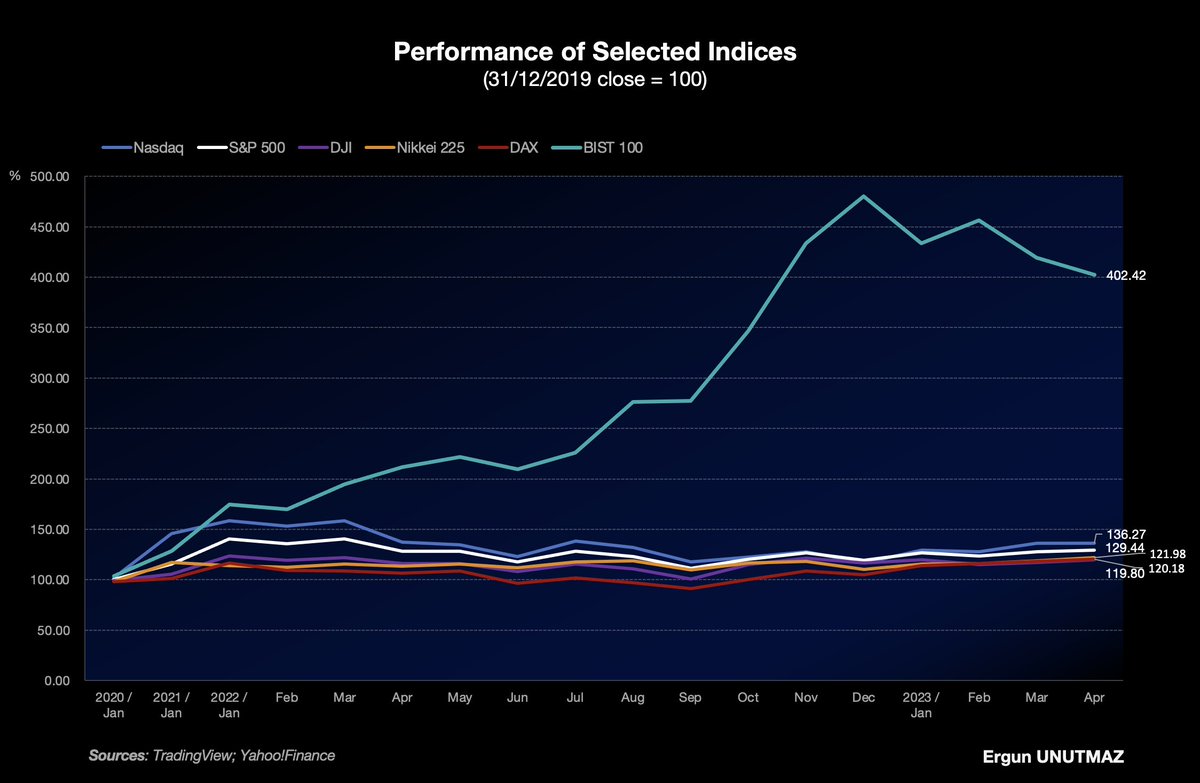

4) #StockMarkets

Returns from 31/12/2019, at their own currency:

➡️ #SPX #IXIC #DJI #DAX #NI225 #XU100

Returns from 31/12/2019, at their own currency:

➡️ #SPX #IXIC #DJI #DAX #NI225 #XU100

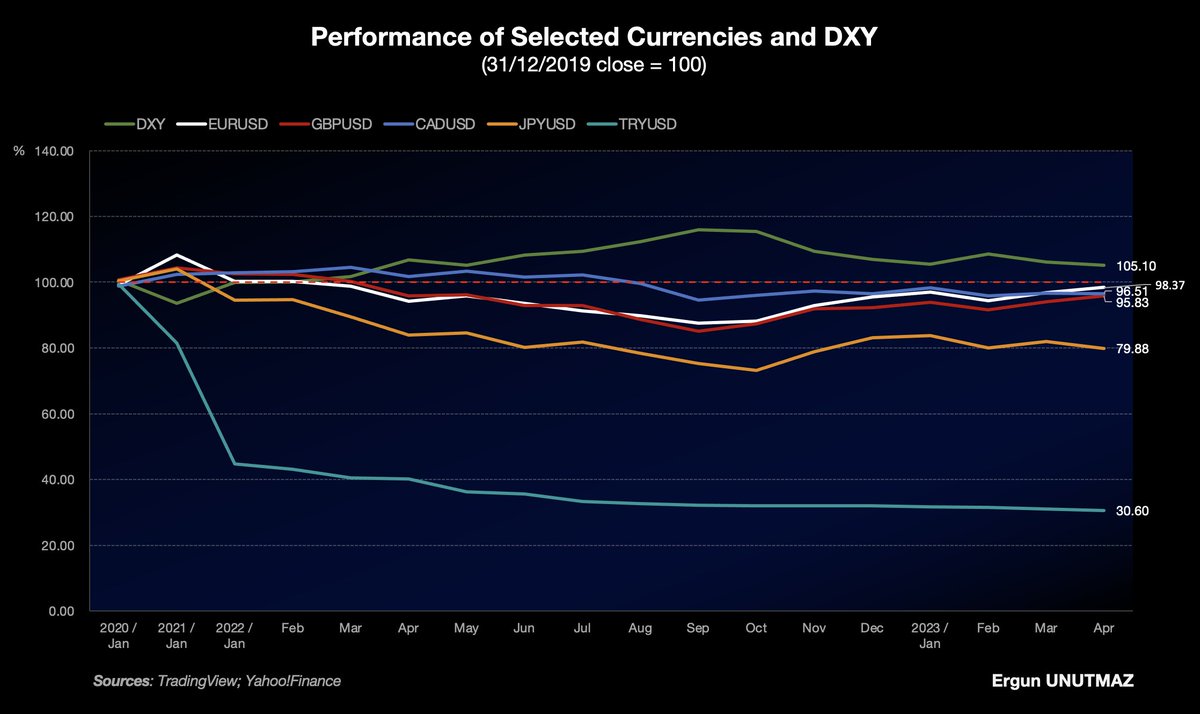

6) #ExchangeRates

Performance from 31/12/2019. Depreciation and appreciation of selected currencies:

📌 #DXY #EURUSD #GBPUSD #USDCAD #USDJPY #USDTRY

Performance from 31/12/2019. Depreciation and appreciation of selected currencies:

📌 #DXY #EURUSD #GBPUSD #USDCAD #USDJPY #USDTRY

7) #FixedIncomeSecurities

#USA

Treasury Bills (3M)

Government Bonds (2Y and 10Y)

Spreads and Reel Yield Approximation.

#USA

Treasury Bills (3M)

Government Bonds (2Y and 10Y)

Spreads and Reel Yield Approximation.

8) #FixedIncomeSecurities

#Germany

Treasury Bills (3M)

Government Bonds (2Y and 10Y)

Spreads and Reel Yield Approximation.

#Germany

Treasury Bills (3M)

Government Bonds (2Y and 10Y)

Spreads and Reel Yield Approximation.

9) #FixedIncomeSecurities

#UK

Treasury Bills (3M)

Government Bonds (2Y and 10Y)

Spreads and Reel Yield Approximation.

#UK

Treasury Bills (3M)

Government Bonds (2Y and 10Y)

Spreads and Reel Yield Approximation.

10) #FixedIncomeSecurities

#Turkey

Treasury Bills (3M)

Government Bonds (2Y and 10Y)

Spreads and Reel Yield Approximation.

#Turkey

Treasury Bills (3M)

Government Bonds (2Y and 10Y)

Spreads and Reel Yield Approximation.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter